Liu Kun, China’s finance minister, is looking to further ease market access for foreign investors and implement a foreign investment law, according to Global Times. Liu’s comments were made during a recent ministerial luncheon at the 99th Development Committee co-hosted by the World Bank Group and International Monetary Fund in Washington DC. Liu called for the World Bank to continue improving trade systems, citing the organization’s status as a vital multilateral development institute.

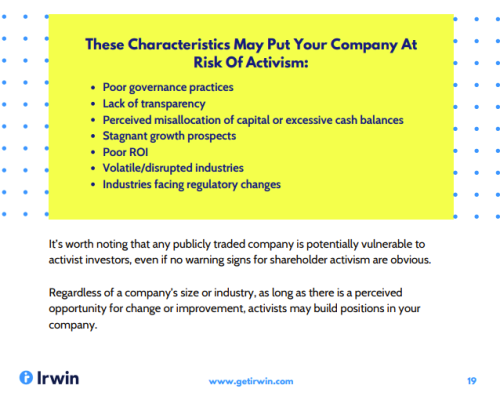

Proxy advisers ISS and Glass Lewis are pushing Boeing to separate CEO and chairman roles following two fatal crashes of its 737 Max plane, according to the Wall Street Journal. ISS recommended in a note earlier this month that Boeing shareholders vote for a proposal that would split the leadership roles at the Chicago plane maker’s annual meeting on April 29.

Blackrock said Asian investors almost doubled their allocations to ETFs last year in a bid to diversify their portfolios and also adjust to short-term market fluctuations, according to Asia Asset Management. The publication noted that Asian institutional investors allocated 23 percent of their total assets to ETFs in 2018, up from 14 percent in 2017. China’s growth is also boosting demand for ETFs.

The rally in South African mining stocks isn’t done yet, as they are now having their best start to the year since 2016, according to Bloomberg. It said the FTSE/JSE Africa Mining Index has gained 22 percent as of April 16 and is close to an eight-year high, helping South Africa’s benchmark gauge advance 12 percent as investors show few signs of nerves before elections on May 8.

Investors are worried about the first quarter earnings of big European Banks as they fear that weak earnings results could lead to further volatility in the stock market, said CNBC. Concerns from analysts include low economic growth, uncertainty over US-China trade deal, Brexit and a U-turn on major central bank policy towards more easing.

Reuters reported that Hong Kong’s securities regulator has told funds that claim to consider ESG factors in their investment decisions to their methodology clear. The Securities and Futures Commission (SFC) said under the new rules, funds that say in their name or their investment strategy that they follow ESG or green principles must provide documents to investors that describe their investment focus, their selection criteria and evaluation methodology, among others factors.