The head of IR at Credit Suisse explains the best way to present your company’s message during a worsening economic outlook

They say every cloud has a silver lining, so does that mean it is possible to take advantage of the recent stock market fall? Yes – if you are prepared. Today’s IROs should be aware of market movements and trends, and know how to optimize strategic initiatives as they relate to a company’s market capitalization.

Armed with a simple but informed approach to market trends, IR becomes a key function in helping senior executives with the substance and timing of their strategic decisions.

Many IR professionals may be caught in the grip of a recession across most developed western market economies, limiting the value-enhancing actions that can support the share price.

Some, however, will have spotted an opportunity: they recognize where we are in the current market cycle and are focusing their company on the right strategic initiatives and investments for the future. They also know how and when to communicate to the market about these initiatives to optimize the market impact.

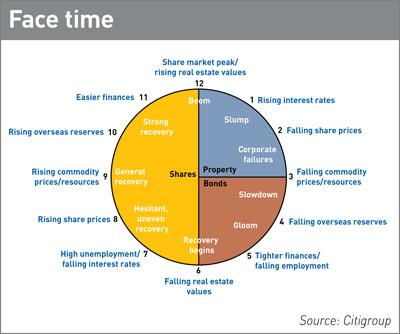

Most market-aware people know of the economic clock concept. Right now we are probably somewhere between six and eight o’clock – between ‘recovery begins’ and ‘hesitant, uneven recovery’. The economic clock is a useful contextual reminder to focus your company’s communication at all times during the economic cycle.

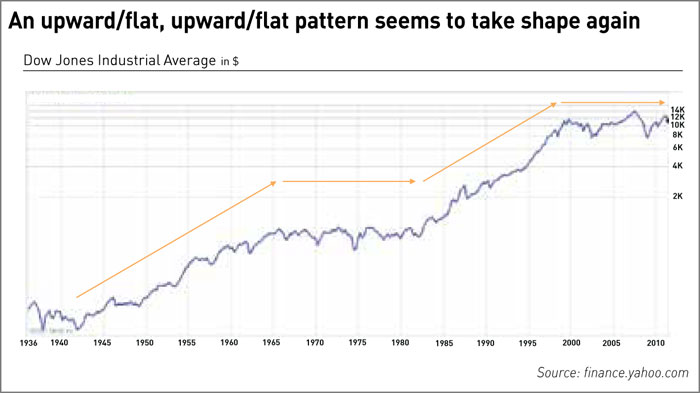

Between the early 1940s and early 1980s we saw a pattern where stock market indices increased over a prolonged period before going flat. Since the early 1980s, this pattern has been repeating itself and we are now entering the flat phase.

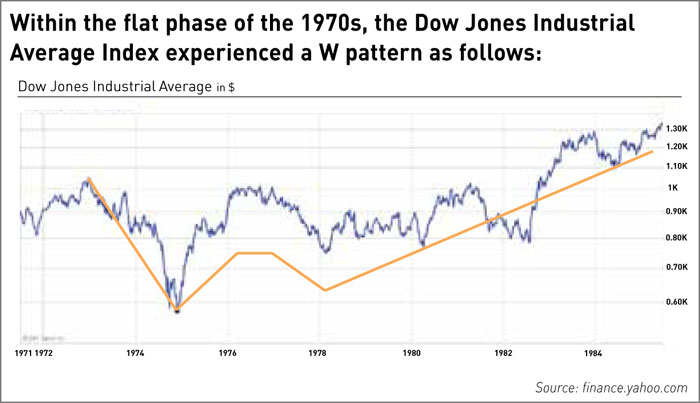

Let’s look a little deeper, however. If we drill down into the 1970s flat phase, the Dow Jones Industrial Average clearly indicates an underlying W-shaped period between the early 1970s and mid-1980s. If we analyze the peaks, troughs and associated timescale of this W-shaped trend from the 1970s and 1980s, we can attempt to predict market behavior within the current overall flat period.

From a high of 1,052 in 1973, the index fell 45 percent to 578 and then recovered to 1,015. This was followed by a second fall of 30 percent to a low of 742, almost 29 percent higher than the previous low.

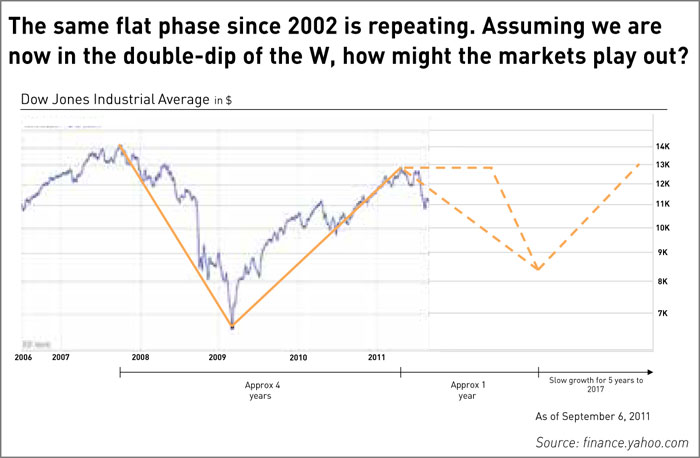

Looking at the most recent flat period, the second high of the current W-shape appears to have occurred in April 2011. Applying the same timescales and percentage movements in the indices for the current flat-phase cycle starting in 2008, we can predict a second low of around 8,500, during the spring/summer of next year. This will be followed by five years of slow but sustainable growth.

This modeling approach indicates that we are close to an historic low for share prices. It follows that asset prices will be at a similar historic low and market shares will become dislocated. As a result, firms should be taking advantage of the opportunities presented, and preparing for the next economic growth phase.

Opportunity knocks

Market falls present an excellent opportunity to deepen the current product offering and develop new product offerings through innovation. This will be important in capturing market share as we enter the slow growth phase of the economic cycle.

This phase represents a great opportunity for companies to acquire assets at low cost to support future growth. This approach would scale up your business quickly at a low price. Now is the time to talk about ‘investing in ABC’, ‘buying XYZ’ and ‘refocusing toward 123’, all with growth and expansion in mind.

Right now, by understanding portfolio managers’ assessment of priority initiatives for companies, IR professionals can also ensure their companies are addressing specific financial issues. When in a profitability decline, your company must operate at maximum efficiency levels by saving all possible running costs.

In a down market, investors may discount a valuation from the industry standard based on a company’s poor financial management. IROs can help executive teams be more effective and gain more impact in their communication of these financial management actions.

Companies demonstrating the best financial management in a down market often achieve good short-term share price performance, but must also identify enough initiatives to seed future growth.

As the market recovers, they should see an early increase in their share price as these growth initiatives translate into superior performance.

Prepare for growth

Investors look to initiatives that position a company to capitalize on the coming growth in markets. In a slow-growth environment, distinctive strategies that capture market share and deepen and extend products are key to a company’s ability to create differential earnings against its peers.

Firms demonstrating these differentiated growth strategies will receive an investor premium to their share price compared with the industry average.

Sometimes, share prices are negatively affected by overarching economic issues over which you have no control. While the firm’s inability to properly manage its costs will result in a discount, the impact of macroeconomic global factors will discount the most.

Your company’s share price might be outside the control of the business at such times, but that does not mean you should stop communicating with your investor community. Neither should the company appear unprepared to take advantage of the market opportunities ahead.

If your company is in a strong financial position, your focus should be on initiatives above the line, and the firm should address them in the following order:

1. Acquire the best people: for example, what strategies will take advantage of the Y-generation workforce?

2. Deepen product lines: what strategic initiatives are focusing on increasing the depth of your existing product lines?

3. Develop new product lines: how are you boosting product innovation and R&D?

4. Penetrate new markets: where are the best geographical market opportunities?

But beware: right now it is very easy for executives to slip into the wrong language concerning belt-tightening and cutbacks. Right now, investors want to hear as much as possible about the plans in place to start gearing up.

If you use this ‘gearing up for recovery and growth’ language with your investors, it sends a message of confident conviction. It’s a different message, one investors want to hear, and one not normally heard in a downturn.

Ian Roundell is head of investor relations at Credit Suisse.