In an age of market fragmentation and close proxy fights, retail investors are still seen as loyal and long term

Aunt Minnie from Kansas has been through a lot in the last few decades. Once a dizzy retiree, the stereotypical retail investor evolved into a Mountain Dew-swigging day trader, then a stressed out baby-boomer delaying that promised early retirement.

Today, retail investors look like a Viagra ad: retirees rocking on the front porch, exchanging hopeful but faltering glances. Alternatively, they’re the young, exploding middle class of emerging market countries like China, Brazil and India.

Through all their incarnations, however, and although bruised by the financial crisis of 2008-2009, retail investors are still viewed as loyal, long-term investors, stable liquidity providers and supporters of management in contentious proxy votes. Institutions often buy or sell en masse, so retail investors add stability when news hits, whether positive or negative.

Lou Cordone, head of advisory services for the Americas at Thomson Reuters, says interest in retail investors among his clients is rising.

‘Shareholder bases are becoming more diversified,’ he explains. ‘Mutual funds are still the big dogs, but they’re starting to lose that power as money flows to exchange-traded funds. As a company’s top 25 shareholders control fewer and fewer of its shares, IROs are starting to think about retail investors.’

As the base thins out across more names, retail investors, despite representing a small chunk of a shareholder base, gain in importance in terms of both liquidity and price discovery.

They can also help dampen volatility. ‘We know long-term institutional investors benefit the stock price,’ Cordone says. ‘But who else out there can counter the chop and churn of high-frequency trading? Retail investors pop up as one likely answer.’

Bargain hunters bought in after crash

One common assumption is that retail investors bailed out of equity markets in 2008 and 2009. But although they did lose trust in their money managers and pulled a lot of money out of mutual funds, bargain hunters decided they could invest just as well themselves and invested directly in equities – just like they did in the early 2000s after the internet crash.

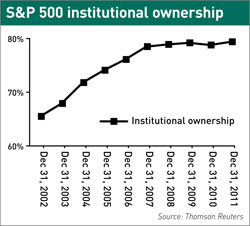

Overall, though, retail investment across the universe of public companies has gradually declined from the traditional equilibrium of 20 percent retail/80 percent institutional as smaller-cap, more institutionally held companies have come to market.

For large-cap companies, retail ownership has gone from around 35 percent to 20 percent over the last decade, according to Thomson Reuters (see S&P 500 institutional ownership, below). For small and mid-cap companies, the range is more like 5 percent to 15 percent retail share ownership.

Tense annual meeting seasons have also thrust retail shareholders into the limelight. Proxy votes surrounding issues such as executive compensation can be contentious, and vote counts in general are closer. That means the 5 percent to 20 percent of shares held by retail investors could swing a decision.

Changes to NYSE Rule 452 in 2009 stopped brokers from voting on behalf of retail owners in director elections. A more recent change eliminated broker voting on compensation issues. Both these amendments make the retail vote even more important.

The problem is that retail investors vote only around 20 percent to 30 percent of the time, according to Frank Scaturro, the former head of Thomson Reuters advisory services who in March was appointed head of IR services at Phoenix Advisory Partners, a division of American Stock Transfer & Trust Company.

‘Companies are stepping up their efforts because retail can be of paramount importance in a close vote,’ Scaturro explains.

The level of retail participation can easily double with a targeted solicitation campaign, particularly with sparing use of notice-only proxy materials, Scaturro adds. What’s more, as a rule, retail investors tend to support management.

How to target the small guy

Targeting retail investors can be tricky, especially as IROs by nature like one-to-one contact. There are several sell-side conferences that are musts, such as the late spring Bernstein Strategic Decisions Conference, now in its 28th year. Many companies doing retail outreach also go to the Money Show or BetterInvesting conferences.

There are two main motivations behind making retail investor outreach part of IR strategy, says John Viglotti, vice president of IR services at PR Newswire: large-cap companies want retail investors’ long-term loyalty and volatility-killing powers. At the other end of the scale, small and micro-caps need the retail audience for the liquidity it brings.

With the Money Show and BetterInvesting conferences well established as ways to meet retail investors and blast emails a doubtful and hard-to-measure means of reaching out, PR Newswire in November 2010 created a virtual conference platform calledRetailInvestorConferences.com with partners including BetterInvesting.

A typical virtual conference extends over a whole day and features several companies presenting, along with two or three educational sessions from organizations like the SEC or the Motley Fool.

Management doesn’t even have to leave the office, Viglotti points out, so it’s a better use of a CEO’s time than taking him or her to shake hands with retail investors in a hotel ballroom somewhere in the sticks.

Henri Perron, a former IRO who founded Montreal-based Renmark Financial Communications, believes in targeting retail investment advisers instead of reaching out directly to retail investors. Oppenheimer & Co, UBS, Morgan Stanley Smith Barney, Wells Fargo and Ameriprise are among the most active retail brokers and make good initial targets.

Perron favors large group meetings with investment advisers from more than one company over going branch by branch. ‘It’s not glamorous; it’s grunt work,’ he concedes. ‘But you can expose your firm to a whole new audience.’

Retail hit When American Electric Power (AEP), a sprawling electric utility with headquarters in Columbus, Ohio, decided in late 2008 to increase its retail shareholder base, Bette Jo Rozsa, managing director of investor relations, thought it would be an uphill battle. When American Electric Power (AEP), a sprawling electric utility with headquarters in Columbus, Ohio, decided in late 2008 to increase its retail shareholder base, Bette Jo Rozsa, managing director of investor relations, thought it would be an uphill battle.With around 500 mn shares outstanding, it would take a lot of retail buyers to move the needle even 1 percent. As it turned out, the macro environment combined with AEP’s proactive approach moved that needle more than Rozsa could have dreamed. Back around 2000, AEP, in line with many dividend-paying utilities, had a shareholder base with around 60 percent retail and 40 percent institutional investors. After merging with a company with the opposite profile, cutting its dividend and doing some institution-heavy offerings, however, by 2008 AEP’s shareholder base had sunk to just 25 percent retail. ‘Whoa, let’s take a look at this,’ Rozsa remembers management saying. Michael Morris, then CEO and now non-executive chairman, wanted more long-term, less volatile retail investors back in the mix. AEP got busy with BetterInvesting conferences as well as presentations to retail brokers at Morgan Stanley offices, and Morris did live webcasts to Wells Fargo’s legions of retail brokers. AEP studied how people used its website and redesigned it to make it more user-friendly. Between 2009 and 2010, retail ownership increased by 15 percent, then by 17 percent the following year. Today the split is 33 percent retail, 67 percent institutional. Rozsa acknowledges AEP had significant tailwinds. As a utility with a dividend yield just under 5 percent, it was a retail investor darling as the economy sank and interest rates dropped to near zero in 2009. ‘We had a lot of appeal for a retail base – we just had to get our name out there,’ she says. Of course, she admits to some side effects: AEP went from mailing 367,000 proxy packages to 494,000 last year. ‘Getting retail investors in the first place is expensive and time-consuming and – once you get them – there’s more expense and effort involved,’ Rozsa says. Sometimes retail shareholders even phone the IR department to complain about the way the electric company trims their trees. But their loyalty – including during annual meeting season – makes it worthwhile. ‘Retail investors are definitely part of our communications and IR strategy going forward,’ Rozsa concludes. |