Technology and competition have sparked an explosion in HFT. However, for IROs, it represents an intra-day distraction, not a long term impact.

The blink of an eye takes 300 milliseconds. Exchanges and other trading platforms are catering to investors who want to execute a trade in less than 100 nanoseconds. That’s millions of shares, millions of trades, each in less than one 3,000th of a blink.

Rapid advances in technology combined with competition among trading venues have created a frenzy in equities trading. According to TABB Group, 70 percent of the trading volume in US equities now comes from high-frequency trading (HFT). More and more investors are using high-return, low-risk computer-driven trading strategies.

Regulation NMS in the US and MIFID in Europe, allowing new trading platforms to compete with traditional exchanges, helped usher in this new era. Transaction costs came down, capacity went up and the speed of execution accelerated wildly. This was not unforeseen. In fact, it was expected sooner.

‘This has taken longer than many people predicted. Strategies seem to include market microstructure, volatility forecasting, liquidity modeling and technical analysis,’ says Patrick Mitchell, chief operating officer of Capital Precision, a market intelligence company owned by Sage Holdings. ‘Is it going to grow? Absolutely - because it is perceived to be low-risk (computers can’t make mistakes). Also the Sharpe ratios that measure reward to risk are potentially large.’

The New York Times this summer blew the lid off the open secret of HFT and flash orders, which are a small subset, around the same time a former Goldman Sachs employee was nabbed for stealing HFT software. Market regulators including the SEC in the US and the Financial Services Authority in the UK are studying whether to regulate HFT along with dark pool trading systems. Changes already in the works, such as new short-selling rules, could also put the brakes on the phenomenon.  What’s the problem?

What’s the problem?

Chris Taylor, managing director of global markets intelligence at Ipreo, says IROs have two questions that have received scant attention amid the furor: is HFT prevalent in my stock and, if so, how is it affecting ownership? Other concerns center around whether HFT hampers price discovery and exacerbates volatility. But considering these ultra-fast money investors aren’t long-term owners and ignore future earnings, quality of management and other typical IR messaging, the main question an IRO may be asking is: do I care?

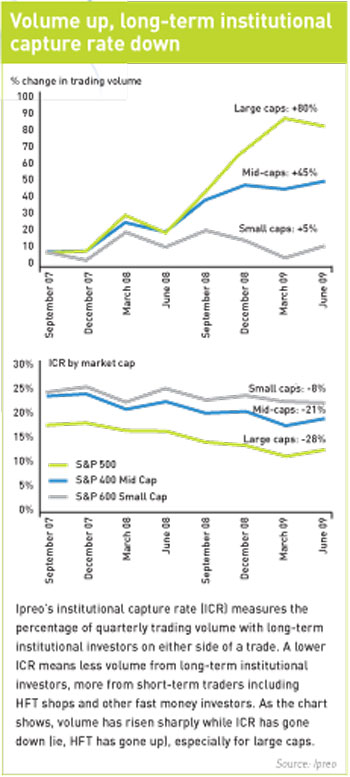

No doubt, trading volume has boomed in the last two years – up 80 percent for large caps, according to Ipreo. Meanwhile, the proportion of trading volume from long-term institutional owners has fallen dramatically, especially for large caps (see Volume up, long-term institutional capture rate down, right).

Frank Scaturro, who has been at the helm of corporate advisory services at Thomson Reuters for six years, says HFT accounts regularly move upwards of 20 percent of a given stock’s volume but hold none at the end of the day. ‘It’s glorified day trading,’ he asserts. ‘Because HFT can control a sizable portion of an issuer’s volume, however, our clients want to know what’s driving it.’

No wonder large caps are such popular HFT targets, then. As Scaturro explains, HFT players look for high liquidity so they can feed off ‘gyrations and aberrations’. As they become active in a stock, they push the volume still higher and contribute to more volatility. It’s a vicious circle. ‘High volatility and high liquidity create the perfect environment for HFT,’ confirms Marie Young at Ilios Partners, a market intelligence firm based in Chicago.

Proponents say HFT brings liquidity to the market. As Ipreo’s data show, however, it is most prevalent in already liquid large-cap stocks. It largely bypasses small caps, which may need more liquidity.

Scaturro says stock surveillance analysis can distinguish institutional orders and traditional fast money like prop desks (trading banks’ own accounts) from the bandwidth that’s likely to be HFT. ‘You focus on what’s transpiring in the trading session, who the market makers are, the type of volume and the trading patterns,’ he adds.

The trouble is, the growth of dark pools, the disintermediation of brokers and the disappearance of large block trades have all resulted in corporate IR having a much poorer picture of intra-day trading than in the past. ‘But given that there is nothing IR professionals can do regarding how their shares are traded – HFT or otherwise – does it really matter?’ Mitchell queries. ‘Our conversations with clients suggest they are not that concerned.’

‘A publicly traded company can’t control how its shares are traded – that’s determined by the buyers and sellers. What’s important is who owns the shares at the end of the day and how to be proactive with that information,’ says Young, who spent 20 years as a trader at Merrill Lynch and on the buy side.

Mitchell zeros in on the difference between trading and settlement. ‘Our custodial approach to uncovering ownership means we see everything – proprietary trading, stock lending, market making, and so on,’ he explains. ‘Once we identify which accounts are being used by high-frequency traders, we just monitor them like any other account.’

By the time trades settle – in the US the cycle is trade date plus three days – HFTs are long gone. ‘Because the volume of trades that are conducted this way are by their nature intra-day trades, they don’t settle. And because they don’t settle, you don’t see this type of trading expressed on the share register,’ explains Charles Hamlyn, UK business development director at Orient Capital, a market intelligence firm specializing in share register analysis.

It’s frustrating for IROs to see their stocks roiled by HFT. As Taylor says, however, settlement is the great equalizer; that’s when the dust settles and you see who bought and sold in any meaningful way. ‘HFT is rather like short selling in that it’s just another distraction,’ Hamlyn adds. ‘It is not a primary driver of share price. Any sensible IRO will focus on active investment managers.’ Or, as Scaturro concludes: ‘In effect, it’s just noise.’

HFT and market abuse

Frank Hatheway, chief economist at the NASDAQ OMX Group, says a lot of high-frequency trading (HFT) is healthy market-making. Sometimes ‘cascading’ buy or sell orders can cause problems for both issuer and investor, but the bigger worry may be the potential for market manipulation. ‘The SEC in particular is looking for institutional algorithms that are being aggressive,’ Hatheway remarked at a meeting of NIRI’s New York chapter in September.

The economist noted that some black-box algorithms could be exploiting retail investors. ‘In some instances there are momentum trends visible in retail orders,’ Hatheway said. ‘We are all looking for the presence of market abuse. These issues have been going on forever with trading but in the human environment the indications of it happening are easier to find.’

The SEC leapt to ban flash trading – a small proportion of HFT that risks letting market-makers ‘front run’ investors – soon after the scandal broke this summer. NASDAQ had begun offering flash trading in June, around the same time as BATS Exchange. Both rivals moved fast to shut it down. ‘Like many things, individually it made sense, but when a lot of people start doing it, it can become difficult,’ Hatheway noted.