Take a first look at the research that underpins IR magazine's Investor Investor Perception Study Asia, 2011/12

The short lists for IR magazine’s Greater China and South East Asia awards are in – and it’s all change for 2011.

A quick glance at the companies short-listed for an IR Magazine Award in Greater China instantly promises to deliver a roomful of new faces at the Conrad Hotel in Hong Kong when the coveted trophies are handed out on December 1.

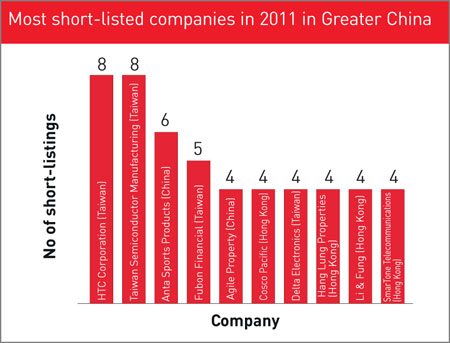

HTC has been short-listed eight times this year – the joint-highest in 2011 across both regions. The Taiwanese smartphone manufacturer shares this honor with awards stalwart Taiwan Semiconductor Manufacturing.

Both firms will be going head-to-head for the Greater China grand prix for best overall IR alongside China Merchants Bank and Cosco Pacific.

The IR team at Anta Sports, third on the list of most short-listed companies in Greater China, is punching above its cap size with six short-listings in total – the most for any Asian small or mid-cap company.

The Chinese sportswear label only went public in Hong Kong in 2007 but in those four years it has acquired the Greater China rights to sportswear manufacturer Fila and persuaded the high-profile NBA basketball player, Kevin Garnett, to switch sponsorship deals from German giant Adidas.

Neither HTC nor Anta Sports featured among the winning companies in the IR Magazine Greater China Awards 2010; they didn’t even make a single short list between them.

In all, only two companies that won a Greater China award last year feature on the short list for the same award this year.

South East Asia

There is also a change in the companies short-listed for the South East Asia awards. New names like StarHub of Singapore, Precious Shipping of Thailand and Indofood of Indonesia replace many of last year’s short-listed companies, such as PTT and Bank Negara Indonesia.

Nonetheless, just over half of the winning companies from last year are short-listed for the same award again this year.

SingTel and CapitaLand are in the running for the most awards in South East Asia, with seven and six short-listings, respectively. Both companies won two awards last year and both will be vying for outright supremacy at this year’s event, to be held in Singapore on December 6.

Strong competition for the 18 awards to be handed out should likewise come from the trio of Singaporean banks – DBS, OCBC and United Overseas Bank – each up for at least three awards.

In the second big development for 2011, IR magazine is also launching the Asia Top 50 – a ranking of the highest-scoring companies across all of the Asian research.

The exact make-up of the inaugural list is kept under lock and key until the Investor Perception Study, Asia 2011/2012 is published in December, but a sneak preview reveals 17 companies from China in the top 50 and 13 from Singapore.

The purpose of the top 50 ranking is to allow companies to compare their IR offerings on a pan-Asian basis, as well as to recognize those companies that perform well across the board but don’t do well enough in any single category to win an award.

IR Insight

The third change this year has involved a fresh approach to the awards research. IR Insight, the in-house research arm of IR magazine, is now managing the process, commissioning Mary Maude Research, an independent firm, to conduct the first stage of the study: hundreds of one-on-one phone calls with members of the Asian investment community.

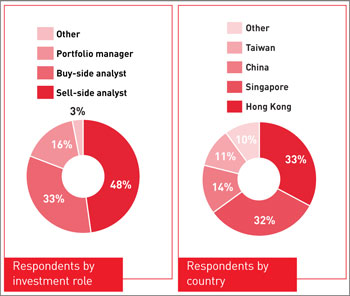

More than 300 buy-side analysts, sell-side analysts and portfolio managers took part in the telephone interviews for this year’s IR Magazine Greater China Awards and IR Magazine South East Asia Awards, an easy majority (93 percent) of whom were located in the region.

As well as asking them about the quality of companies’ IR programs, the researchers quizzed them on certain matters pertinent to IR best practice in Asia.

The researchers asked them which areas of IR they would most like to see improve; and whether access to senior management was necessary before recommending or acquiring a company’s stock.

Overall, access to management comes second on the list of desired improvements, but its importance varies from country to country.

The sliding scale begins with Singapore at the top, where access to management is spoken about in terms of how much rather than if any at all. ‘I always need to meet with the CEO and CFO before buying stock,’ said one Singaporean buy-side analyst.

There are mixed results in Taiwan and Hong Kong, whereas in China, at the bottom of the list, accessing senior management is not considered usual practice and CEO/CFO visibility is almost non-existent.

‘All Chinese companies need to improve their IR, and they should start by providing more access,’ suggested a buy-side analyst in China.

About IR InsightIR Insight is the research arm of IR magazine, the leading voice in global investor relations. We regularly engage with both the IR and investment communities through extensive studies, surveys and detailed interviews. Our recent survey of around 1,000 IROs worldwide, for instance, provides an unrivaled global perspective on the latest IR trends and industry best practices.For the Greater China and South East Asia awards, highlighted on these pages, IR Insight commissioned Mary Maude Research to survey more than 300 investors and analysts who cover Asian companies. The resulting Investor Perception Study Asia, 2011/12, complements our reports covering the US, Canada, Brazil and Europe. All these reports identify what makes a successful IR program and reveal the key drivers of investor sentiment. For customized reports on your global peer group, visit www.irmagazine.com/research. To order a copy of the Investor Perception Study, Asia 2011/12 or to become a professional subscriber to IR Magazine, please call Jonathan Cardle at +44 20 7107 2566 or email jonathan.cardle@thecrossbordergroup.com.  |