Garnet Roach talks to the IROs embracing the medium – and those who say it’s no place for material information

The SEC’s April guidance sent ‘a huge statement that social media is here and it’s real,’ says Kurt Heinemann, chief marketing officer at Marketwired.

Indeed, the SEC’s sanctioning of social media as a valid platform for material information – five years after it first approved the use of corporate websites – looked set to open the social media floodgates.

Without fear of falling foul of Regulation FD, IR professionals would be free to tweet and post material information, allowing thousands of investors to stay up to date on their holdings, whether on the go or at their desks.

The SEC’s clarification, which requires companies to notify investors in advance about which channels they’ll be using, might have removed regulatory barriers, but are IROs really ready to embrace social media?

According to research from NIRI, conducted one month after the SEC’s announcement and released in June, the majority (72 percent) of IR professionals don’t use social media as part of their IR program, but almost half of them (49 percent) ‘plan to reassess their position in the next 12 months.’

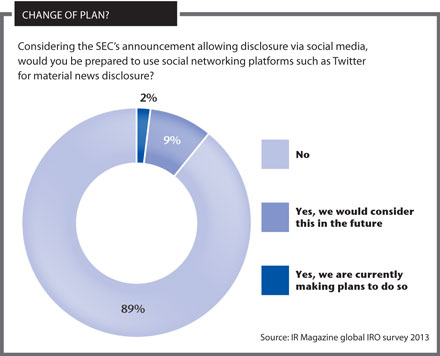

So is the IR community prepping itself for a plunge into the social media pool? It would appear not: when IR Magazine asked whether or not IROs would be ‘prepared to use social networking platforms such as Twitter for material news disclosure’ a massive 89 percent said ‘no’.

Lack of demand

The SEC’s clarification was clearly welcomed by the investor relations community, but regulation is only one part of the reason IROs haven’t already flocked to Twitter, Facebook and the like. The other issue is demand: investors simply aren’t that interested, say IROs.

‘Respondents report not using social media for investor relations primarily due to lack of interest from the investment community,’ notes NIRI.

And accompanying research from Corbin Perception, looking at social media use by institutional investors, shows that while 52 percent say they use it as part of their research process, that number has actually fallen slightly from 56 percent in 2010.

A lack of demand is definitely a deterrent for Amy Giuffre, director of investor relations at Harley-Davidson. The motorcycle legend does use social media for ‘consumer interaction’, especially when reaching out to young adults.

But Giuffre points out that ‘the financial community has not indicated any interest in social media as a channel for our financial or business-related communications.’

She hasn’t ruled out using social media for IR in the future, however. ‘The SEC announcement triggered internal discussion on the topic, but it didn’t change our approach,’ explains Giuffre.

‘We would certainly consider incorporating social media into our plan, but we need some compelling reasons to do so, and these have not materialized – yet.’

Cole Lannum, vice president of IR at Covidien, agrees. He says he has never received a request from an investor for more information via Twitter or Facebook.

There are several potential reasons for this: more than 90 percent of the company’s investor base comprises institutional investors, the information Lannum releases via social media is ‘very specifically public information and/or immaterial information’, and Covidien is a largely business-to-business company operating in a highly regulated industry.

The global healthcare products firm does use social media in a number of areas – including its IR program – but in addition to the lack of demand, Lannum feels social media simply isn’t a suitable platform for material disclosure.

‘Whether or not the SEC says it’s appropriate, it’s not consistent with our policy of fair and complete distribution to the broadest possible audience,’ he explains. ‘There are lots of things deemed ‘legal and acceptable’ by the commission, but that doesn’t necessarily mean they’re best practice, in my opinion.’

Even if you’ve told investors you might release material information through Twitter, for example, and that information is released after the stock exchanges have closed, Lannum argues that it is just too easy to miss a tweet. Like Giuffre, however, he hasn’t ruled out using social media as an additional channel – alongside traditional methods of information dissemination – in the future.

‘The area where I become uncomfortable is using social media as a sole and primary distribution mechanism,’ he says.

Use with caution

Even among those who argue that social media is the future of material information distribution, few – if any – are willing to go it alone and ditch the alternatives just yet, regardless of what the SEC says.

Seattle-based real estate firm Zillow, which became the first company to take questions via Twitter and Facebook for its earnings call in May, has always been a ‘social company,’ says IRO RJ Jones.

As well as the @Zillow Twitter handle and the company’s Facebook page, which are both used by the IR team, the firm’s chief executive Spencer Rascoff is a prolific Twitter user, with more than 18,000 followers on his @spencerrascoff feed.

‘Investors have been paying attention to our CEO’s tweets since before we went public,’ says Jones, who definitely sees an interest in social media from the investors and analysts following his firm.

Zillow had been planning to integrate social media and IR for some time, adds Jones. ‘The SEC announcement both elevated the awareness of the channels for investors and prompted us to take the plunge,’ he notes.

But he acknowledges that adoption is still in the early stages, and says social media isn’t in a position to take over from traditional distribution outlets, which remain ‘the most widely known, accepted and monitored channels by investors.’

Another firm making the leap is independent research broker ITG, which announced in July that it would also begin to use social media for material disclosure. James Farley, director of IR and corporate communications at ITG, says the company will continue to file 8Ks and issue press releases, but the speed of dissemination social media offers is a big draw – both for the IR team and ITG’s investors.

‘All of the financial journalists who cover us are on Twitter and many of the prominent commentators on issues that are of interest to us in terms of the industry are on Twitter, so there’s an active dialogue going on,’ Farley says.

‘While some of it is not specifically IR-related, it’s definitely important to be in the mix.’ And from an investor perspective, he adds, ‘if you look at our Twitter feed you can see the developments in our company over the last month or two in very short order.’

These benefits, however, are also a cause for caution, warns Farley. ‘In some ways the things about Twitter that are the most useful – its speed and brevity – are also its biggest potential pitfalls,’ he says. ‘Any channel that offers immediate disclosure has the potential for error.’

Bloomberg and Twitter

One indicator that social media is here to stay is the integration of Twitter into Bloomberg terminals, added just days after the SEC’s social media clearance.

With research from Marketwired showing that almost half (49 percent) of investors have access to social networks blocked by their employers – rising to 74 percent at large firms – the addition of Twitter for Bloomberg Professional users means many more investors can now follow the likes of @Zillow and @ITGinc without taking their eyes from the terminal.

Jones says Bloomberg has incorporated tweets from Rascoff into its terminal feeds, and ITG chose to focus primarily on Twitter, based – in part – on the Bloomberg move. ‘Our clients and the financial media we deal with are more present on Twitter than on anything else,’ explains Farley.

‘But the real thing that clinched it for us was when Bloomberg announced it was going to include corporate Twitter feeds in the news feeds for its companies.’

Farley made the right decision, according to data from advisory firm CEB, which says Twitter remains the most active social media platform for the IR community, while the @StockTwits handle, which has more than 292,000 followers, ‘shows the highest percentage increase in average monthly traffic, rising by about 75 percent from 2011 to 2012.’

Regulation and demand are clearly important, but social media adoption is also about age, argues Heinemann. Marketwired’s own research, conducted in April, finds the investment community’s younger members – the under-40s – are far more likely to use social media: 60 percent say they regularly consult social media to research investment options, while 53 percent agree ‘information provided through social media is very credible or somewhat credible when making an investment decision’.

This drops to 18 percent in the 40-65 age group and to zero for the over-65s. ‘People who use social, know how to use social, and people who don’t use it tend to think of it as isolated, unreliable and questionable,’ Heinemann says.

Monitoring mattersSocial media isn’t just about putting out information: it’s becoming increasingly important for companies to monitor what’s being said about them online. In March the Australian Securities Exchange (ASX) issued guidance ‘strongly encouraging’ listed firms to monitor ‘any investor blogs, chat sites or other social media it is aware of that regularly post comments about the entity.’ While an ASX spokesperson stresses that its Guidance Note 8 ‘does not call for listed entities to monitor all social media channels and respond to them’, it does require firms to respond to rumors or speculation that appear credible (whether the information is accurate or not) and have affected – or could affect – the stock price.Regulatory requirement or not, monitoring is an essential first step into the world of social media, says Kurt Heinemann, Marketwired’s chief marketing officer. It offers two key benefits: it allows you to find out what works before you start posting, and it keeps you up to date on any online conversations about your company. ‘It’s important to ‘understand who those key people are who talk about your stock and who have insight – and how you can involve yourself in conversations with them,’ explains Heinemann, adding that influential commentators can have an impact ‘on the outcome of your releases and even the performance of your stock. You have to make sure those conversations don’t get out of control because you’re responsible for them even if you’re not tuning into them.’ But that doesn’t mean you have to get involved in a conversation with every anonymous Twitter user who has something to say about your firm. ‘The ASX provides a really good guide,’ advises Heinemann. For Zillow’s IRO RJ Jones, monitoring social media offers a number of advantages. ‘The increased information exchange leads to a better understanding externally of our opportunities, strategy, products and results,’ he says. ‘And social media interactions also provide us with an enhanced sense of what investors are interested in learning more about.’ |