Integrated reporting can provide information investors seek both comprehensively and concisely

As the IR function faces increasing demand for corporate disclosure from stakeholders, a patchwork of regulations and best practices have been added to the annual report and financial statements.

For example, the International Accounting Standards Board (IASB) completed an IFRS practice statement for management commentary to serve as a basis for understanding management’s objectives and strategies.

Sustainability reporting, which operates under frameworks such as the Global Reporting Initiative (GRI) and the Prince’s Accounting for Sustainability Project (A4S), is encouraged by several stock exchanges. More data is provided through longer and more complex financial statements and commentaries. Inevitably, many complain that this huge volume of data buries key information within the clutter. It poses the question: can integrated reporting simplify investor relations?

Integrated reporting in a nutshell

The integrated reporting initiative is one of the most successful recent efforts to improve corporate reporting. In 2009 the UK’s Prince Charles convened a meeting of investors, standard setters, companies, accounting bodies and UN representatives to establish the International Integrated Reporting Council (IIRC), tasked with overseeing the creation of the Integrated Reporting Framework.

The IIRC moved quickly to consult stakeholders on the framework and established the IIRC pilot program to obtain feedback about implementation. In December 2013 the IIRC published the framework and explicitly stated the aim of integrated reporting as ‘to support integrated thinking and decision making, where the cycle of integrated thinking and reporting result in efficient and productive capital allocation that acts as a force for financial stability and sustainability.’

While sustainability reporting is an important driving force in the creation of integrated reporting, the purpose of the framework is to explain to providers of financial capital how firms create value in the short, medium and long terms. Integrated reports provide information on environmental matters only if they materially affect value creation.

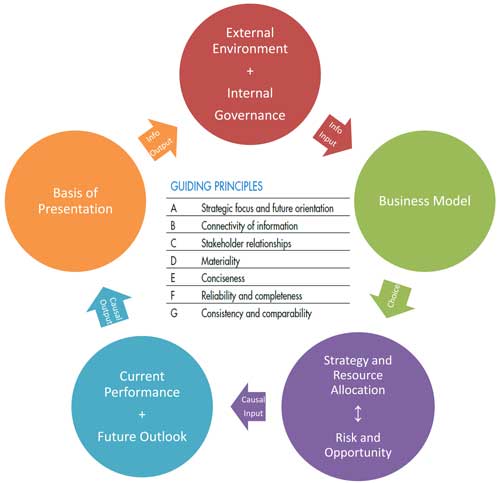

The gist of the framework is the articulation of the seven guiding principles and eight content elements (summarized in the diagram below). Integrated reports must comply with all seven guiding principles and all eight content elements unless reliable data is not available, there is specific legal prohibition or disclosure is deemed competitively harmful.

The IIRC's integrated reporting framework, summarized

In Strategic management: Competitiveness and globalization by Michael Hitt, Duane Ireland and Robert Hoskisson, the content elements provide a complete and concise story of a firm’s strategy that investors seek to know. The firm’s external environment and internal governance provide the context for articulating an explicit business model for value creation over time.

The firm makes strategic choices – the business to enter, the advantage to pursue (low cost or differentiation), the scope of competition (geography, market niche and diversification), organizational structure for effective execution and so on – about the process of value creation. Given the chosen strategy, the integrated report explains how risks and opportunities both influence and are influenced by the firm’s strategy and resource allocation. The results of strategy execution are reported as the firm’s current performance and future outlook using a clear basis of presentation.

Investor relations and integrated reporting

As of 2014 integrated reporting is a listing requirement in South Africa and – as reported by the IIRC Business Network – has been voluntarily adopted by significant firms all over the world. The momentum for adoption of integrated reporting is accelerating but the gap between early adopters and others is not easy to cross.

Integrated reports can provide relevant and material information arranged in a systematic and logical flow to serve as the basis for disclosure to investors, helping to bring together in a cohesive fashion the financial and non-financial information demanded by today’s investors and other stakeholders. This disclosure is important to promote two-way communication between managers and investors, building up mutual trust over time.

Tan Boon Seng is assistant director of technical research at the Institute of Singapore Chartered Accountants.