Shammara Hussain tries to get old blogs purged from Seeking Alpha

The Galleon insider trading scandal is reverberating around the IR industry. IROs are dusting off disclosure policies and training procedures while wondering if their analysts and shareholders have risked crossing the blurry line of insider trading when digging for market-moving information.

Market Street Partners (MSP), a small San Francisco IR firm founded in 2000 by former Morgen-Walke Associates consultants, is near the heart of the case.

Federal investigators say a former MSP employee leaked information about Google’s Q2 2007 earnings to ‘Tipper A’, now known to be Roomy Khan, who passed the information to Galleon’s Raj Rajaratnam. The MSP employee is alleged to have asked for $100,000 to $150,000 each quarter for future tips but was turned down.

Today the Wall Street Journal named the Google tipster as Shammara Hussain. Quoting people familiar with the matter, the WSJ says Hussain, a former hedge fund employee, was fired by MSP in September 2007 after writing blog posts about two companies that were Market Street clients or competitors of clients. She has not been named as a defendant in the Galleon probe.

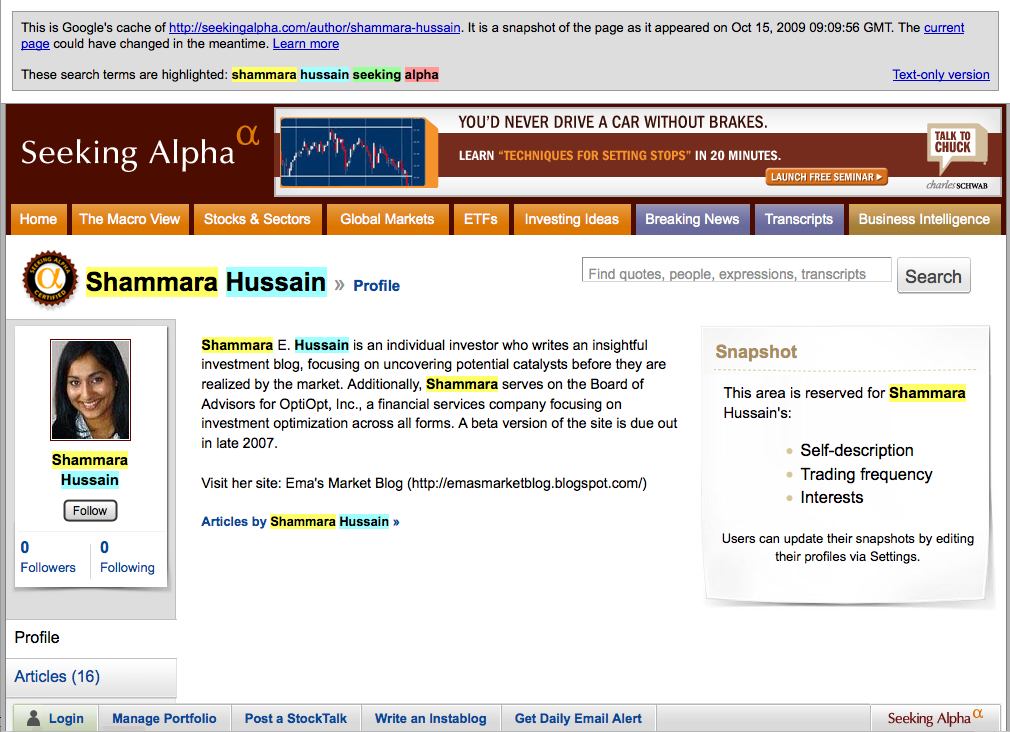

Hussain’s 2007 blog posts still appear on Seeking Alpha, an aggregator of financial blogs. However, her profile and photo have been deleted and replaced by her initials. A cached version from October 15 still shows her profile and photo, and searching for her name on Seeking Alpha still turns up her blog posts.

In a number of emails yesterday, Hussain urged Seeking Alpha to remove all her old blog posts, her author profile and her photo. ‘Please remove all my articles, picture, all info ASAP,’ she emailed.

Seeking Alpha responded that it was against policy to remove published articles. ‘We are the blog aggregator of record because we don’t remove content. Once an article has been published in the domain, we will not remove it unless there’s a case of material error in the article,’ says Eli Hoffmann, Seeking Alpha’s managing editor.

Hussain questioned that policy, arguing that she was not a contributor and hadn’t been for a long time. She also said she was in the process of looking for a job, and her photo and bio wouldn’t reflect well on her. Eventually Seeking Alpha removed her photo and bio and replaced her byline with ‘S.H.’

Hussain didn’t mention her Galleon connection to Seeking Alpha. When the WSJ outed her today, ‘it completely blindsided us,’ Hoffmann says.

All Seeking Alpha contributors sign a compliance document, which includes the promise not to blog about a company they’re connected with through a PR or IR relationship, or any other kind of link. ‘In a couple of cases we found that a blogger was connected to a firm and kicked them off,’ Hoffmann says.

At least one of Hussain’s blog posts that may have got her fired from MSP is still on Seeking Alpha. Hussain blogged about Visual Sciences, which is listed as a client on MSP’s website, in May 2007. Hussain appears as the contact name on Visual Sciences press releases from July 2007.

MSP was founded in 2000 by Carolyn Bass and JoAnn Horne, who had led West Coast operations for Morgen-Walke Associates, an independent IR consulting firm acquired by Lighthouse Global Network in 2000. Bass was formerly an investment banker and Horne an institutional salesperson.

While Google said on Tuesday that MSP was still a vendor, on Wednesday it said it had suspended MSP’s services and was doing its own independent investigation. MSP’s lawyer told AP that the firm was cooperating with investigators, and had been assured neither it nor any current employees were targets of the probe.