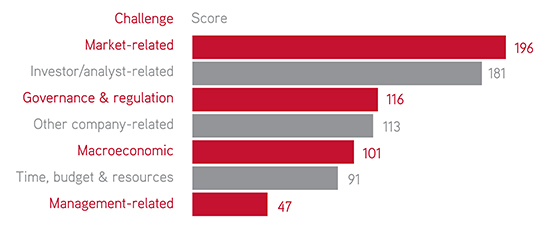

Market-related issues have been named as the top challenge faced by European IROs, followed by investor/analyst-related issues. Governance & regulation ranks third, despite Mifid II coming into force across the continent this year.

The findings are part of a survey of IR Magazine Awards – Europe 2018 nominees, published in the report, Award-Winning IR – Europe 2018.

The research asks award nominees what they consider to be their main challenges over the previous 12 months and to rank them in order of priority (first to fifth). The point scores below allocate five points to each first-place rank, four points to each second, and so on.

While investor/analyst issues – which cover everything from analyst coverage, investor outreach and guidance to investor expansion/retention, targeting & shareholder ID – are considered more pressing than governance & regulation, Mifid II is tied up with many of these issues. Indeed, when asked to expand on how they tried to overcome these issues, survey respondents mention Mifid II a number of times.

Below is a selection of comments related to the pan-European regulation from awards nominees:

‘The introduction of Mifid II has caused us to rethink our IR strategy: we are now taking responsibility for arranging our own IR roadshows and are cutting out brokers altogether where possible’ – Consumer discretionary

‘We were faced with the first Mifid II-related effects in the sense that it has become more challenging to organize a high-quality investor meeting schedule, at least in smaller locations’ – Consumer discretionary

‘We are not talking dramatic events: it is evolution, not revolution. Both management and – especially – the IR team are very focused on the consequences of Mifid II and the increasing importance of managing the relationship with investors directly rather than relying on banks/brokers. Having said this, we still have very good co-operation with brokers, and we continue to see this as an extremely important part of our investor relations work’ – Industrials

‘The main challenge has been the implementation of Mifid II. We are reinforcing the IR department in order to cope with more demands from investors that rely less on the brokers’ – Utilities