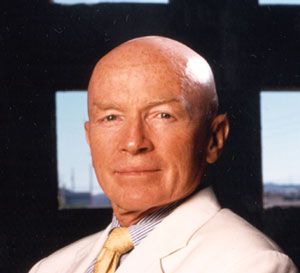

Veteran emerging markets investor Mark Mobius explains his stock picking philosophy to Alex Jolliffe

Mark Mobius, who is responsible for managing $50 bn in emerging market equities, recently wanted to eat in a restaurant in a Chinese province. ‘We went into a restaurant, and I spotted a nice table at the back of the room,’ he says. But the manager told Mobius, a man of significant power, that he could not eat there because he was about to close that part of the restaurant. When the investment manager asked why, the restaurateur blamed electricity shortages.

The anecdote illustrates the reason why Mobius, who has invested in emerging market equities for decades, has made the energy sector his biggest bet in the Templeton Emerging Markets Investment Trust. He has put 22.8 percent of the fund into this industry, 8.3 percentage points more than its weighting in the MSCI Emerging Markets Index. ‘You notice that there are increasing shortages of electric power, so they need more coal and gas,’ he explains. ‘In China, there are definitely power shortages.’ The trust showcases opportunities for IROs at European companies to sell their shares to emerging market fund managers, if they have significant operations in the relevant regions. In the energy sector, OMV of Austria and MOL Hungarian Oil and Gas were holdings at the end of the first quarter.

The trust showcases opportunities for IROs at European companies to sell their shares to emerging market fund managers, if they have significant operations in the relevant regions. In the energy sector, OMV of Austria and MOL Hungarian Oil and Gas were holdings at the end of the first quarter.

Mobius’ fund has generated strong returns over the past 10 years. Of course, that was a good decade for emerging market equities, so investors expected robust returns. But Mobius outperformed in emerging markets, defined as countries whose gross domestic product per head is below $25,000 annually. A shareholder who invested £100 ($163) in Mobius’ trust 10 years ago and reinvested the dividends would have £710.10 today. By contrast, an investor who put £100 into an average global emerging markets investment trust would have £648.80, according to the Association of Investment Companies.

Investment rationale

While Franklin Templeton, which employs Mobius, does not comment officially about individual stocks, the investment trust has released explanations for purchases to the London Stock Exchange. The argument about energy led Mobius and his team to invest in PetroChina. They also hold SK innovation, a South Korean oil refinery that has done well out of strong refining margins, and also operates service stations and diversifies into chemical products.

Turning to peak oil and concerns that by 2030 the world might struggle to meet demand for crude, Mobius says: ‘The trend for oil prices is to increase – demand will increase, supply will [increase].’ He adds that the pattern in the cost of supply must also be taken into account.

Fund snapshotName: Templeton Emerging Markets Investment TrustLaunch date: June 12, 1989 Benchmark: MSCI Emerging Markets Index Lead manager: Mark Mobius Total net assets: £2.31 bn Largest country weightings: China, Brazil, India, Thailand, Indonesia Top five holdings: Brilliance China Automotive Holdings, Vale, Itaú Unibanco, Banco Bradesco, Tata Consultancy Services Source: Franklin Templeton |

Few investors can ignore China. Mobius says its consumers are increasingly determined to demonstrate their wealth, for instance by buying luxury leather goods. ‘Consumers in China are becoming more sophisticated,’ he says. ‘They want brands, such as Louis Vuitton. And companies are now doing product placements in movies.’ Such factors have led Mobius to bet heavily on the consumer discretionary sector, in which he has invested 15.6 percent of the fund. That is more than double the global index weighting of 7.6 percent.

Another change in Chinese consumers’ behavior has seen them throwing away their bicycles and buying cars instead. In this sector, Mobius has made Brilliance China Automotive his biggest bet. The car maker has a joint venture with BMW to manufacture and sell the German group’s 3-series and 5-series cars and Mobius is expecting the company to benefit from growing demand. In addition, it will benefit from provincial governments offering free land to car makers to encourage them to manufacture in their regions. The infrastructure is also improving, judging by the increasing number of new roads.

Essential commodities

Emerging markets are famous partly for their demand for commodities. Between April and June, Mobius increased his holding in Impala Platinum, which produces about a quarter of the world’s supply of the metal from operations in South Africa and Zimbabwe. He believes Impala is one of the lowest-cost producers and likely to do well out of the long-term uptrend in commodity prices. His second-largest bet is Vale, the Brazilian mining company that is one of the world’s biggest iron ore producers. Mobius expects Vale, like Impala, to continue to benefit from rising commodity prices.

Commodities have also led him to back Aluminum Corporation of China (Chalco), the country’s leading producer of alumina and primary aluminum products, which he expects to benefit from market consolidation and continuing growth. One of his top 10 holdings is Sesa Goa, an Indian exporter of iron ore. On a long view, Mobius is attracted by its undemanding valuation, strong balance sheet and high profitability.

But perhaps his most striking holding is one of the least famous. Between April and June he invested for the first time in Univanich Palm Oil, a producer of crude palm oil in Thailand. Mobius says the company is a beneficiary of strong growth in demand for its product and expectations of higher prices. The stock is significant because it is in a frontier market, one which has less liquidity than an emerging economy.

Franklin Templeton has invested $1.1 bn in frontier markets. ‘The new game in town is frontier funds,’ says Mobius. ‘That’s gone up dramatically. The most significant markets are Vietnam and Cambodia.’ He is considering Sri Lanka and Bangladesh, too.

Sector specifics

Mobius has also backed the materials sector significantly. Like energy stocks, they did well in January and February, despite a sell-off in other emerging markets equity sectors. He has invested 18.5 percent of shareholders’ assets in the materials industry, 3.6 percentage points more than its weighting in the MSCI Emerging Markets Index, and has bought Norilsk Nickel of Russia.

His largest bet on a sector, however, is financials, which have 25.9 percent of the trust. Recently Mobius invested in Bank Central Asia of Indonesia, because of robust deposits and a large distribution network. He raised his holding in MCB, a Pakistani bank, because of its cheap valuation and relatively high return on equity. He also invested in Banco Bradesco of Brazil, because of its nationwide coverage and its strong retail business.

In the technology industry, he holds Tata of India among his top 10 stocks. He expects it to benefit from the trend that has clients outsourcing services to Indian IT services companies.

Making an impression

IR officers who are hungry to present their companies optimally must sell their managements first, their valuation second. When asked why Dairy Farm, the Asian supermarket group, is a top 10 holding, Mobius praises the company’s managers. ‘We first of all look at management,’ he says. Dairy Farm also passed the test of price, in relation to its five-year earnings forecast.

Valuations in the fund are cheaper than the benchmark: the trust’s companies trade on an average P/E ratio of 12.2 times, compared with the index’s 12.8.

China’s importance is clear from activity in its provinces and the country’s involvement in frontier markets, where the Chinese are a frequent sight, like hedge fund managers in emerging markets, Mobius says.

He travels frequently and recently, while in Botswana, asked where the market was. The person he spoke to asked him which one: the local or the Chinese marketplace? China’s market sells clothing, shoes and electronics, the respondent said: ‘You name it, it’s got it.’

This article appeared in the September print edition of IR magazine.