Mark Kopinski of American Century International Discovery Fund on what he looks for in an IRO and how he picks his investments

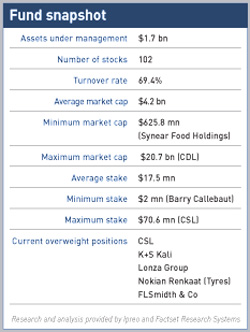

Mark Kopinski’s growth approach-based fund focuses on undiscovered – hence the fund name – small to mid-sized companies right across the globe. Returns have been strong: almost 25 percent ahead in 2007, up 31 percent in 2006 and up another 31 percent in 2005. Over a 10-year period Kopinski is significantly ahead of the MSCI AC World ex-US Mid-Cap Growth index.

So which companies does this ex-University of Illinois student and fluent Japanese speaker – he spent eight years in Japan working for Salomon Brothers and Sanyo – really rate for IR quality?

‘Carphone Warehouse is very good,’ Kopinski says. ‘It’s proactive, calling us if it has a piece of news to impart or if some news story hits the markets and it needs to comment. When I meet the company it’s usually the IRO and I always get good quality info. I think good IR is a reflection of strong management. Royal Bank of Scotland (RBS) has strong management – it’s not just a good company.’

RBS currently needs all the first-rate IR it can muster as it struggles to convince investors to back a £12 bn ($23.5 bn) rights issue to raise funds thanks to credit crisis write-downs; just two months’ ago, RBS was insisting it didn’t need the cash.

Consistent IR quality is certainly appreciated. ‘We got an email yesterday from a company asking us how we will vote on the proxy,’ says Kopinski. ‘Unless the issue is especially contentious, we tend to vote with management. But it’s nice that the firm bothered.’

An increase in a company’s IR exposure does not always result in better quality all-round investor relations, Kopinski adds. ‘In Japan they’ve bumped up IR exposure, but that doesn’t necessarily mean there’s any improvement in the quality of disclosure, for example,’ he explains. And less than frank IR disclosure does not help dialogue.

It’s also about confidence, Kopinski says. ‘If an IRO says, No comment in a meeting, I have to ask why he or she came to see me,’ he argues. ‘If an IRO isn’t prepared to talk like a senior person in the company, it’s a waste of my time. I understand guidelines and the limits of what people can say, but I’m not going to pump someone for info he or she can’t say publicly.’

European affairs

More than half of Kopinski’s fund is locked into Europe so the rising value of the euro has helped give his fund some lift. He’s happy to take advantage of currency fluctuations and political instability, but more significant for Kopinski is forensic scrutiny of earnings direction. ‘We’ll buy a company that’s not doing well but where the earnings drift is possible, even if there’s a negative earnings report,’ he explains. ‘If the outlook says it will turn things around… that’s different from when earnings are negative, so we draw a conclusion that things will improve.’

A good example of this approach is Kopinski’s largest holding, Commonwealth Serum Laboratories (CSL), an Australian manufacturer of medical and blood plasma products – and a storming performer. Kopinski’s team originally bought in almost five years ago and has steadily increased the holding, despite some scares en route.

‘When we first invested, earnings were negative but we could see improvement,’ Kopinski recalls. ‘When 9/11 occurred the market was flooded with blood plasma and prices went down, but CSL was a consolidator of several firms and grew out of that. It was a stock that was restructuring.’

In terms of industry sectors, Kopinski has soaked himself fairly thoroughly in oil services; it’s a basic supply-and-demand issue with plenty of interesting opportunities, he reckons. ‘There’s not a lot of oil and everyone is looking for more,’ he states bluntly. ‘Recently there was this big Brazilian find offshore: 30 bn barrels. In order to develop that, you’re going to need a lot of oil service companies.’

Further tests are ongoing but analysts appear to agree that the new deep-sea field off Rio de Janeiro could be huge, even though it will be years before the floods of crude can be processed and piped to the service station. Copper and steel is another area Kopinski likes – the demand from the developing world still continues apace despite widespread economic anxiety in the West.

Kopinski also has a liking for soft commodities, an investment play anticipating that fast-growing economies like China and India will increasingly demand better-quality food. ‘They’re becoming wealthier,’ he says. ‘So if you plant corn, you’re going to need a lot of fertilizer. That poses questions for us: what sort of competition is there going to be for these companies? What about competition coming out of the developed world? How are companies structuring themselves for this now?’

Food, glorious food

The recent dramatic rises in global food prices – and the accompanying riots from those at the sharp end of rice price hikes – looks set to support Kopinski’s soft commodities strategy.

Wary of any rush into regional hot-spots, however, Kopinski is more a trend-watcher. Companies may look great and report an impressive set of numbers, he cautions, but it’s the drivers behind those numbers that are his real priority.

Mistakes? He’s had a few, naturally. The most disastrous was UTStarcom, a telecommunications company in China. It pioneered a technology called personal access system (PAS) at the beginning of the decade, which focused on mobile phone users in high-density urban areas. But the company’s investors endured a white-knuckle ride after telecom operators like China Telecom and China Netcom phased out PAS, opting for 3G technology instead.

UTStarcom’s share price crested at $40 in 2003; it now staggers around $3.20. ‘But the good investments definitely overwhelm our boo-boos,’ says Kopinski, laughing.