Investors: what do they really, really want?

The whole process of investor relations is about trying to give investors what they want: the information they need when they need it; the meetings they want, with the people they want to have them with, when they want to have them; the kind of website they want (navigable, efficient and with up-to-date information they can download into their own systems); and much more besides.

Those are practical demands. More fundamentally, and financially, companies have to try to give investors what they want in terms of return on investment – or, perhaps more appropriately, find the kind of investors who want what an investment in their stock will provide.

Because, even taking short-sellers and their ilk out of the equation, investors have a wide variety of requirements in terms of returns: some want a steady stable income, others want the chance of making a fast buck in exchange for higher risks.

But all else being equal, how would the majority of shareholders prefer the companies they’re invested in to spend any spare cash they may have? Do they want it distributed, in the form of dividends? Would they welcome a buyback program? Or would they prefer the company to invest in growing its business, perhaps through organic growth or an acquisition?

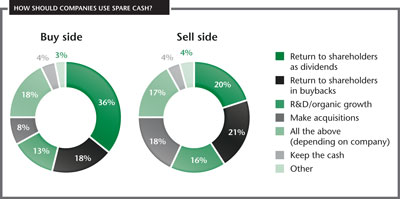

These were some of the general questions asked in this year’s US investor perception survey, carried out to identify the best corporate IR programs. The survey asked respondents for their views on how cash-rich companies should spend their reserves and were given a list of four options.

Most (93 percent) of those questioned answered readily, but 7 percent (3 percent buy side and 4 percent sell side) offered the comment that none of the companies they covered actually had any spare cash, so the question was irrelevant.

The responses show a pretty clear preference for companies to return cash to shareholders either in the form of dividends or through share buybacks. Last year these top two options were reversed and were much stronger, with 41 percent overall preferring buybacks and 39 percent plumping for increased dividends.

Click to enlarge

Sensibly enough, many respondents in this year’s research note that there is no one-size-fits-all solution; on the contrary, what’s appropriate for one company or sector won’t be for another. And around 10 percent of respondents said it would be unwise for companies to do anything with their spare cash until the new tax regulations were in place.

Investors have their say

The following are some of the precise comments made by members of the investment community in response to this question:

-‘Raising dividends, because I like money you can spend and so do my clients, especially with bond yields so low today’ – buy side

-‘I’m happy for companies to do any of these things providing they can give me the reasons. If not, then just give us the money back in dividends’ – buy side

-‘It depends on the company, of course, but – increasingly – dividends and buybacks are good because of the slower growth environment with few good investment opportunities. So if cash is building up, firms ought to give it to shareholders’ – buy side

-‘Organic growth should be the main use of the cash. If they can’t find a way to do this, pay dividends – but never do pointless acquisitions’ – sell side

-‘A very well thought-out acquisition plan is best for a good return’ – sell side

-‘You have to trust companies to know best how to allocate their capital. Obviously they should reinvest if they can get a good return, and make acquisitions when necessary’ – buy side

-‘If it’s a growth company then acquisitions or internal investment are the best options; for a value company, dividends or buybacks are better’ – sell side

Of the 4 percent wanting companies to sit on their cash, nearly all attribute this to caution about the future. ‘We’re still in an exceptionally volatile period,’ says one analyst. ‘Companies should hold onto their cash until Europe sorts itself out.’ Others are more sector-specific, like this one: ‘The IT sector has been up and down for a while and I am not keen for people to dip into their reserves.’

The investment community’s views overall haven’t changed hugely on this issue over the past 12 months. Indeed, when asked directly, nearly three quarters of buy-side respondents (73 percent) and more than a third of sell-siders (37 percent) say their views have not changed. ‘I haven’t changed my view much on this,’ notes one sell-sider, although he concedes: ‘Maybe last year I was more excited by dividends and now I want to see the scope for takeovers because I want more growth.’

About the researchIR Insight is the research arm of IR Magazine, the leading voice in global investor relations. We regularly engage with the IR community and the investment community through extensive studies, surveys and detailed interviews with corporate IR professionals, investors and analysts. The results of our rolling surveys of investor relations professionals located in every major business center across the world provide us with an unrivaled global perspective on the latest IR trends and industry best practices.Our research publications include in-depth investor perception studies, which we produce in conjunction with IR Magazine’s highly regarded annual awards in the US, Canada, Europe, Asia and Brazil. Each year, in each of these markets, we ask thousands of buy-side analysts, sell-side analysts and portfolio managers the same question: which company has the best IR? The reports we produce uncover and explain the reasons for successful investor relations, as well as the key drivers of investor sentiment. |