A European perspective on activist hedge funds

Although corporate governance failings are a vital weapon for activist investors, companies are also likely to become targets of activist hedge funds if their share price has been underperforming against their peers or they have hidden assets yet to be realized.

Hedge fund activism in the US is already well established and documented. In Europe, where there is far less transparency, it is harder for IROs to track the activities of these funds.

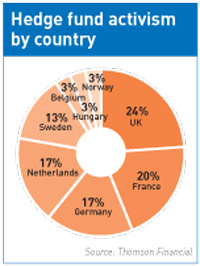

In response, Thomson Financial conducted a study looking at data from 30 European companies that were targeted by activist hedge funds. The study shows the highest concentration of activist interest in the financial services and banking sectors; combined, they represent 23 percent of the sample. A geographical breakdown shows most activity is in the UK (24 percent) and France (20 percent).

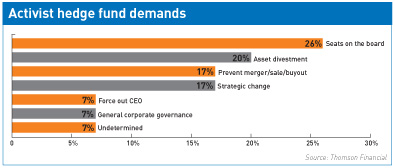

Thomson’s study also suggests the most common demand by activist hedge funds is for seats on the board of directors (26 percent of cases), closely followed by requests to spin off parts of the business (20 percent of cases).

Most activist hedge funds in Europe started out with holdings of around 1 percent, much lower than the 5 percent threshold required in the US. However, these funds show no less zeal than their overseas counterparts in trying to influence management thinking. The survey shows that, in 63 percent of the cases examined, activist hedge funds successfully influenced management strategy in their favor, often proposing their own slates at AGMs and extraordinary general meetings, where they tended to achieve a high rate of success. Generally, the first sign of activist interest an IRO receives is a phone call from the hedge fund requesting to meet the CEO and management to share ideas with regard to the company’s strategic direction. If the activists are not satisfied post-meeting, they may increase pressure on management through a public fight with letters to the board, followed by motions to be put on the agenda for the next AGM. Other hedge funds may take out advertisements in the business press to gather support for their agenda.

Generally, the first sign of activist interest an IRO receives is a phone call from the hedge fund requesting to meet the CEO and management to share ideas with regard to the company’s strategic direction. If the activists are not satisfied post-meeting, they may increase pressure on management through a public fight with letters to the board, followed by motions to be put on the agenda for the next AGM. Other hedge funds may take out advertisements in the business press to gather support for their agenda.

Activists may also use a company’s quarterly earnings conference call as a way of aggressively posing questions to the CEO/CFO, or control the AGM by putting their slate on the agenda and using ‘empty voting’ measures to gain voting power.

These activist hedge funds are set to play a growing role, using the failures of corporate governance and the waning influence of private equity as a means of rallying support among disgruntled shareholders. Companies with a strong investor relations program – one that ensures continuous shareholder monitoring and communication – will be best prepared to deal with such activity.