Investors still rely on a small number of companies for the vast majority of payments, finds survey

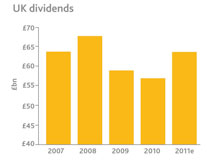

UK dividends are set to recovery strongly in 2011, according to the latest dividend survey from Capita Registrars.

The registrar expects payouts to jump by at least 9 percent in 2011 following two years of falling dividend payments. And this could rise to 11.5 percent if BP makes three dividend payments this year. The oil and gas company suspended its dividend last June in the wake of the Deepwater Horizon oil spill.

‘After a really tough two years, income investors can look forward to a much better year for dividends in 2011,’ comments Charles Cryer, chief executive of Capita Registrars, in a statement.

Investors will learn more about BP’s dividend plans tomorrow when the company releases its full-year results. Previously BP has said it will resume paying a dividend in 2011.

Excluding BP, UK dividends actually rose in 2010 by 7.5 percent, according to Capita’s survey. During the year, a total of 435 companies paid a dividend, compared with 417 in 2009.

‘Last year finally saw a very broad-based recovery in dividends – the vast majority of companies and sectors returned more to shareholders, as the need to hoard cash in the face of tight credit and a weak economy receded,’ says Cryer.

The dramatic effect of BP’s cut on the overall dividend level underscores the reliance of UK income investors on just a small number of companies for the vast majority of payments. In 2010, the top five companies for dividends made up 38 percent of the total paid out by UK companies.

The concentration did fall slightly from 2009, however, when the top five companies handed over 46 percent of all UK dividends.

Top five companies for UK dividends

1. Royal Dutch Shell

2. Vodafone

3. HSBC

4. GlaxoSmithKline

5. AstraZeneca

Source: Capita Registrars