What’s the impact of stock trading trends on IR?

How was your math at school? If you studied the subject after leaving school it’s probably better than it would otherwise be, but the chances of its being good enough to let you understand today’s quant activities in investment banks are still pretty remote. The question is: are those IROs doomed to remain in the dark about algorithmic trading at a disadvantage to those who can follow the math?

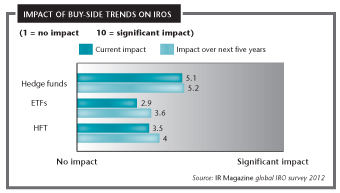

Well, probably not. That’s because neither group of IROs can establish the all-important two-way relationship of honesty and trust between an IRO and an investor when that investor is a computer program. Interestingly, however, most respondents to our global practice survey say the advent of high-frequency trading (HFT), for example, has had  little impact on their role.

little impact on their role.

With the greatest respect to IROs everywhere, could this be because they’re insufficiently aware of the impact? Do they realize how much the volatility of share prices in recent years in response to macroeconomic changes has been exacerbated by HFT, for example?

And these programs are ever-more self-propelling, as the Foresight report from the UK Government Office for Science explains: ‘New technologies are creating new capabilities that no human trader could ever offer, such as assimilating and integrating vast quantities of data and making multiple accurate trading decisions on split-second timescales.’ It goes on, in case any reader still thought investment decisions needed human beings: ‘Ever-more sophisticated techniques for analyzing news are also being developed and modern automated trading systems can increasingly learn from monitoring sequences of events…’

The response to our research questionnaire would be less surprising if such computer-driven activity were minimal but, according to Foresight, HFT now accounts for around 60 percent of trades in the US and 30 percent in the UK. That’s in part because it offers benefits for investors, in terms of both enhanced liquidity and reduced trading costs.

The ETF role

Another way to enjoy reduced costs and high liquidity is to trade exchange-traded funds (ETFs), rather than the underlying shares. As Del Stafford of BlackRock pointed out at a Bank of America IR conference held in New York on the day of the IR Magazine Awards – US: ‘To buy all companies in the Russell 2000 Index will cost about 17 basis points; to buy an ETF will cost just 1 basis point.’

That’s clearly compelling for an investor but is there any benefit for companies whose stocks are being traded in ETF form? If so, surely the IRO respondents to our survey would be acknowledging more of an impact on their role. Of course, increased liquidity is broadly beneficial for companies, as it makes stocks more attractive, but that’s not company-specific enough for it to be regarded as role-changing.

Nevertheless, IROs – and their senior managements – should be aware of the growing importance of ETFs in the market and help themselves by understanding what will make their stock more attractive to ETF managers.

After all, data suggests around 30 percent of trading volumes in the US are now in the form of ETFs. And in a recent survey of investors, published by Nice-based EDHEC-Risk European at the end of March this year, a paltry 4 percent of investors say they expect their use of ETFs to decrease, while 67 percent anticipate an increase. The survey asked investors about their expected future use of other instruments, too, but the next highest area of anticipated growth was futures, which just 28 percent of respondents expect to make more use of.

For companies, then, inclusion in ETFs is a sensible IR goal and some are certainly thinking in terms of what will make them more appealing to these funds. Indeed, some have already decided, for instance, to pursue the kind of dividend strategy that will make them more attractive to ETF managers. That’s at least to some extent because billions of dollars worth of stock have flowed into dividend-oriented ETFs in recent years as part of the general flight to quality. Anyway, improving your payout profile is doubly effective, since both ETF and direct investors are interested in firms returning more of their cash to them.

Other influences

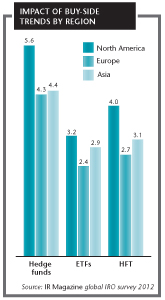

As our research shows, however, our IR professionals aren’t willing to concede that ETFs have had much impact on their jobs, either; nor do they think other index trading or futures or dark pools have changed the IR role much. The development they believe has changed things most – albeit still not a lot – is the prevalence of hedge funds in  today’s investment market.

today’s investment market.

And perhaps this tells us something. IR is a people business. Yes of course it’s about investment and corporate strategy and macroeconomics and all sorts of other financial and business matters. But IROs are communicators, and a large part of their day-to-day work revolves around listening to people and talking to people. So the factors that seem to have most impact on their roles are bound to be those relating to the analyst and investor communities they spend their time dealing with. And hedge funds are a significant – and voluble – strand in this group.

It may also be that corporate management is particularly concerned with hedge funds – some would say disproportionately so. IROs in some cases report their management teams being unwilling to meet with hedge fund managers at all, tarring all hedgies with the same brush. For IROs, however, they are a far from homogenous group; any IRO will tell you that plenty of hedge funds are now serious long-term investors with detailed knowledge of and interest in individual firms.

Of course, there are still fly-by-nights, but many hedge fund managers are among the smartest people in the investment room, which makes them both challenging and rewarding people for IROs to deal with. This may well be why our respondents acknowledge more impact from them on the IR role than from the arrival of new-fangled investment instruments.

In the end, however, what’s probably most interesting about this research is that IROs are much less aware of any impact from any of these factors than one might have expected. And that’s true across all countries, regions and market caps. Perhaps our next line of inquiry should involve asking IROs what factors they do think are having an impact on their role. When we do, we'll report back.