Public companies are slowly but steadily adopting virtual shareholder meetings

A growing number of companies are adopting virtual shareholder meetings, or VSMs, yet the debate over their use shows little sign of going away. In 2009 Intel used a system developed by Broadridge Financial Solutions to become the first company to allow shareholders to listen and vote online during its annual shareholder meeting. Later that year, Broadridge itself held the first virtual-only AGM.

|

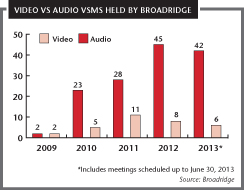

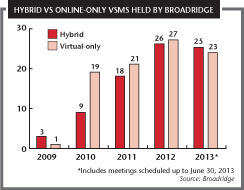

During the following four years, the number of companies hosting VSMs has risen at a gentle pace. Looking at Broadridge’sclients, 28 companies held virtual meetings in 2010, followed by 39 in 2011 and 53 last year. Broadridge says it expects continued slow but steady growth in 2013.

Companies considering VSMs have several different options. First, they can choose whether to hold an audio meeting, which is relatively cheap, or a video meeting, where the costs are more substantial. Second, and more importantly, is the decision between a virtual meeting in conjunction with a physical meeting, known as a hybrid, or a virtual-only event.

The latter option is the one that continues to raise most concerns. While almost half of Broadridge’s VSM clients hold virtual-only meetings, larger companies that have tried to go down this route have met with considerable opposition from shareholders. Intel, for example, had to scrap plans for a virtual-only AGM in 2010 after an investor backlash.

While excited about the potential of online meetings to expand shareholder participation, US lobby group the Council of Institutional Investors (CII) says virtual-only VSMs should be avoided.

|

‘The opportunity for face-to-face interaction between shareowners and the company’s leadership is rare and should be preserved,’ says Amy Borrus, CII’s deputy director. ‘A virtual-only format may create the impression the company is insulating management and the board from shareowners.’

To help allay fears, Broadridge created the option for companies to make all the questions posed during VSMs visible for attendees. The fact that no client has taken the firm up on this functionality might raise concerns further.

As more firms take the online route, the debate looks set to grow. A consortium of interested parties has developed a best practice guide – ‘Guidelines for protecting and enhancing online shareholder participation in annual meetings’ – to help companies keep their noses clean. For now, however, if there is something controversial to discuss, it’s best to avoid further controversy by doing it in person.