Confidential feedback system extended to all roadshow meetings

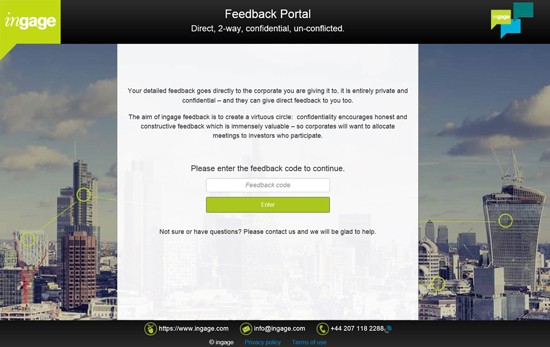

Alternative corporate access platform ingage has opened up its secure feedback system to non-clients, allowing IROs to gather responses from all meetings on an ingage roadshow. The new, open feedback system was used for the first time at hospitality firm Whitbread’s recent roadshow in Edinburgh, says founder and managing director Michael Hufton.

He explains that in the ingage feedback system, all questions are designed by the corporate, using closed questions for quantitative analysis as well as the option for two-way feedback back to the investor. ‘Imagine you’re doing 90 meetings on a roadshow: [using these closed questions] you can chart the responses and see how views on certain issues change over time or how issues vary across different regions,’ he says.

While this system has been on offer for a while for clients, the company has now extended it to non-clients as well.

Iain Fulton, global equities investment director at Nikko Asset Management Europe, which isn’t an ingage client, says he’s been aware of the firm for some time. He stresses that he’s never experienced any misuse of feedback given to brokers, but the confidential nature of the ingage system and the fact that feedback goes direct to company management is preferable. ‘If you’re dealing with a broker, often it’s not clear whether those comments you get in feedback are confidential,’ he notes.

The move from traditional forms of feedback – often simply provided via email – to the set-questions option has also gone down well. ‘It was interesting to discover what the management team wanted to find out about,’ says Fulton. And while he says the questions already reflected what he wanted to offer feedback on, there was an option to add any additional comments at the end.

Fulton highlights the ‘chicken and egg’ issue ingage faces, though, whereby it needs to add more corporates to attract more institutions and vice versa, though he adds that Nikko is assessing potentially signing up to the platform.

Stephen Porteous, investment manager at Alliance Trust, which is an ingage client, is more scathing in his view of the traditional broker system. ‘Calls from organizing brokers after meetings are often inconsistent in detail – and certainly inconsistent in whether they happen at all,’ he says. ‘[They are] often carried out by people with limited knowledge and you never know what information actually gets back to the company.’ The ingage system puts the ‘ownership of feedback in our hands,’ he adds.

On the subject of two-way feedback, Porteous says that from his point of view [feedback to the institution] ‘ensures we maintain the highest standards in preparing for our meetings. Our experience is that it creates a virtuous circle whereby good preparation leads to good meetings that companies enjoy – and then they want to come back and visit us.’

ingage is part of a new breed of alternative corporate access platforms, including Glass Lewis-owned Meetyl, the CorporateAccessNetwork from Phoenix-IR and WeConvene, that have been growing in number since the UK’s Financial Conduct Authority and the European regulator have focused on the use of client commissions in the corporate access process.