Social networking companies are all about sharing information. So are they?

Some of the names breaking the IPO backlog in 2011 had a lot of star power: internet phenomena like LinkedIn, Pandora, Angie’s List and Groupon.

Investors pored over their filings and hung on every word during their roadshows and early earnings calls. These companies had devised unique new business models. Would their IR break the mold, too?

Meet the new generation of investor relations officers, like Matt Sonefeldt at LinkedIn, a former buy-side analyst whose professed goal in becoming an IRO was to understand how a company worked from the inside, but only if the company fit with his values – values reflected in his experience as an AmeriCorps elementary school teacher and a volunteer for other good causes.

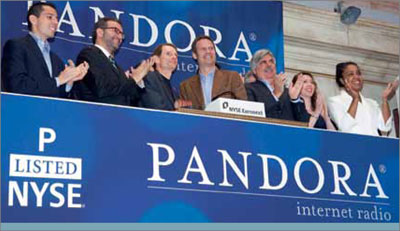

Or Dominic Paschel at Pandora, who took on his first IR leadership role at Salesforce.com in 2004 aged just 23. On his personal Twitter stream, he identifies himself as a ‘disciple of cloud computing & emissary to Wall Street’.

Dominic Paschel of Pandora (left) at the NYSE – ©NYSE

According to the results of the IR Magazine US Awards 2012 on March 22, these unorthodox young IROs are winning over investors to their unique styles.

LinkedIn took home the prize for best IR for an IPO, followed closely by Pandora in third place behind Dunkin’ Brands. ‘[Paschel] is a pleasure to work with, and goes the extra mile to keep the lines of communication open,’ said one sell-side analyst in the research survey. As for LinkedIn, its financial reporting practices are said to be ‘best in class’.

New kids on the block

Sonefeldt joined LinkedIn several weeks after its May 2011 IPO as manager of financial planning and analysis and was named head of IR in August.

Formerly an analyst at Capital Research, he says he’s drawing heavily on his time on the buy side when the IR professionals who stood out were the ones with their own unique insight that went beyond the company line.

‘Whether that’s a qualitative data point, analysis or what they’re seeing in the industry, they offered extra value,’ he explains. ‘So a lot of my time is spent understanding what’s driving LinkedIn’s business, immersing myself in a lot of the key meetings and working on relationships with people in different parts of the company.’

So far Sonefeldt sounds like a typical IRO. But next he takes a sharp turn away from tradition, in more ways than one.

‘If you follow me on LinkedIn or Twitter, a lot of what I post is industry-related or has an economic focus, not necessarily about our company,’ he points out. ‘I’m trying to be Switzerland: an unbiased third party. I see my role as educating the world, not trying to sell LinkedIn stock.’

Perhaps that’s a luxury that comes with a stock that doesn’t take much selling – one that more than doubled on its first day of trading.

Click to enlarge

In another twist on the mainstream IR model, which today emphasizes senior management’s involvement and, increasingly, the participation of lower-tier managers, Sonefeldt consciously limits the exposure of his CEO and CFO to about one investor conference a quarter and has no plans for an investor day.

The reason is one investors probably wouldn’t argue with: management is too busy running the business. That goes double for other layers of management.

‘It is not our head of engineering’s job to think about what his comments might mean in the context of one quarter’s results,’ Sonefeldt explains.

Pandora, on the other hand, is getting known for its constant presence on the conference circuit. Plus, as one of the respondents to the awards survey appreciated: ‘The CEO, Joe Kennedy, goes out of his way to make room in his schedule to talk with sell-side analysts.’

In addition to Kennedy, founder Tim Westergren and CFO Steve Cakebread, the IR program includes ‘re-founders’ like chief technology officer Tom Conrad and Jessica Steel, executive vice president of business and product development.

‘The amount of time and intensity they devote to IR doesn’t distract from the business because we have such a strong bench of executives from across the organization,’ Paschel says.

Since leaving Salesforce.com, Paschel took SuccessFactors through its IPO in 2007 and joined Pandora as IR chief in advance of its June 2011 IPO. He’s conscious of the challenges of doing IR for highly anticipated ‘internet darlings’ and ‘beloved brands’, the key ones being ‘trying to keep expectations within reason and trying to keep emotion out of it.’

With all the hype around social media and new media companies like Pandora, the nuance is often missed, Paschel adds: ‘For most investors, Pandora seems like it’s six months old.

The reality is that modern-day Pandora is six years old and the technology that started with the music genome product is 12 years old. Our challenge at Pandora at all levels is to articulate the nuances.’

Paschel says not enough new companies get an IRO involved before their IPO like Pandora did. ‘That’s one improvement they could make – understanding that an IRO can help craft the message and help investors understand the investment decisions,’ he says.

Creative thinking

Some new internet companies have opted to outsource IR during and after the IPO to firms like the Blueshirt Group, a San Francisco-based firm founded in 1999 that has represented more technology IPOs in the years since than any other IR company.

It is currently the IR contact for Angie’s List, Active Networks, ReachLocal and Zipcar, and at time of writing the agency was on the road with Yelp’s IPO roadshow.

Blueshirt co-founder Alex Wellins says the new wave of internet companies is showing more creativity in presentations than at any time in the past. ‘Even five years ago there was less creativity in IPO roadshows. They were much more cookie-cutter and formulaic,’ he notes. ‘Now the use of video is more prevalent, helping the company’s personality shine through.’

Angie’s List, for example, included a video on its roadshow that showed its local Indianapolis roots and unique corporate culture. Post-IPO, too, internet companies are bringing more visuals to quarterly earnings by releasing slidedecks.

What really sets such companies apart, though, is how critical managing expectations is. ‘That’s why we like to work with companies well before their IPO, making sure expectations are set early on,’ Wellins explains. ‘It’s critical for a high-profile, venture-backed company with the objective to build valuation to proactively manage Wall Street’s expectations properly.’

That’s no easy task when this space is so crowded with fast-money tech funds and a large, competitive crowd of analysts. Even $2 bn market cap Pandora has more than 20 analysts covering it. LinkedIn, which is nudging $9 bn, has 24.

Denise Garcia at IR firm ICR, which worked on the IPOs for Zillow and Pandora and still manages Jive Software’s IR, points out an interesting aspect of the research ecosystem that results from so many companies today being seen as internet companies.

‘We’re seeing worlds collide. There are a lot of collaborations between analysts in different industries for the first time – internet companies dragging over into industrials, security or – most likely – retail,’ she explains.

Lack of innovation

One analyst contacted for this article is blunt in his assessment of IR at social networking companies. ‘They should be doing more innovative things with IR than I have seen to date; so far, the lawyers are winning,’ declares Kris Tuttle, founder of both Research 2.0, an independent investment research firm, and SoundView Investments, a new fund management firm.

‘No matter how innovative and open they are as private companies, as they start to contemplate the public markets the lawyers, bankers and – in some cases – CFOs end up forcing these companies into a fairly investor-unfriendly position.’

Tuttle is considering financial transparency as well as new communications platforms. ‘We would love to see IR start to embrace more modern practices,’ he says. ‘Why not online sessions where we can have an open chat with management? We use tools like that every day in technology-land, but not one of the new IR efforts truly incorporates technology with its IR practices.’

Tuttle includes corporate governance in his analysis, but here too he has low expectations. Indeed, Zillow, LinkedIn, Angie's List, Jive Software, Pandora, Groupon and Zynga have all been criticized for having classified boards or dual-class shareholder structures, or both.

‘The fact is investors have looked right through all that stuff. Right now everything’s coming up roses so no one cares about these things,’ Tuttle points out. ‘When business turns for the worse I expect this discussion to resurface.’

Facebook, too, is subject to criticism of its governance ahead of its IPO, with a dual-class structure and other agreements giving founder Mark Zuckerberg around 57 percent of the vote. Jeff Corbin, CEO of KCSA Strategic Communications in New York, suggests no institutional investor would take a large, long-term stake in a $100 bn company without a voice at the table.

He speculates that questionable governance is one reason behind the volatility in new internet stocks because institutions get in at the bottom of the pricing for an IPO but jump at the first earnings miss.

As a former securities lawyer who used to write S1 IPO filings, Corbin has combed over Facebook’s – and found it wanting. ‘There is not a whole lot of commentary. It’s bare bones. I don’t think it justifies a $100 bn valuation,’ he says, adding that it will take strong investor relations to persuade investors.

Looking at the already public social media companies, Corbin believes they’re suffering from barefoot shoemaker’s son syndrome – except for LinkedIn, whose IR he admires.

‘Social media is all about transparency – it’s about sharing, and so is IR, so you would think these companies would practice what they preach,’ he laments, pegging opacity as another cause of earnings day price drops like those suffered by Zynga and Groupon last quarter.

Corbin is still hopeful Facebook will break the pattern and focus on what matters as a public company. He recently sent Zuckerberg the new edition of his book Investor relations: the art of communicating value. ‘Maybe he’ll get it,’ Corbin says – IR, that is.

The view from cyberspaceIf any company was going to create a unique new IR website, you’d expect it to be one of the hot new social networking or new media IPOs from the last year (writes Tom Johansmeyer and Neil Stewart). At first blush, though, their websites appear to be much of the same, with the usual charts, contact forms and earnings call archives.Most of them are off-the-shelf Shareholder.com sites – albeit with highly customized designs – which new IPOs get free from NASDAQ OMX corporate services. Even NYSE-listed LinkedIn’s bears Shareholder.com hallmarks. Demetrios Skalkotos, senior vice president of global corporate services at NASDAQ OMX, confirms that eight of the last nine most-recent tech IPOs on NASDAQ take advantage of the bundle of corporate services provided by the exchange. Even when it comes to actual social media channels, these social media companies lag way behind early adopters like Dell or Cisco. Angie’s List provides links to its corporate social media accounts on its IR page and stops there. Groupon and Zynga don’t even go that far, despite the fact that CEOs Mark Pincus (Zynga) and Andrew Mason (Groupon) are active social media users. The situation looks grim until you run into Dani Dudeck, general manager of corporate communications at Zynga. With her, you see sophisticated and effective social media use. Dudeck live-tweeted Zynga’s earnings call in February, referring to Pincus by his Twitter handle, @markpinc, and using the hashtags #zynga and #letsplay to make it easier for users to follow her stream. She also appears on Quora, answering questions about the critical success factors for managers at Zynga. While Zynga relies on Dudeck’s social media prowess, LinkedIn demonstrates structure and corporate commitment. The winner of the IR Magazine US Award for best IR for an IPO links from its IR website to its corporate blog, which has posts for each quarterly earnings announcement and instructions on how to follow the ‘live sharing’ on its LinkedIn and Twitter pages. Additionally, the posts have embedded SlideShare presentations on the company’s results, and these also appear on a dedicated IR ‘badged’ page on StockTwits. The only shortcoming – and it’s a minor one – is that the link on LinkedIn’s IR page doesn’t connect directly to the blog’s IR posts. IR head Matt Sonefeldt leaves LinkedIn’s official social media outreach, including live-tweeting earnings, to the communications and marketing people he regards as the real social media pros. ‘That’s their focus every day,’ he says. His own stream (@mattrek) and LinkedIn posts are as much about volunteering and his other personal interests as they are about LinkedIn’s business. Dominic Paschel at Pandora seems to have an easy approach to social media. He was an early user of Facebook and a more recent but keen tweeter. ‘I grew up with the internet. I’m ADD, constantly absorbing information,’ he says. His Twitter stream, @dpaschel, while using Pandora’s stock symbol as a profile picture, has a lot of information on cloud computing in general. Other Pandora streams are more official, with @PandoraRadio managed by Pandora’s community manager, and @PandoraPress by Deborah Roth, vice president of corporate communications |