Using Twitter to send out quarterly earnings may spark changes elsewhere

The beginning of October marked the start of a new era for banking giant Goldman Sachs’ earnings reporting, as the firm took the unusual step of using Twitter and its own website to distribute official documents rather than newswire services.

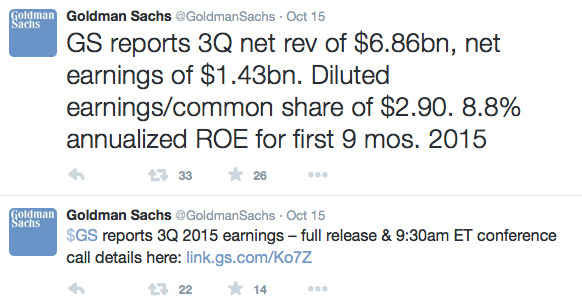

How Goldman Sachs’ earnings were seen be investors. Source: twitter.com

‘Generally speaking, this decision was driven by desire to make the process simpler for us,’ says Jake Siewert, head of PR at Goldman Sachs, in an interview with PR Week. ‘Preparing our earnings release and getting the documents in shape is a complicated process.

‘It takes up a lot of people’s time. So anything we can do to cut one step out of the process saves us hundreds of hours, as well as energy and money.’

Though Goldman Sachs may still use Business Wire or a similar service when news calls for targeting ‘specific audiences’, adds Siewert, this is how the company’s disclosures will be delivered from now on.

Many industry onlookers have questioned the wisdom of such a decision, such as David Collins, the managing director of IR consultancy Catalyst Global, who wrote a response to Goldman’s announcement on IR Magazine. He questions what the firm can gain other than slightly reduced costs and publicity for its corporate finance client, Twitter.

Collins writes that security is a problem that faces any entity hosting sensitive financial information, and that newswires are already working on improving this. ‘Our sense is that the wire services are spending a lot more time and money on addressing those risks than most corporate or IR sites, and their speed and breadth of reach is really not beatable,’ he continues.

Another problem – as raised by Matt Levine, writing on his Bloomberg blog – is that though using Twitter means that content gets to a wide audience for now, there’s nothing to stop the platform going the same way as Facebook: gating content, earnings included, behind paid-for advertising premiums.

As far as NIRI president and CEO, Jim Cudahy, is concerned, the practice is still ‘emerging’ in the US, rather than anywhere near being a standard. Indeed, in the institute’s 2013 study into the topic, three quarters of IROs said they didn’t use social media for work, with most citing a lack of investor demand for the platform.

‘We’ve seen most companies continue to utilize multiple disclosure channels, including an SEC form 8-K filing, for this type of information in order to ensure the broadest possible non-exclusionary distribution of information to the public,’ Cudahy summarizes.

Lucy Hartley, head of social media and creative content at Investis, sees the move as ‘a real sea change’ in the perceived legitimacy of Twitter and similar channels, however. ‘This is sensitive, market-changing information, and it is being released on channels that for some in the corporate space are still seen as being the realm of teenagers and people with too much time on their hands,’ she says. ‘From my point of view, it is a logical step – we have seen the use of social media by corporates, particularly Twitter and LinkedIn, increase over the past two years.’

She adds that integrating Twitter into traders’ terminals is another indication of social media’s importance, if only because issuer’s audiences are more often than not located there.

‘Of course, Twitter has been hacked in the past - the AP Twitter hack in 2013 caused share prices to tumble - and it may be that Twitter seeks to monetize such activity in the future,’ Hartley continues. ‘But, for now, Goldman Sachs decision looks like a savvy one; I doubt they’ll be the only company to make the shift.’