Flood of equity investment back to developed markets that began in Q4 2010 looks to have reversed direction

The torrent of equity investment out of emerging markets into developed ones kept flowing hard for the first part of the year, according to Nick Arbuthnott, managing director of EMEA global markets intelligence for Ipreo. Chinese and Indian stocks were the big losers while North American equities outpaced Europeans two to one in attracting global investment dollars. With the sovereign debt crisis still dogging Europe, however, emerging markets are starting to get fresh capital again.

Arbuthnott will be one of the session leaders at the IR Magazine Euro Leaders Think Tank on June 30, 2011, an invitation-only event held in London for top IROs from across Europe. He will be joined in a panel discussion by Magdalena Moll, head of IR at BASF, which won the grand prix at last year’s IR Magazine Europe Awards. This year BASF is nominated for 10 awards – more than any other company.

The panel’s topic is targeting non-domestic investors, which includes tracking capital flows to figure out where interest in a particular stock might lie, in terms of both geography and investment style.

‘We saw a massive shift in mid-Q4 2010, when reports started coming in of the biggest ever reversal of a 14-year bias toward emerging markets,’ Arbuthnott recounts. ‘Most of it was flowing out of China and India. Russia was wobbly at the beginning but it proved totally immune as the oil price went up. Brazil, too, is immune. Observers like EPFR Global say they had never seen anything like this flood of money heading back to developed market economies.’

Interestingly, hedge funds helped pick up some slack, keeping up their interest in emerging markets while their mutual fund counterparts fled.

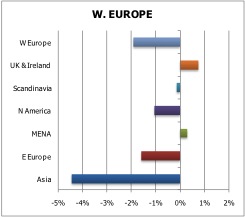

So far in 2011 a preference for North American equities over European stocks shows there is still a ‘residue of doubt’ about Eurozone countries. Still, some money kept coming into Europe, including emerging Europe, with Turkey and Poland both seeing net investment during Q1.

Net buyers and sellers of western European equities in Q1 2011 – Ipreo:

Overall, global equities had a good start to the year. Stocks in general benefited from improved sentiment toward the global economy despite European sovereign debt. Ipreo notes that Bank of America Merrill Lynch’s February investor survey reported an all-time high of 67 percent of investors overweight in equities and 66 percent underweight in bonds.

The turmoil in North Africa and later Japan’s tsunami upset some of that optimism, however. Emerging markets got the worst redemptions but flows into developed market stocks also weakened. Asian investors became the biggest net sellers of western European funds in Q1, taking over from US investors at the end of last year. Even European investors were sellers of western Europe, with only UK and Middle East investors still showing some net positive investment in the region.

Going into Q2, the ‘massive shift’ that began in late 2010 definitely looked to be tipping back. By mid-April, emerging market funds were getting more fresh capital than developed market ones, helped by doubts about Europe and the European Central Bank tightening in contrast with Fed loosening.

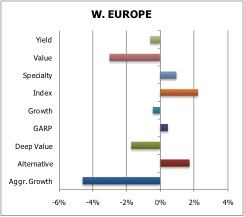

Where should European companies look to target new investors? It’s simple, says Arbuthnott: look to the institutions that are the biggest buyers of western Europe, which right now means value investors. Or consider the likes of Capital Group, which pulled an enormous amount of capital out of Europe in Q4 2010 and a quarter as much in Q1.

‘Now they’ll make specific investments in western Europe if they see the value or any hint of growth. You’ve just got to be more focused on investors’ firm strategy,’ Arbuthnott says.

Net buyers and sellers in Q1 in terms of style – Ipreo: