Google drops Moderator application but takes up YouTube stream for its earnings call

The creative spark found at Silicon Valley companies doesn’t stop with the product team. In recent quarters, IR departments in the region have been busy tweaking their earnings calls to improve the experience for analysts, investors and executives alike. Google is at the forefront of innovation. For its Q4 results in January, the search giant streamed its call over YouTube. This followed a one-off experiment with its own Moderator application for Q3, which allowed investors to vote on which questions were put to management. ‘We own YouTube and it was something we wanted to try for the earnings call to see how it would go,’ explains Maria Shim, Google’s director of IR. ‘We’ve used it for other events as well. It was just a question of bringing it in-house.’

Google is at the forefront of innovation. For its Q4 results in January, the search giant streamed its call over YouTube. This followed a one-off experiment with its own Moderator application for Q3, which allowed investors to vote on which questions were put to management. ‘We own YouTube and it was something we wanted to try for the earnings call to see how it would go,’ explains Maria Shim, Google’s director of IR. ‘We’ve used it for other events as well. It was just a question of bringing it in-house.’

Other Silicon Valley firms, like Intel, Brocade and Netflix, are also getting in on the act. While the approaches may be different, the main aim is the same: to keep the sell side happy.

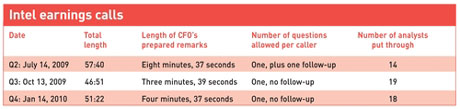

And it seems to be working. ‘The feedback has been excellent,’ says Kevin Sellers, head of IR at Intel. The microchip manufacturer, unlike Google, has found a new method it likes and is sticking with it. For its Q3 results, which came out in October last year, the company posted a CFO commentary to its IR website an hour before the earnings call began, the idea being to cut down on prepared comments and questions around the figures. Reaction to the move was so positive that Intel stuck with the commentary for its Q4 call this January.

‘We found trying to give details in answer to fair questions hard to do purely audibly,’ says Sellers. ‘By using a commentary, we could get the details into the hands of investors and analysts before the call, which we hoped would then raise the level of the question quality – and we found it has definitely had the desired effect.’

A need for change

Sellers is understandably pleased with the positive feedback he has received, and has stored several emails and analyst notes praising the new system. ‘We’d had a couple of calls where we found the Q&A devolving into some low-level details, which you don’t ever want to happen. So we thought: what can we do?’ he explains.

The answer was provided at a roundtable, where Sellers heard about earnings call changes at Altria Group. ‘Altria had used a commentary and thought it was well received,’ Sellers recalls. ‘So we took the idea back to Intel, kicked it around a bit and looked at our own needs.’

Analyst complaints also played a role in driving the changes, admits Sellers. ‘We are covered by 45 analyst companies and were getting complaints from some,’ he explains. ‘They were saying they would like to ask a question but couldn’t get on the call.’

Under the new method, Sellers has been able to cut down chief financial officer Stacy Smith’s prepared remarks to around four or five minutes. By contrast, back in Q2 Smith spoke for eight and a half minutes. Sellers has also banned analysts from asking any follow-up questions. Together, these changes mean more questions and strategic themes are now covered on Intel’s calls, with Q4 seeing 18 analysts putting queries to management.

‘One guy who covers us said that was perhaps the most efficient and effective post-earnings conference call he’d ever attended,’ says Sellers of the Q3 call.

Not to everyone’s taste

Google, another innovator, has been more fickle than its Silicon Valley counterpart. The search firm used its own application, Moderator, to run the Q&A portion of its Q3 call back in October. Moderator is a free application that allows investors to submit questions and then vote on their favorites. Google had used Moderator for internal events and educational webcasts for a while, but Q3 was the first time it tried the application on an earnings call.

The experiment seemed to go well: a total of 396 people logged on and used the system during the call, submitting 124 questions and casting 5,525 votes. It left many scratching their heads, therefore, when Google revealed it would be going back to a more traditional method of Q&A for Q4.

Some IR commentators were clearly displeased with the decision. IRWebReport’s Dominic Jones, who praised the original move for bringing transparency to the earnings call queue, said in a blog post that the decision to drop Moderator was ‘disappointing’.

Google says sell-side comments were the main reason for the decision. ‘The feedback wasn’t black and white,’ says Shim. ‘Some people preferred the new method, but others really didn’t like it. Overall we decided the best option for us at this moment would be to go back to the old method of Q&A.’

Google would also not have been encouraged by reports that sell-side analysts had asked people in their office to vote for their questions to push them up the queue. ‘That’s not what the whole thing is supposed to be about,’ says one IRO who asks to remain anonymous.

Shim points out that it is typical of Google to experiment in this manner, which can be put down to the spirit of ‘dogfooding’. The phrase, also known as ‘eating your own dog food’, is said to originate from an internal Microsoft memo and refers to the practice of making your employees use the very products they create for their own work. The idea is to motivate staff to work harder, as well as offer another way to market your products.

Google’s desire to consume its own products led to a further innovation for the search engine’s latest earnings call. For its Q4 results in January, the search firm streamed its call over YouTube, the video-sharing site Google bought for $1.65 bn back in 2006.

The move should make it easier for web users to listen in. On previous calls, Google streamed using Windows Media Player and RealPlayer, which some computers have compatibility issues with. By contrast, all YouTube needs to run smoothly on any computer is a browser and Flash, an advantage that was pointed out by TechCrunch blogger MG Siegler at the time of the call. ‘Obviously we think YouTube gives people great access, but there’s no implicit critique of any other product,’ notes Shim.

Cooperative spirit

There is clearly a mood of collaboration among Silicon Valley IROs when it comes to making the earnings call a success. Intel borrowed from Altria when making its changes, for example. Furthermore, Shim says a handful of companies in the region have spoken to her about Google’s use of Moderator and YouTube, to see whether they would be able to adapt the tools for their own use.

A third example is Brocade, a provider of network solutions based just a few miles down Highway 101 from Google in San Jose. Brocade uses an email system to collate questions for the Q&A, an idea senior IR director Peter Ausnit lifted from fellow Silicon Valley firm Netflix.

‘Netflix went with emailed Q&A, which worked well for it, so now we are doing it too,’ explains Ausnit. ‘We split our Q&A into two segments, taking strategic questions through email during the first half of the call. Then we did normal, live Q&A for the remainder of the call.’

Brocade provides comprehensive written comments, which means the entire live call can be dedicated to Q&A. ‘Under the new system introduced last quarter we maintained the same amount of live Q&A via telephone, which investors wanted,’ comments Ausnit. ‘At the same time, by allocating additional time to Q&A and taking some questions beforehand, we were able to cover more questions. Investors appreciated the additional time and the convenience of having a complete written record in advance, instead of waiting for spoken comments.’

Is there anybody out there?

Netflix, an online DVD rental firm, began using an emailed Q&A system about two years ago, following a conference call mishap: right when the company was about to start taking questions, the lines all cut out. As a result, the analysts could no longer get through and ask questions, although they could still hear the call. Thinking on their feet, the folks at Netflix quickly told the listening sell side to email in any questions they wanted to ask.

Netflix has been asking analysts to email in questions ever since. The company maintains the option of opening up the call, in case there are some follow-up questions people want to ring in. Mostly, however, the company runs out of time.

The only problem with the emailed system is that the in-house IR team has to collate and organize the emails on the fly. There is also no way for analysts to know whether their question is coming up, which can lead them to pepper IR with emails in an attempt to ensure their messages are read out. This is one of the main reasons why some issuers are eyeing Google’s Moderator application with interest: it organizes questions automatically as they are submitted.

It’s hard to know who to credit with all this innovation. Intel borrowed from Altria; Brocade borrowed from Netflix; Google continues to do its own thing. But the experimentation couldn’t be timelier. With a predicted tech boom round the corner, Silicon Valley firms are likely to see an increase in coverage and scrutiny over the next year, adding to the already considerable burden on many IR departments. Silicon Valley’s IROs look ready to take on the challenge.

Conference call changes: industry opinion

‘ACT has noticed changes in how customers use our conferencing services for investor relations calls – many are combining services in unique ways for different purposes. Clients are taking advantage of our interactive ConferenceCast™ service to enhance their presentation and engage audiences. This enables our clients to take questions via the web, which allows them to select and prioritize questions in real time before having the speaker respond.’

- Gary Iles, senior director of strategy and products, ACT Conferencing

‘We’re seeing increased use of automated entry for participants, whether on earnings calls or larger calls. Our services allow participants to register ahead of time and receive a PIN code. This method is not only efficient but also reduces the amount of time people have to wait to get on the call.

‘There are two great benefits to this approach. One, it’s a better experience for our customer’s participants. And two, we can provide a price break based on the participants who use automated entry.’

- Tim Reedy, president and CEO, ConferencePlus

‘A number of our clients provide slides to accompany a conference call. Providing the content is focused, that can be helpful for analysts. In some cases, when analysts publish their follow-up notes after the quarter, they’ll drop in slides we have created for that call. It helps them get their notes out faster and focus on some of the key metrics.

‘The most important thing is to make your comments focused and know what the issues are. It doesn’t need to be long, 10-15 minutes of scripted remarks is suitable for most companies. Ultimately, analysts want to get to the Q&A and hear their issues and concerns addressed – and put management on the spot.’

- Craig Armitage, senior vice president, Equicom