South East Asia’s stock exchanges plan to create a unified market but the road to integration is proving bumpy

As beleaguered European governments consider whether European economic integration went too far in the pre-financial crisis years, countries in the Association of Southeast Asian Nations (ASEAN) have been making progress with their own brand of regional co-operation.

Indeed, developments currently under way in the ASEAN region mirror similar efforts in Europe in the late 1990s that culminated in the creation of the Markets in Financial Instruments Directive, which was passed in 2004.

Last year’s launch of the ASEAN Trading Link was an important step toward the establishment of the ASEAN Economic Community, which will see the economies of the 10 member countries merged into a unified production, trade and investment bloc in 2015.

The first participating exchanges in the link were Bursa Malaysia and Singapore Exchange (SGX). The Stock Exchange of Thailand (SET) joined a month later, giving a combined market capitalization representing 67 percent of the stocks listed on the entire ASEAN exchanges group, which includes the bourses of the Philippines, Indonesia and Vietnam.

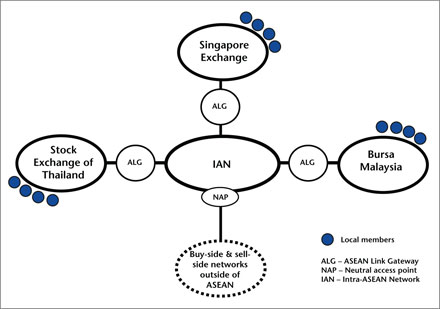

There are three main components in the ASEAN Trading Link:

-The Intra-ASEAN Network is the infrastructure connecting the participating exchanges

-The ASEAN Link Gateway provides connecting points between the exchanges

-Neutral access points provide access for parties from outside the ASEAN market

Source: ASEAN exchanges

At the launch of the trading link, Tajuddin Atan, chief executive of Bursa Malaysia, claimed it would attract liquidity and give investors access to the region – especially as more regional exchanges followed suit.

‘The ASEAN Trading Link marks the first key milestone for ASEAN exchanges toward breaking down the barriers to cross-border trade in the ASEAN region,’ he commented. ‘The link is an excellent conduit to tap the region’s growth opportunities as it allows investors easy access to a wider investment selection across the connected markets.’

Strength in numbers

Part of the success of the venture rests on the combined clout of the region’s stock exchanges. Taken together, the 3,000 companies listed on the seven ASEAN exchanges have a combined market cap of more than $2 tn. And the benefits of this increased size should be manifold, explains Boon-Hiong Chan, head of market advocacy for Asia-Pacific & MENA at Deutsche Bank.

‘When the ASEAN Trading Link comprises all seven exchanges, they will rank among the top 10 exchanges in the world by market capitalization on an aggregated basis,’ Chan says. ‘A larger market capitalization can translate into better liquidity and better price discovery, and encourage cross-border trading.’

Nellie Dagdag, executive director for Asia-Pacific at post-trading specialists Omgeo, notes that the ASEAN Trading Link supports cross-border trading by connecting participating bourses. ‘It will increase liquidity between these markets, enabling capital to reach areas where it is most needed and providing the end-investor with greater choice in where he or she can invest,’ she explains.

‘Investors will be connected to participating exchanges through a central connection point. This will let investors both receive market information and, critically, place orders electronically through their domestic brokers. This represents a significant opportunity for this part of the region to create a single and increasingly standardized trading community.’

Skeptical commentators have questioned whether the link will make that much difference to investor participation in the short term, however, pointing out that some brokers in the region have been offering similar services for many years.

For example, OCBC Securities has been providing customers with the chance to trade in Singapore, Malaysia, Indonesia, Thailand and the Philippines for some time.

‘OCBC Securities has had the vision of helping our customers to trade not only in Singapore, but also Malaysia and other ASEAN markets since as early as 2006,’ says Raymond Chee, OCBC’s managing director.

‘As such, we had invested in building up the trading platform and connectivity and by 2009, we had expanded our connectivity beyond five key ASEAN markets to 14 global markets.’

More choice

Chan believes the more widespread investment in infrastructure brought about by the link will be a plus for capital markets participants in the region. ‘The broker take-up has been very encouraging − the key broker-dealers in Singapore, Malaysia and Thailand are all using the trading link,’ he says.

‘ASEAN countries want to create a level playing field for investors in different markets so they are investing in infrastructure and education as part of these changes and, because of this, the whole region stands to gain.’

Dagdag believes the link brings more robustness and efficiency to the system. ‘The use of technology creates efficiencies in an accounting sense, because of scales of economy and automation,’ she explains.

‘It also frees up market information so the investment community, both locally and abroad, can make a more informed comparison between investment choices, and execute a better investment decision as a result. This is market efficiency in the economic sense.’

Dagdag predicts the link will encourage more cross-border trading, create greater liquidity in the market and enable capital to go where it is most needed. ‘In some ways this is textbook economics: creating market efficiency by joining up what would otherwise be a very fragmented marketplace where there are many impediments for issuers seeking out investors,’ she adds.

Spreading interest

The link also opens up the marketplace for issuers beyond the ASEAN community, making it more attractive to global investors. ‘Moreover, in theory, once all ASEAN countries are participating, an issuer seeking a listing in one market – such as SGX – has the whole ASEAN investor base as a source of liquidity for any single listing,’ Dagdag points out.

Despite incentives such as capital gains tax exemption and lower transaction costs, however, evidence linking the launch of the trading link with increased trading volumes has been thin on the ground.

Indeed, there have been reports of lackluster trading volume through the new trading link. SGX, Bursa Malaysia and the SET were all contacted for this article but none produced any current data on cross-border trading volumes.

Among the reasons cited for investor reticence about new forays into non-domestic markets are the lack of integration in the rules and regulations across ASEAN markets, currency risk and unfamiliarity with foreign capital markets.

It is perhaps because of this latter point that the exchanges have more recently been turning their attention to investor education. In December 2012, two months after the initial launch of the ASEAN Trading Link, ASEAN exchanges launched a schedule for the Invest ASEAN 2013 roadshows.

As part of the roadshows, 30 of the leading blue chip companies in each market were promoted in a bid to raise the profile of the ASEAN market as a ‘highly investable asset class’. The top stocks, dubbed the ASEAN Stars, are 180 ASEAN blue chip stocks selected on the basis of market capitalization and liquidity.

At the same time, the SET is attempting to boost the number of first-time investors in Thailand by 70,000 by launching an education campaign in conjunction with 28 brokers.

Chan notes that the region is home to complementary economies that cover a wide range of sectors. ‘Each ASEAN market has its own strength and, when combined, they make for a more compelling investment story,’ he says. ‘For example, the Thai market has more conglomerates, Indonesia has a focus on natural resources, and Singapore has more of a banking and finance focus.’

First stage

The region’s exchanges are also working toward the goal of stock exchange integration with the launch of their website last year, which features aggregated ASEAN market data and analytics.

The ASEAN Trading Link is just phase one of a multi-stage process, however. Phase two, which will affect clearing and settlement, is anticipated to come in toward the end of 2013 or early 2014, as a precursor to further harmonization as outlined in the ASEAN Economic Community 2015 Blueprint, the master plan adopted by the ASEAN back in 2007.

And ultimately, for many issuers, the more interesting development will be the journey toward more harmonized ASEAN disclosure standards, which will present both more challenges and more opportunities.

‘The market will benefit from a move toward a single set of disclosure standards for equity and plain debt securities prospectuses in Singapore, Thailand and Malaysia,’ Chan says. ‘At the same time, issuers may need to become more familiar with the listing rules of each exchange.’

As cross-border trading increases, language problems will also become increasingly pertinent. ‘There are already discussions in some areas on how to deal with issues surrounding the fact that multiple languages are used in the region,’ Chan says. ‘Among the discussions are questions such as: which language should be used in legal documents?’

In the short term, while many issuers seem relatively indifferent about the trading link, it remains an important foundation for future initiatives that will pave the way for further economic integration. Dagdag expects more growth within the ASEAN community as well as rising cross-border volumes into Asia as a result of the link.

‘There are many factors at play, including the relative performance of some of these economies versus other markets that aren’t growing as rapidly,’ she observes.

‘Omgeo is seeing increased volumes in Asia overall, driven by developments such as the ASEAN Trading Link as well as this part of the world’s increasing focus on automation and standardization of markets, including post-trade processing. The ASEAN link marks an important milestone in the development of the Asian region. We already have a number of well-established, mature markets.

‘But what this shows us is that, through technology, many opportunities exist for freeing up the marketplace and creating opportunities that wouldn’t necessarily exist otherwise.’

Growing painsAchieving greater economic integration was never going to be an easy task and, accordingly, initiatives such as the ASEAN Trading Link have been dogged by delays. Reports were circulating in February 2011 that the link would be up and running by the end of the year. That deadline passed and subsequent announcements bought the exchanges more time.In May 2012 the link was scheduled to open the following month, connecting Singapore Exchange and Bursa Malaysia, with the Stock Exchange of Thailand scheduled to join in August. But the launch was then postponed until September. Meanwhile, while various reports suggest that in Vietnam the ASEAN Trading Link is on its way to the Hanoi and Ho Chi Minh stock exchanges, as yet no firm date has been set. The readiness of other exchanges, such as the Philippine Stock Exchange (PSE), to connect to the ASEAN Trading Link has also been called into question. Whether the deadline for further integration between ASEAN exchanges will be met is uncertain, too. In July this year PSE president Hans Sicat said the local bourse is unlikely to join the planned integration of ASEAN exchanges in two years’ time. |