Push for greater transparency over political contributions and controls hits eight-year high in 2011, reports study

As the US presidential primary campaign shifts into high gear, a new study reports that mutual funds are increasing their support for greater disclosure and board oversight of corporate political contributions.

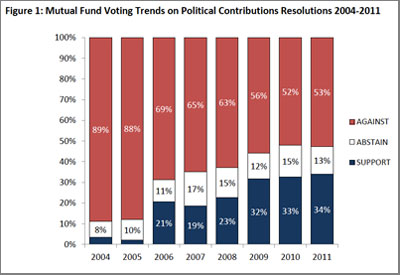

The Center for Political Accountability (CPA) reports that votes cast by 40 of the largest US mutual fund firms in 2011 reached an eight-year high of 34 percent in favor of shareholder resolutions focused on corporate political spending.

Source: CPA

That is up from only 8 percent support in 2004, the first year CPA studied the issue.

At the same time, opposition remained high at 53 percent with 13 percent abstentions. Opposition has declined each year over the same period until last year, when it ticked up one percentage point.

Despite the slight rise in opposition, CPA president and founder Bruce Freed is optimistic that mutual funds’ support for the issue will continue to grow. ‘The votes have been edging up,’ he says in an email.

ISS move ‘led to jump’

Proxy adviser Institutional Shareholder Services (ISS) decided in 2006 to recommend shareholders look at resolutions on a case-by-case basis, which ‘led to a jump in the vote for the CPA model resolution,’ Freed says.

Mutual fund support doubled from 10 percent in 2005 to 21 percent in 2006, according to CPA records.

Recently, ISS announced that it is changing its policy again and will advise clients to ‘generally vote for’ shareholder resolutions on political spending.

‘We expect overall support totals to grow as a result of the ISS policy change,’ Freed states. ‘Another factor [increasing support] has been a growing recognition that political spending poses significant risks to companies. That will only grow with the 2012 election.’

Former NIRI president and CEO Lou Thompson, who consults with companies on governance risk issues, also expects to see an increase in shareholder resolutions targeting political spending this year.

‘We’ll see this in spades in the 2012 proxy season, given that this is a presidential election year,’ he says.

Supporters and abstainers

Allianz, MFS, Morgan Stanley, Oppenheimer, Russell Investments, Schroders and Wells Fargo all supported more than 80 percent of political spending resolutions in 2011, according to CPA.

Fidelity and Vanguard, which are among the largest managers of corporate 401K plans, have consistently abstained from votes on political contribution resolutions.

Other mutual funds that did not support resolutions in 2011 include BlackRock, BNY Mellon, Dodge & Cox, Dreyfus, DWS Investments, Federated, Harbor Funds, Lord Abbett & Co, Pioneer, Putnam and T Rowe Price.

The vote percentages in the CPA report do not correlate to actual shares voted, but to the proportion of mutual fund families reporting affirmative votes on 35 shareholder resolutions as identified through SEC filings.

But the 40 mutual fund families studied are among the largest in the US and hold voting power over nearly $3 tn in US securities, notes CPA.

The Washington, DC-based non-profit has been pushing for increased corporate reporting of political contributions since Freed founded it in 2003.

Read the full CPA study here.