SWFs control trillions of dollars in assets under management but are tricky to define - and even tricker to monitor

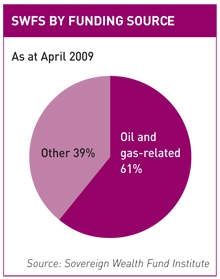

Given that most governments invest in assets abroad, defining a sovereign wealth fund (SWF) can be tricky. In general, SWFs are funds owned by a state but kept separate from the state’s regular budgeting activities. They invest surplus revenues from either the economy in general, or perhaps just one industry like oil and gas, in various assets globally, such as property, bonds, commodities and stocks.

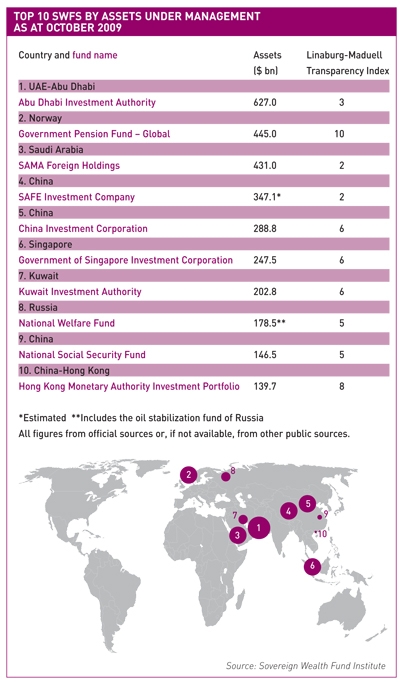

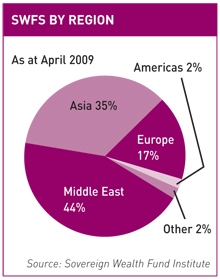

The phrase was coined in 2005 by Andrew Rozanov – today head of sovereign advisory for State Street Global Markets – in an article called ‘Who holds the wealth of nations?’ he wrote for  Central Banking Journal. In 2009, SWFs were estimated to have about $3 tn in assets under management, with more than $2 tn of that held by just a handful of funds from Norway, China, Singapore and the Middle East.

Central Banking Journal. In 2009, SWFs were estimated to have about $3 tn in assets under management, with more than $2 tn of that held by just a handful of funds from Norway, China, Singapore and the Middle East.

Wary state

While their stakes may one day recover, it is hard not to think that many SWFs were burned during the financial crisis when investing in US banks. Abu Dhabi’s attempts to extract itself from its share-purchase program with Citigroup is as much about saving face as investment strategy.

Overall, SWFs are estimated to have lost around $600 bn in value during the last two years, according to a Reuters report. Some of these losses have been recouped during the market rally that began around March 2008. For example, Norway’s Oil Fund jumped from $400 bn to $445 bn in size, according to figures from the country’s central bank, on the back of the surge in equity prices.

But Norway, and others, remain cautious about diving back into equities too quickly. Yngve Slyngstad, CEO of Norges Bank Investment Management, which manages Norway’s SWF, recently told Reuters he expects profit taking in the next few months.

Not all are so cautious, however. China has continued to invest heavily abroad through its China Investment Corp and the fund is said to be receiving a fresh capital injection of around $200 bn in 2010.

The first SWF The first SWF is said to be the Kuwait Investment Authority, which was set up in 1953 to invest revenues from the country’s oil industry. Today it is one of the world’s largest, with an estimated $203 bn in assets. The government of Kuwait continues to up the growth of its fund by putting in 10 percent of the country’s revenues each year. Notably, its equity investments include stakes of 7 percent in Daimler and 6 percent in Citigroup.

The first SWF is said to be the Kuwait Investment Authority, which was set up in 1953 to invest revenues from the country’s oil industry. Today it is one of the world’s largest, with an estimated $203 bn in assets. The government of Kuwait continues to up the growth of its fund by putting in 10 percent of the country’s revenues each year. Notably, its equity investments include stakes of 7 percent in Daimler and 6 percent in Citigroup.

Transparency

One of the main concerns about SWFs is their lack of transparency, both in what they invest in and why. A lack of transparency was highlighted in a 2009 report by Transparency International, a global organization dedicated to fighting corruption. It wrote: ‘Little is known about most SWFs’ investment policies, governance structures and accountability mechanisms.’ The group added that Kuwait’s SWF actually prohibits by law disclosure to the public of its assets.

Norway, on the other hand, is one of the countries leading the way internationally on SWF transparency. It releases quarterly data on its individual holdings in stocks and bonds, as well as qualitative information on its investment strategy.

Norwegian equity story

Norway’s SWF announced in 2009 it now owns, on average, 1 percent of the world’s listed companies, making it by far the most significant SWF out there for investor relations professionals.