– Stock markets suffered some of their worst falls for decades in the first quarter of 2020 as investors responded to the coronavirus outbreak, reported the BBC. The FTSE 100 Index dropped 25 percent and the Dow Jones Industrial Average fell 23 percent, marking their biggest quarterly declines since 1987. The S&P 500, meanwhile, experienced its biggest quarterly drop since 2008.

– CNBC noted that Goldman Sachs had updated its projections for the US economy. The investment bank said the negative impact of Covid-19 will be worse than previously thought, with the jobless rate hitting 15 percent and GDP falling 34 percent in the second quarter. But Goldman also predicted the recovery in the economy in the third quarter would be the fastest on record.

– JPMorgan analysts think US pension funds could add $400 bn to equity allocations over the next two quarters, reported Reuters. Some funds may have held back from rebalancing their portfolios due to market volatility during the first quarter, said the analysts. ‘We still expect that US pension funds will eventually rebalance within one to two quarters,’ wrote Nikolaos Panigirtzoglou, a strategist at the bank.

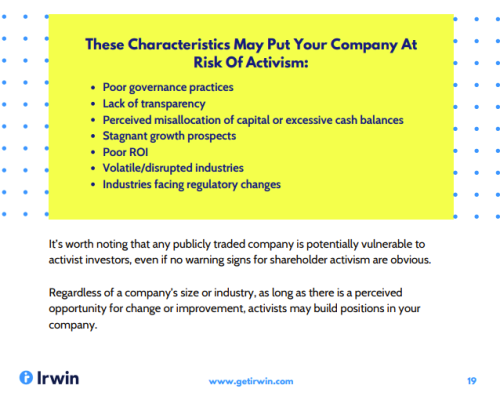

– Many activist investors have walked away from campaigns or settled early amid the disruption to businesses caused by Covid-19, according to the Wall Street Journal. The article says being an activist ‘isn’t such a good look right now’ given that ‘executives are struggling to keep their companies afloat and their workers employed as the coronavirus spreads.’

– John Parker, a British businessman who wrote a key report on ethnic and cultural diversity, said UK boards need to do more to improve ethnic minority representation, reported the Financial Times (paywall). ‘I’ve been a supporter of diversity in boardrooms for a very long time,’ he told the newspaper. His report, released in 2017, found that half of FTSE 100 boards had no members from black, Asian or minority ethnic groups.

– Zentalis Pharmaceuticals became the second company to go public in the US following the declaration of Covid-19 as a pandemic, according to Bloomberg. The cancer treatment developer raised $165 mn after expanding the offering size from 7.65 mm shares to 9.18 mn. WiMi Hologram Cloud, a Chinese technology company, also went public this week in the US in a downsized IPO.