Countries, companies, individuals and institutions are personally impacted by the virus, with lives at risk. Understandably, IR practitioners have been inundated with requests from the investing community and the media regarding the impact on their company, how management is preparing for this Black Swan event, and some basic granular issues related to the employees, customers, suppliers and business contingency and continuity.

Singapore leaders have indicated that this might potentially continue for as long as one year. This means a deep and lengthy impact on businesses. Shareholders of companies will be anxious about not only their health but also the health of the companies they have invested in.

These are some of the common areas of interest that require answers from IR practitioners:

Practical propositions

AGMs and attendance: Singapore Exchange has granted extensions up to the end of June for AGMs. Is it safe to hold AGMs and what steps are taken if the AGMs have to go ahead? Are there alternative ways such as virtual AGMs? In this age of technology, what rules must be reviewed to enable virtual AGMs?

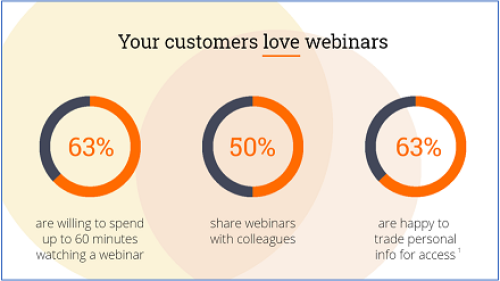

Curtailed travel and canceled meetings: Many companies as part of their business continuity plan have banned all non-essential travel. The question is: what are the alternative ways to communicate with domestic clients, customers, the investment community and overseas clients and colleagues to minimize disruption to business continuity? Covid-19 will prompt companies to review travel plans, and may help reduce carbon footprints with fewer airplane journeys and overseas meetings. Technology allows webcast meetings to deliver perhaps the same results with fewer costs.

Financials

Cashflow: This is one of the critical issues for the investment community – can the company last if this is a one-year crisis? What are the contingency plans for six months and 12 months to manage cashflow? What cost-cutting measures must be taken without fundamentally hurting the business?

Capital spending: Companies may want to re-evaluate capital spending plans, address opportunities on the horizon post-crisis, and guide on changing circumstances and prospects.

Fund-raising: What steps can be taken to seek financing support? On what terms? What are the narratives that set the company apart in these difficult times and that will help it come out stronger with additional financial support?

Sales forecast: In almost all industries – except perhaps mask producers and medical products necessary to combat Covid-19 – we will see a drop in their sales in the foreseeable future. Again, there is a need to develop narratives that talk of steps taken and the capacity to emerge stronger after this crisis.

Business proposition

Business activity: The pressing and persistent questions on this includ: how has it affected business activity? And how significant is the drop in business activity? The narrative would cover the near term – before the next results – and prospects for the next several months. Are there any steps to be taken to mitigate the drop?

Supply chain disruptions: With many countries, in particular China, in an unprecedented lockdown mode, is the company affected? In what way? If not, this is a positive point to highlight that the business is not exposed to supply chain disruptions and that there are no concentration risks in the supply chain.

Employees: This is a sensitive issue and will attract maximum publicity. It is time to be realistic while also being compassionate and caring for the most important asset of the company: its employees. Internal communication is essential so that staff feel safe, especially key staff, and know that management is managing the crisis with the company's and their interests in mind. The Singapore government, in particular, expects employees to be treated as assets and not as disposable cost items to be shed at every bump in the business cycle.

Minimizing negative fallout on staff

Covid-19 has presented new challenges for companies, requiring them to clearly articulate the impact on business operations, and also to communicate with shareholders and stake-olders on the steps being taken to prepare for the worsening situation.

Many Singapore Exchange companies have announced pay cuts at senior management level while trying to keep their headcounts.

The Singapore government’s policies are supportive of keeping employees and minimizing the negative fallout on staff by providing financial incentives to companies. This is also a time to re-skill the workforce and step up the use of technology to augment business continuity plans.

Reviewing Singapore Corporate Governance Code to go virtual

It makes more sense, for example, to hold virtual AGMs to avoid crowded function rooms that could lead to another cluster infection. To do so, howeve, calls for a review of the Articles of Association, which require shareholder meetings to be held in a physical location and, in Singapore, a review of the Practice Guidance of the Code of Corporate Governance on whether AGMs can be held virtually. Finally, there is the issue of having a quorum – can one have a quorum in a virtual AGM?

The Investor Relations Professionals Association Singapore recommends an active dialogue on managing virtual AGMs in the light of advanced technology solutions while meeting the governance requirements. While the technology to allow webcast meetings or vote electronically already exists, there are outstanding issues to be addressed such as the authentication of proxies and ensuring the privacy of the webcast is sufficiently robust. It will be ideal if the authorities can set some guidelines to provide some assurance to companies.

Covid-19 will inevitably bring about a sea change in community behavior.