The conversation around ESG has never been as pertinent as today. Right now, the world is at a point of climate emergency and 2023 brings the possibility of economic turbulence and unprecedented new regulations. But this year also brings new opportunities to make sustainability a strategic imperative that will positively impact the organization’s workforce, workplace and global community.

While sustainability reporting is likely to become a regulatory requirement, it has grown in popularity in recent years. In 2011, only 20 percent of S&P 500 companies published sustainability reports; fast forward to 2019 and that number had reached 90 percent. The cause for this popularity is the positive consequences of good sustainability reporting. When done well, sustainability reporting drives two compelling outcomes for organizations: informed decision-making by stakeholders and improved sustainability performance by companies. In the end, therefore, it pays to develop a robust sustainability reporting process and strategy.

But effective ESG reporting is challenging and includes must-do steps that will drive significant value for any organization. As you plan how to deploy robust sustainability reporting, here are five steps to good sustainability reporting to get you started:

- Get the basics in place – set priorities and develop a strategy

- Organize and structure your report against your strategic priorities

- Draft your content and iterate

- Get the report in front of internal and external audiences

- Review learnings and iterate for the next reporting cycle.

Get the basics in place – set priorities and develop strategy

The first step in developing your priorities and strategy is to perform a materiality assessment that will allow you to understand the sustainability issues that may have an outward impact and those that stand to impact the business (double-materiality).

When done well, a materiality assessment has the benefit of driving alignment on sustainability priorities and should be refreshed every two to three years to consider emerging business risks. Given the speed at which the business environment changes, the need to refresh your materiality assessment is more critical than ever. Indeed, Covid-19 showed us how quickly the global landscape could change.

A robust materiality assessment will typically leverage the two pre-eminent reporting standards – GRI and SASB – which take distinct, though complementary, approaches to materiality. While GRI tends to focus on the impact of the organization on the economy, the environment, the people and human rights, SASB is concerned with how an organization is prepared to manage external risks that may impact its financial performance.

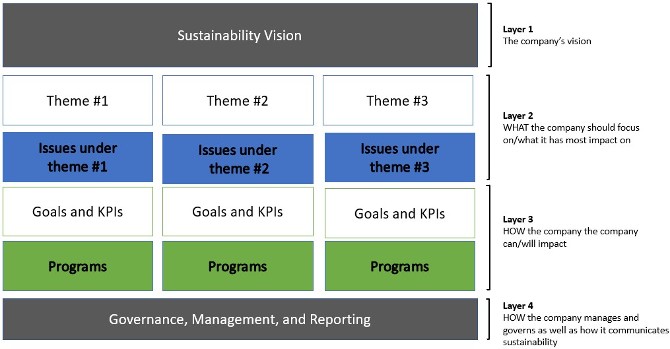

Your materiality assessment will become the foundation to help you organize which material issues are significant enough to become the pillars of your organization’s sustainability vision. These can be grouped by type (such as environmental or social), business unit, level of ambition or other means.

For each material issue, determine the appropriate target (goal) and associated KPI. Key performance narratives are equally important in telling the story through your KPIs. One crucial step is to pressure-test your KPIs. Peer benchmarking – comparing your ESG performance against your competitors’ performance – helps contextualize your sustainability reporting.

Sustainability reporting can be a source of competitive advantage and undertaking a benchmarking project early in the reporting process enables a company to:

- See what other companies are disclosing (material issues) and measuring (KPIs)

- Compare performance on these issues and metrics

- Determine what success looks like and the level of investment required to get there

- Build an internal business case for colleagues who may be unaware of market dynamics

- Borrow good ideas and find opportunities for innovation

- Forecast potential business risks and opportunities and provide recommendations for closing potential gaps

- Demonstrate the positive impacts of your sustainability programs.

Sylvie Harton is chief business strategy officer at Lumi Global.

Keep visiting IRmagazine.com for the next steps in strong sustainability reporting