The Investor Forum aims to help domestic and overseas investors collaboratively engage with UK companies

Your CFO is on the phone. Your chairman has just received a letter from an organization called the Investor Forum. It wants you to sit down with a group of large investors, ranging from domestic holders to overseas firms and even a sovereign wealth fund (SWF). They all have ‘strategic concerns’ they’d like to discuss with your management. Apparently, they all agree things need to change.

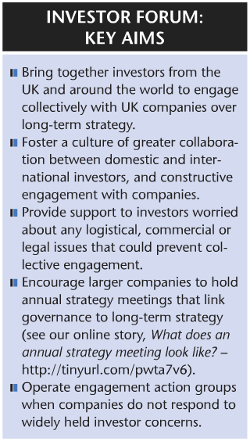

This scenario could become a reality for public companies in the UK. Last December, a group of institutional investors announced the creation of an Investor Forum to promote better engagement between listed companies and long-term shareholders.

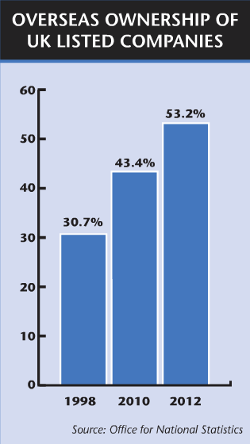

Given the growing size of overseas ownership in UK companies, one of the forum’s central aims will be to foster greater collaboration between domestic and international investors. The UK’s Office for National Statistics estimates that overseas investors held more than half the UK equity market at the end of 2012, up from less than a third in 1998 (see Overseas ownership of UK listed companies, below).

|

|

The working group that set up the forum reflects this global outlook. Along with UK institutions like Schroders and Legal & General, the lineup includes North American investors Vanguard and Capital, along with Netherlands-based pension fund APG.

‘It is inadequate for collective engagement to be so heavily driven by local players,’ wrote James Anderson, a partner at Baillie Gifford and chair of the working group, in a December report on the forum. ‘Most UK companies are now majority-owned by overseas owners. This is unlikely to reverse.’

Overseas outreach

The decision to set up the forum follows an extensive review of the UK equity markets by Professor John Kay, an eminent economist who also writes a column for the Financial Times.

Kay reported that a great deal could be done to improve the stewardship of listed companies, and one of his recommendations called directly for the creation of an ‘investor forum’ to aid this process. With plans for the forum announced, an implementation team is now working on the details and is due to report on progress in March. The new body should then be up and running by June.

Getting North American investors to work with their UK counterparts has historically been difficult, Anderson tells IR Magazine, so it was particularly pleasing to have two US institutions sitting on the working group that set up the forum. One other ‘very large’ American investor has also shown interest in being involved, along with one or two Canadian pension funds, he adds.

The potential for legal complications has held back collaboration in the past, according to Anderson. ‘They’ve always been very nervous about the legal framework,’ he says. ‘They’re not used to the less legally driven, less clarified approach UK regulators have compared with the SEC.’

The forum aims to address legal concerns through a secretariat, which will have access to counsel and can advise investors on whether any actions could trigger concert party or insider trading rules. If an investor is concerned about being too closely involved in engagement, it could signal its support at the outset and then step back from the process, according

to the working group.

Growing collaboration

But Anderson also questions how hard investors have tried in the past to take a unified approach. ‘To be quite honest, [Vanguard and Capital] were receptive,’ he says. ‘I’m not sure you could draw a cigarette paper through the difference in their general perspective on these matters, and that of L&G, Schroders and Baillie Gifford.’

The willingness of US investors to join forces with others overseas is growing, albeit from a low base, says Amy Borrus, deputy director at the Washington, DC-based Council of Institutional Investors, which campaigns for better corporate governance and shareholder rights.

‘Cross-border collaboration, while in its infancy in the US, is definitely on the rise,’ she says. ‘The trend reflects the rise in institutional investor assets invested across home borders. US pension funds, for example, are putting more and more of their assets to work in other markets. And more non-US funds are investing in US markets.’

Borrus cites as an example the co-filing of resolutions by Hermes Equity Ownership Services, the UK asset manager, at JPMorgan and Walt Disney last year. The latter campaign, which called for a proxy access bylaw, received 39.8 percent support from the votes cast. She also highlights how a US pension fund led a global ‘coalition’ of 25 investors that engaged with companies regarding board oversight of political spending and disclosure of payments.

|

|

‘Nine of the companies agreed to improve their disclosure,’ Borrus explains. ‘A similar coalition is considering seeking engagement with a European pharmaceutical company about a policy on when a clawback of CEO pay is warranted.’

European institutions are also in the sights of the Investor Forum, Anderson points out, citing the presence of APG on the working group. ‘We’re not a Europhobic group, in the way that so much of our financial culture is, so we’re keen to try to gather representation from some of the European groups that are serious long-term investors,’ he says.

New money

In addition, the forum has tentatively approached SWFs for support. With a reputation for secrecy, a collaborative forum does not feel like a natural home for funds like the Abu Dhabi Investment Authority, which has $627 bn in assets but only scores five out of 10 on the Linaburg-Maduell Transparency Index, according to the Sovereign Wealth Fund Institute. (Norway’s Government Pension Fund Global, by contrast, scores 10.)

Anderson says he is treading carefully, and taking the long view. ‘It’s only going to get more important over the years, just looking at the math of where the money is,’ he says. ‘I think this is one area where we need to be prepared to proceed cautiously. But we also need to spend a great deal of time and effort on it, and be able to give SWFs gradual involvement – and that needs to be involvement that isn’t too public, either.’

There has been ‘more interest than you would expect’ continues Anderson, but he cautions against any serious SWF involvement early on. ‘I think it’s going to be surprising if they are very early and very public in what they want to do,’ he says. ‘But would I say I was more confident than six months ago that we could get some of them at least as supporters? Yes, I would.’

It could take the weight of an SWF with a large stake to truly change the direction of some of the companies the forum has in its sights. The working group’s report notes that smaller companies are less likely to be the focus of the forum’s engagement, as typically single, large institutions hold enough sway to make their presence felt. ‘Shareholders typically have relatively small holdings, particularly in larger companies,’ states the report. ‘This can at times make it difficult for them to be effective on their own.’

Critical response

The forum is not without its critics, however. When details were announced in December, it received a less-than enthusiastic response from certain sections of the media. The FT, for example, questioned how interested overseas shareholders will be in the

‘stewardship’ of UK companies.

‘In general, it is entirely sensible for even the most diligent globally invested SWF or US shareholder to have priorities other than their British holdings,’ wrote the paper’s Lombard column. ‘The UK has highly developed corporate governance standards and a pretty vigilant domestic shareholder base. Whether the forum exists or not, only really serious issues can command the attention of international investors.’

The working group’s report outlines three reasons given by international investors for why they have not engaged more in the past alongside UK institutions: existing shareholder groups are not always accessible to overseas firms; commercial concerns; and legal concerns. While the forum seeks to address these issues, many investors may still prefer to stay away.

But John Wilcox, chairman of Sodali, the international corporate governance advisory firm, believes the forum makes a lot of sense from the perspective of shareholders. ‘Those at least who are diligent about share voting and their monitoring duties should certainly welcome this,’ he says.

Strategic moves

The Lombard column also highlights that investors, in general, have very different objectives and will often not agree that any one strategy is the right approach. What’s more, a senior member of the UK’s investor relations community has worries about several aspects of the forum that have ‘significant implications for extra cost and misdirected engagement if adopted inappropriately’.

One area that has particular implications for companies is the call for annual strategy meetings: the forum would like large companies to engage in a two-way discussion over long-term strategy with their institutional investors on a yearly basis. Brokers and their analysts would be banned from the meetings. The forum also plans to set up ‘engagement action groups’ when it feels companies are not responding to its concerns. The action group would send a letter to the chairman, outlining any perceived issues and calling for meetings to address them. Once the issues have been resolved, the action group would disband.

‘We’re very keen on emphasizing that we’d rather not get to these end stages,’ stresses Anderson. ‘But with the proviso that… if you have a very large mass of serious, long-term shareholders involved in the company and they are seriously worried, then we have the right to push it just as hard as we possibly can.’

In the spirit of encouraging a better working relationship between companies and shareholders, the forum plans to offer a way for companies to approach it if they’d like to gauge institutional sentiment on current strategy or a significant change in approach. If the forum does manage to achieve the desired level of engagement from investors around the world, this could make it a useful sounding board for companies.

‘One of the more standard ways of going about things, if there is a big structural issue inside a company, is to talk individually to many of the major shareholders,’ explains Anderson.

‘Now, we have no problem with that; we think it’s quite a sensible way of doing it. But we think there are some occasions when actually, both from the company’s point of view and the investors’ point of view, having a forum where you could gauge overall opinion might be quite good. We’d really welcome it if a company was prepared to acknowledge, We haven’t got this entirely right in the past, we’re trying to be better, we’re trying to be clearer about our strategic advantages, both to the outside world and in thinking about ourselves.’

This aspect, for Wilcox, is why companies should embrace the idea of the forum. He says there are often instances when companies cannot reach shareholders. For example, there may be a major initiative to discuss, but there is no one to answer the phone, or shareholders don’t have time to discuss it, or companies can’t find the right person to talk to.

‘It should be looked upon as something that can be useful to corporations as well, depending on how it’s organized and how well it works,’ he concludes.