A recent SEC ruling will open the doors to more climate-risk resolutions making the ballot

Last October the SEC issued Staff Bulletin No 14E, making it much simpler for shareholders to file resolutions on climate change and financial risk. The move was a real victory for shareholder activists who have been working behind the scenes lobbying for this change. Experts are now predicting more shareholder proposals tying environmental, social and governance (ESG) issues to financial risk this proxy season, as well as in seasons to come.

‘We will see a steady growth of these types of shareholder resolutions integrating the concept of risk,’ predicts Tim Smith, senior vice president at Walden Asset Management. Indeed, big oil companies including ExxonMobil, Chevron and ConocoPhillips have already received resolutions asking them to report on financial risks resulting from climate change and its impact on shareowner value.

‘A great many of the resolutions shareholders would have filed anyway are now asking about risk,’ adds Sanford Lewis, a Boston-based attorney whose clients include the Investor Environmental Health Network and other investor activist groups.

This latest move is a reversal of a prior SEC Staff Bulletin that prevented shareholder proposals asking companies questions about the relationship between risk and environmental concerns. That bulletin was issued under the Bush administration in 2005, and blocked proposals on climate change or other ESG issues that asked about financial risk. Companies could reject such proposals through ‘no action’ requests. This is no longer possible since the SEC decided risk is part of a company’s ordinary course of business and therefore an appropriate topic for a shareholder vote.

Behind the scenes

‘The old rule excluded the exact question investors wanted to ask, which was how social and environmental issues affect the financial risk of a company,’ notes Lewis. When President Barack Obama was elected, Lewis organized a letter signed by 60 institutional investors suggesting this was an area to be addressed. This eventually led to a multi-stakeholder meeting with Meredith Cross, director of the SEC’s division of corporation finance, on September 22, 2009 to discuss changes to the no-action process.

‘Investors have now been freed up to ask the question they wanted to ask to begin with: how does climate change affect your business plans and how will you mitigate the risks?’ comments Rob Berridge, senior manager of investor programs at Ceres, a shareholder network and advocacy group. He is predicting a record proxy season this year in terms of the number of ESG resolutions and the nature of those resolutions now that shareholders can tie these issues to risk.

In the past, these proposals have focused mainly on greenhouse gas (GHG) measurement and climate strategy disclosure. These topics will continue to be important this year with big labor stepping up and requesting company-wide climate change policies, according to Berridge. Some companies will also face shareholder proposals on newer environmental topics such as supply chain risk disclosure, he adds.

On the radar

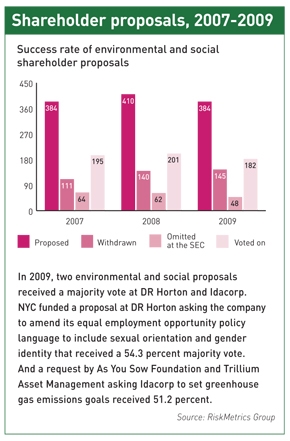

Investor interest in environmental risk has grown steadily in recent years. In 2009 US and Canadian investors filed 68 environmental resolutions, an 11 percent increase over 2008, according to Ceres. A group of 475 institutional investors with $55 tn under management annually requests GHG emissions disclosure from global companies under the Carbon Disclosure Project. And Ceres’ Investor Network on Climate Risk represents an $8 tn network of investors that petition firms to include more information on climate risk and sustainability.

Last proxy season also saw a landmark 51.2 percent majority vote at Idacorp on a proposal asking the utility to set GHG emissions reduction goals by year-end. ‘The majority vote at Idacorp shows investors want companies to do more to address climate change,’ points out Michael Passoff, associate director of As You Sow, which led the proposal. As You Sow is working on several resolutions this proxy season, including a new campaign on the impacts of natural gas drilling, especially hydraulic fracturing, a process used to extract oil and natural gas from tight rock formations that can result in ground water contamination.

‘For shareholders, this issue raises all major red flags of legal, political, regulatory, reputational and financial risk, and this will be the big new environmental resolution this year with at least 20 different investor groups filing at 20 companies,’ reports Passoff. While the proposal is not a direct result of the SEC’s about-face, Passoff expects to see a higher number of resolutions relating financial risk to social and environmental issues this season.

The SEC’s reversal is a great triumph for activist investors, who have been writing highly convoluted shareholder proposals on ESG issues for years in an effort to meet the SEC’s criteria. ‘Before, we would have to use a corporate governance-related resolution around political contribution disclosure to address climate change, for instance,’ says Lauren Compere, director of shareholder advocacy at Boston Common Asset Management. ‘We really had to work to couch arguments in order to pass the SEC’s limited view.’ The reversal provides a clear way to communicate with management and prevents resolutions from becoming blunt tools, she adds.

NorthStar Asset Management has been trying for several years to file a proposal with Western Union that was disallowed by the SEC. Now its founder says the reversal gives the resolution a better chance of making it onto the ballot. The proposal looks at the economic risks the company faces from charging high fees to a largely poor immigrant clientele. ‘We are asking it to form a risk governance committee, independent of the audit committee, to fully address these risks and submit reports to shareholders,’ says Julie Goodridge, founder of NorthStar. Experts expect the commission’s next move will be to mandate better disclosure on environmental and social risk. Lewis fully expects this to happen but doesn’t know when; he was involved in writing a letter from the Social Investment Forum in July asking the regulator to mandate sustainability reporting. ‘We haven’t had a response but that letter resulted from conversations with some SEC commissioners who indicated they would invite such a proposal,’ he says.

Experts expect the commission’s next move will be to mandate better disclosure on environmental and social risk. Lewis fully expects this to happen but doesn’t know when; he was involved in writing a letter from the Social Investment Forum in July asking the regulator to mandate sustainability reporting. ‘We haven’t had a response but that letter resulted from conversations with some SEC commissioners who indicated they would invite such a proposal,’ he says.

Stepping up

In November 2009, institutional investors managing more than $1 tn in assets petitioned the SEC to mandate companies to disclose more about their financial exposure to climate change and GHG emissions policy. ‘Investors believe this is important information and there are hundreds of companies stepping up, doing meaningful sustainability reports and putting information in their 10K,’ says Smith.

Companies like Texas-based Fluor say there are advantages to being proactive with sustainability and climate change reporting. ‘One benefit of such efforts (including public reporting), is that stakeholders have confidence Fluor operates transparently – a key attribute of corporate favorability,’ says Lee Tashjian, vice president of corporate affairs at the global engineering and construction firm.

Ultimately, investors say they would rather see companies increase their disclosure on environmental and social issues than face a shareholder vote. This move by the SEC certainly makes it easier for them to ask questions around risk evaluation and ESG concerns, however.

‘Shareholder proposals are only one tool in the kit that we view as useful and has become even more useful now we can communicate more clearly with management on these issues,’ summarizes Compere.

What the experts say

With companies more likely to face shareholder proposals on environmental, social and governance issues following a recent SEC decision, proxy experts weigh in on how to respond.

‘If a shareholder proposal comes along on environmental risk, the more you are prepared at the board and management level, the easier it will be to talk to investors about what the risks are. You will also have a sense of what you are doing to ameliorate or have a handle on what they are proposing.’

Rachel Posner, senior managing director and general counsel, Georgeson

‘Firstly, it’s important to take these proposals seriously: don’t presume that the proposal/issue will not receive shareholder support. Keep in mind that with the voting power of the large institutions behind some of these proposals, they will survive the reintroduction threshold and some may gain very respectable numbers. Secondly, consult with your counsel and proxy solicitor. Ask them to research the history of the proposal (or resolutions similar to it), the vote it has received in the past and who the proponent is. With that information in hand, a company can make a realistic determination on whether to engage with the shareholder.’

– Francis Byrd, managing director, the Altman Group

‘Once filed, approximately one third of all proposals – across all issues – subsequently become withdrawn by the proponent, usually following a successful dialogue between the proponent and the issuer. We typically recommend that our clients engage with the proponent to see whether they can reach a mutually acceptable understanding or accommodation that might result in the proposal being withdrawn.’

- Ron Schneider, vice president of business development and senior manager of the proxy solicitation group, BNY Mellon Shareowner Services

‘Environmental and social proposals are like all other shareholder proposals: we first review the shareholder base and project the likely outcome of the vote based on the voting practices of the shareholders, especially institutional shareholders, on similar proposals at other companies. We also consider the impact of the recommendations by the proxy advisory services on the individual institutional holders. That vote projection guides the client’s decision making with respect to the proposal.

‘If the projection shows it is likely the proposal would receive significant support, the client may decide to reach a settlement whereby the proponent withdraws the proposal. In such circumstances, we can provide the client with advice on the likely concessions necessary to reach settlement.’

– Arthur Crozier, co-chairman, Innisfree