As the crises of 2008 play out, good corporate governance is vital as shareholder activism rises and takeover theats add pressure

This year will undoubtedly be remembered as the hellish hangover that followed a sustained period of relative decadence. Cheap debt, a sustained bull market and a laissez faire attitude toward regulation helped promulgate a heady culture of weak risk management, inadequate checks on power and, ultimately, recklessness. Never has the future appeared so uncertain as governments scramble in a last-ditch effort to restore confidence to a battered market.

This was the year when the unthinkable occurred, respected execs were toppled from their perches, Bear Stearns and Lehman fell and investment banking titan Merrill Lynch was sold for a relative pittance to Bank of America without a whimper of dissent from shareholders.

Headlines have already proclaimed the death of private equity and hedge funds as we know them. As valuations plummet, redemptions skyrocket and access to credit dries up, these predictions don’t seem so far-fetched.

Some are already calling 2008 a key turning point, prophesying the end of fat cats, gargantuan bonuses, ill-experienced boards and biased directorships. But will any of these predictions come to fruition or will they wither on the vine? The answer probably lies somewhere in between.

Shareholder support

It’s not just the market that has been up and down. Investor sentiment has been similarly erratic. Pat McGurn, special counsel at RiskMetrics Group, thinks the fall of Bear Sterns in mid-March frightened many investors into rallying behind management.

‘It seems shareholders went from anger to angst to absolute fear at that time,’ he says. ‘Investors have actually been more supportive in the US this year. Bear Stearns went belly up four weeks after the start of the year’s major AGM activity and after that there was not one voting result in April where there was a majority no vote against the directors.’

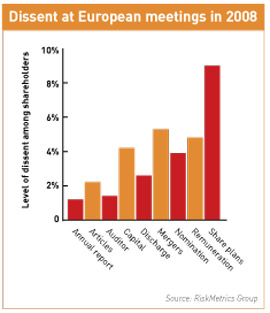

In Europe, levels of opposition were higher. RiskMetrics Group found that for more than one in five general meetings it analyzed in Europe, at least one resolution was rejected or withdrawn.

There is widespread agreement on one issue at least: executive compensation will be a major focus for 2009. Richard Grubaugh, senior vice president at DF King, thinks recent events will increase scrutiny on companies. ‘The world changed in 2008 but the main issues have not changed significantly,’ he points out. ‘And many companies will be stuck between a rock and a hard place with their executive compensation equity plans.’

Many an activist has lamented the paradoxical nature of executive bonus compensation plans at public companies. A bonus by definition is something that is not paid without regard to performance. And yet, increasingly, bonuses have become annual ‘entitlements’ that are rarely forgone by managements.

Paying the piper

Arguably it is the inability of a number of companies to manage this issue well that has landed so many of them in hot water. Pay is still very seldom linked to performance. In the UK, figures suggest that over the last two years more than 90 percent of executive bonus plans paid out.

In the US, after much fanfare, say-on-pay proposals failed to garner more support in 2008 than they did in 2007. As we go into 2009, however, deep political changes in the US will propel the issue to the top of the agenda, with governments, shareholders and the general public becoming increasingly reluctant to pay for failure.

In previous downturns, boards have tended to ignore metrics and pay out regardless but heightened disclosure of compensation plans means investors will be able to scrutinize such maneuvers. XBRL could also increase sensitivity on the issue of executive pay.

‘Once compensation data is in XBRL, users will be able to look at a spreadsheet and see the numbers rather than the words, so other disclosures could become less relevant,’ McGurn notes.

He thinks the Wall Street versus Main Street element of the US presidential campaign has etched the issue of executive compensation deep into the minds of legislators and the general public. ‘We will see legislation that mandates a lot of reforms investors have been pushing,’ he predicts.

The UK and US governments have signaled increasing checks on remuneration, and countries such as the Netherlands have already implemented higher corporation tax on perks such as golden parachutes. In France, MEDEF, the French employers’ body, and the Association of French Private Business have called on firms to strengthen the link between pay and performance, and suggest caps on pension contributions and severance bonuses.

Many expect hedge fund activism to take a back seat as all but a few struggle to survive. ‘Some hedge funds in the City are very negative about what the future holds,’ notes Keith Parnell, managing director of MacKenzie Partners in the UK.  Many have already crashed and burned; other well-established funds have been forced to liquidate their positions as investors rush to pull their burned fingers (and money) out of the pot. Alex Flatscher, chair of the advocacy committee at the CFA Japan Society, points to US fund Steel Partners, which has had to pull out of around 10 Japanese companies it is invested in, despite some successful activist campaigns earlier this year.

Many have already crashed and burned; other well-established funds have been forced to liquidate their positions as investors rush to pull their burned fingers (and money) out of the pot. Alex Flatscher, chair of the advocacy committee at the CFA Japan Society, points to US fund Steel Partners, which has had to pull out of around 10 Japanese companies it is invested in, despite some successful activist campaigns earlier this year.

Cas Sydorowitz, managing director of corporate advisory at Georgeson, thinks those left with capital will still be active as they take advantage of depressed prices and agitated investors. Established players with limited portfolio risk, such as Laxey Partners and Knight Vinke, will be among the few that can take advantage of the current turmoil. As one fund manager puts it, the financial crisis has been an unpleasant wake-up call for some investors, many of which ‘mistook a bull market for their own brilliance.’

A new activism

As well as state and union pension funds, the new strand of activism will come from previously passive long-only funds that have had their minds concentrated by their rapidly shrinking portfolios. McGurn thinks many investors feel badly let down. ‘They believe they were kept in the dark; that’s why you will see a different reaction and less rallying,’ he explains.

In the US, there could be a bigger role for mutual funds, money managers and an increasingly mobilized retail fraternity to take center stage as veteran activist Carl Icahn launches his United Shareholders of America, asking for greater accountability of boards in the US. But the dire performance of so many stocks may lead to a situation where America’s Mom and Pop investors unwind their positions and seek solace from a market that has only really known one direction of late: down.

Deals that seemed previously unlikely could be sealed at bargain prices with greater consolidation and more cross-border M&A deals happening once markets stabilize. Active sectors may include minerals and mining, and production from Asia and Australia. John Siemann, a partner at Laurel Hill, predicts some blockbuster deals for 2009. ‘Once the market stabilizes, you’ll see foreign investors snatching up real bargains because there will be operations that are very attractively priced,’ he says.

A key issue for investors will be ensuring they are able to demonstrate ownership rights. ‘A direct fallout from the banking crisis is the notion of being able to process your assets and the accounts at custodians,’ notes Paul Hewitt, European business development manager at Manifest, the UK-based proxy voting agency. ‘With the value of assets being under observation, it’s one of those times when institutional investors’ ability to keep track of what’s there is more sensitive than previously. In such cases as the Icelandic banking crisis, we have seen savers and investors struggle to trace what is theirs.’

Hewitt thinks pooled accounts could come under the spotlight more as a result. ‘It might be academic but being able to demonstrate what was yours in the first place is fundamental to determining what you are owed,’ he explains.

The banking crisis has had other repercussions for proxy voting. Several companies have found themselves in an uncertain position after the collapse of Lehman Brothers left assets tied up in now defunct prime brokerage departments. Chinalco said recently that Lehman was custodian of its 12 percent stake in Rio Tinto’s London-listed shares. Because Rio is currently the subject of hostile takeover interest from rival BHP Billiton, voting interest on Rio’s shares could be crucial to the outcome of the firm’s future.

Shock waves hit Asia

In many ways, the fallout has only just started to make life difficult for Asian firms, yet investors there have already felt the consequences of a volatile market with a vast throng of small investors in China out of pocket after the massive losses sustained by Chinese stocks. In Hong Kong, retail investors who bought Lehman mini-bonds in good faith have taken to the streets to protest.

Japan is slowly edging toward a more open structure and this year saw a move away from Japanese meetings all taking place on the same day, something that helped to increase participation. According to a survey of individual investors carried out by Nomura Securities, 52 percent say they exercised their voting rights at 2008 meetings, with management support only marginally down on last year.

As shareholder despair turns to anger, 2009 will certainly be a proxy season to remember. Governments will be paying closer attention and, as institutions count their losses, pressure will be mounting from all sides for more checks on company management.

Weak controls, poor governance and low prices will also make some companies – even larger ones – vulnerable to takeovers, and only well-governed firms that really engage and listen to their shareholders will be safe.