Successful IR comes down to managing your time (and your management’s time) effectively. Choices must constantly be made between spending time with different funds, different investor events – and different sell-side analysts.

Indeed, managing your time with the analyst community is perhaps the hardest area, because analysts want more of your time than you can give. That’s especially true at today’s larger companies where coverage of 30-plus or even 40-plus followers is not unusual.

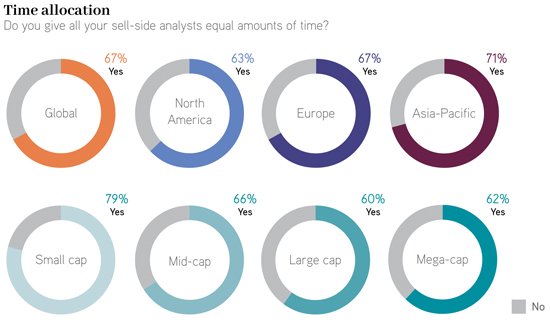

But many companies follow the mantra that all analysts should be treated equally, regardless of quality, attention or rating. In IR Magazine’s recent research report, How to manage your sell-side coverage, we investigate this issue by asking IR professionals whether they give all analysts the same amount of time. The results are based on a survey of more than 650 IROs from around the world.

The findings show that a third of companies are happy to admit they don’t give all analysts equal attention. The results may be tempered by the fact that many companies would like to treat all analysts the same, even if the number of followers makes that impossible.

As companies get larger, fewer respondents say they treat analysts equally. That’s unsurprising given that larger companies have more followers and hence a trickier time getting back to all requests. Survey respondents’ comments indicate the varied reasons IR professionals may not treat all analysts the same. Here is a selection:

‘They have a bigger clientele base and they are cleverer and provide better-quality insight (good or bad). We want high-caliber professionals having the most access’ – US, mega-cap, industrials

‘Because they are interested in us, not just mailing it in. I don’t care about the rating, only the interest level’ – US, small cap, technology

‘The ones we don’t spend much time on don’t seem to want to talk with us on a regular basis’ – US, mid-cap, consumer

‘Priority is given to those who are more supportive of the stock’ – Singapore, mid-cap, financials

‘We give less time to the analysts who take a non-constructive view’ – Russia, mega-cap, materials

‘Highly ranked/respected/well read by the buy side gets more of our attention. Analysts who don’t call us or who don’t write on us regularly get less attention’ – Canada, mega-cap, financials

‘We do [spend equal time] when it comes to answering questions, but when it comes to non-deal roadshows, it’s a different story’ – Canada, large cap, financials

For these and other findings, please see IR Magazine’s new report, How to manage your sell-side coverage, which is available to Professional subscribers. Please click here for more information on how to access the report.