A first look at the findings from IR magazine's survey of more than 700 investors and analysts covering US companies

The US is now a far less predictable place, what with market volatility, lingering domestic debt issues and the eurozone crisis across the Atlantic all prompting investors to run for the hills.

Yet the majority of IR teams in the US have stayed the course – or at least stayed behind.

That is the finding of a recent poll of 130 investors and analysts, selected from the 700-plus who took part in the research underpinning IR magazine’s annual US IR awards, to be held this year in New York on March 22.

‘IR is the same as ever,’ points out one sell-side respondent. ‘It is the business environment that has changed.’

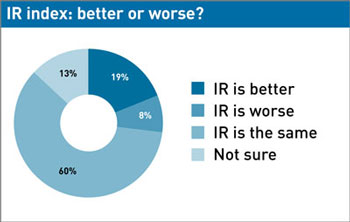

Echoing this view, the majority of respondents (60 percent) say there has been no discernible change in the quality of corporate IR over the last 12 months (see IR index: better or worse?, below).

The main change, according to some investors, is simply the value they place on IR. In these uncertain times, the qualities good IR teams demonstrated before the turmoil – like responsiveness and accessibility – are now more important than ever, making IR more in demand than previously. More ‘attractive’ even, in the words of one respondent from the buy side.

In reaching this collective viewpoint, there is no noticeable difference of opinion between the investors and analysts making up the sample. ‘When the market is inundated with panic, IR is the first port of call,’ declares one buy-sider.

‘IR has become a more valuable commodity in the turmoil, but the quality hasn’t changed,’ agrees a sell-side respondent.

Implied problems

This IR stasis is not a wholly positive indicator, however. For one thing, it implies that many investor relations departments have not changed or improved their communications in response to the altered economic landscape.

Fewer than two in 10 investors and analysts (19 percent) think IR has shown improvement in the last year, although this is more than double the number of respondents (8 percent) who think IR has regressed.

‘Some companies are consistently good, others consistently poor!’ explains a buy-side respondent, expressing a view that is repeated by a peer almost word for word: ‘Some have been good and others poor, but largely they’re the same as they were before things became volatile.’

Respondents expressing the view that IR has either improved or deteriorated were then asked whether any company had either exceeded – or failed to live up to – their expectations. Most say their expectations have neither been exceeded nor disappointed.

As one particularly difficult-to-please buy-side respondent puts it, ‘I would say IR is better at the moment because all of my companies are being more responsive. This is what I would expect, so my expectations have neither been exceeded nor undershot.’

Nonetheless, a few respondents do cite specific examples of companies that have exceeded their expectations, such as Dice, AOL and Family Dollar.

Just one disgruntled respondent on the sell side gives a specific example of expectations not being met (which we have diplomatically redacted): ‘It totally depends on the IR team. The companies I’ve mentioned have all been brilliant but ****, for instance, has been useless. In four years on equities I have never dealt with a team that has so little knowledge of the operations of the company or cares so little about response time – and that’s if it responds at all. If anyone nominates ****, challenge him or her as to why!’

Movers and shakers

Investors and analysts were also asked a number of other pertinent questions alongside their views on the current state of US investor relations, including the importance of accessing senior management prior to buying stock or instigating coverage.

The full results of the research will be published in IR magazine’s Investor Perception Study, US 2012.

The new-look perception study will launch the inaugural US Top 100, IR magazine’s official list of the best investor relations programs in the US.

The rankings are based upon the points scored by each company mentioned in the research for the IR awards and they formalize the data IR magazine has been collating and publishing for many years.

It may be true that the general investor opinion of IR has not really changed during the last 12 months, as indicated above. All the same, the US Top 100 is showing some of the same unpredictability that is now commonplace in today’s unsettled stock markets.

As a simple indicator of this upheaval, less than half of the companies from last year’s Top 100 feature again this year.

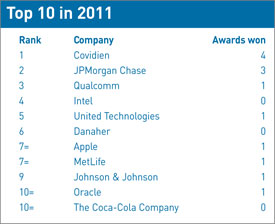

What’s more, almost two in three companies in the 2012 US Top 100 have moved up the rankings; more than a dozen companies in the Top 100 were unranked last year, led by the highest new entry at number 14; and there are three new entrants in the top 10, which was headed in 2011 by healthcare products company Covidien (see Top 10 in 2011, below).

The highest climber in 2012 has moved up nearly 400 places!

About IR InsightIR Insight is the research arm of IR magazine, the leading voice in global investor relations. We regularly engage with both the IR and investment communities through extensive studies, surveys and detailed interviews with corporate IR professionals, investors and analysts.Our research publications include in-depth investor perception studies, which we produce in conjunction with IR magazine’s highly regarded annual awards in the US, Canada, Europe, Asia and Brazil. Each year, in each of these markets, we ask thousands of buy-side analysts, sell-side analysts and portfolio managers the same question: which company has the best IR? The reports we produce uncover and explain the reasons for successful investor relations as well as the key drivers of investor sentiment. The results of our latest survey of the Canadian investment community provide us with an unrivaled perspective on the latest IR trends and industry best practices. To generate customized reports on your global peer group, please visit www.irmagazine.com/research. To order a copy of the Investor Perception Study, US 2012 or to become a professional subscriber to IR Magazine, please call Constance Blackman at +1 212 430 6855 or email constance.blackman@thecrossbordergroup.com.  |