Despite taxes, packaging bans and the growth of ethical investment, tobacco companies remain a big attraction for investors

In March, Japan Tobacco International (JTI) launched itself upon a waiting market with a secondary offering that, in effect, privatized it. Owning renowned brands like Winston, Camel and Benson & Hedges, the $60 bn company joined Philip Morris International (PMI), British American Tobacco (BAT) and Imperial Tobacco as worldwide cash cows for the canny investor.

Despite their current streams of cash, however, the tobacco companies still face some problems. Alex Williams, PMI’s director of investor relations and financial communications, identifies ‘potentially disruptive, outsized excise tax increases’ as a major, but manageable, concern. Meanwhile, governments continue to find other ways to regulate against the industry, such as Australia’s plain-packaging laws. In response, PMI is suing the Australian government over loss of brand equity. There is also the growing focus of investors on ESG issues, although IROs in the sector seem relaxed about ethical investor pressure. ‘Ethical investors make a very basic choice: either they see us as tobacco and want nothing to do with us, or they see us as tobacco but like the financial returns,’ explains Nick Rolli, vice president of IR and financial communications at PMI.

There is also the growing focus of investors on ESG issues, although IROs in the sector seem relaxed about ethical investor pressure. ‘Ethical investors make a very basic choice: either they see us as tobacco and want nothing to do with us, or they see us as tobacco but like the financial returns,’ explains Nick Rolli, vice president of IR and financial communications at PMI.

‘There is a small subcategory, which has concerns yet wants to be in the stock, but also likes to talk about our next-generation products and our agricultural labor practices, because we’re making significant progress in these, and other, areas.’

Erik Bloomquist, consumer staples analyst at Berenberg Bank, says the impressive financial performance of tobacco companies puts some less-committed ethical investors in a quandary. ‘Of course, generally, socially responsible investors are not going to come tobacco’s way, but some of them are trying to fit it in because of the great returns,’ he says.

In fact, far from ethical qualms, Bloomquist has found many investors have two far more pragmatic issues in mind: ‘One is litigation in the US, but that’s been largely moderated and is under control, although it has not gone away. The second concern is whether tobacco firms can consistently grow revenues given the secular decline in mature markets.’

But Bloomquist says investors have become ‘more comfortable with companies’ ability to offset the decline with moderate price increases, along with a steady shift toward emerging markets where the population is growing, smoking is relatively stable and there’s [scope for] up-trading as consumers move up-market.’

Growing business

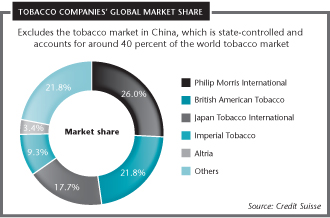

Global consumption of tobacco products continues to rise, albeit slowly, with declining demand in developed markets compensated for by growth in low and middle-income countries. The main driver of growth has been China, where the industry is state-controlled; the communist country is the world’s largest market for tobacco products, accounting for around 40 percent of all smokers.

PMI estimates that, between 2012 and 2015, the international market (excluding China and the US) will range from stable to down 1.3 percent. With China included, however, growth is estimated at 1.5 percent-2.5 percent.

Excluding China, the industry is heavily consolidated with JTI, BAT, PMI and Imperial accounting for three quarters of the market, according to a 2011 report from Credit Suisse, a fact that has helped tobacco players deal with the problems coming their way.

‘Consolidation in the industry has led to a lot more rationality, fewer price wars and reduced competition, as well as a more consolidated approach to regulatory issues,’ explains Grant Edmunds, Imperial Tobacco’s investor relations manager.

Investors usually own a couple of companies in the sector, says Bloomquist. ‘We have a buy on most because the dynamics are really favorable and the structural drivers of the industry are mostly intact, [the firms] focus on shareholders and the behavior of the players is largely rational.

‘We point out to investors that it is a bit like buying a bond, but you are diversified globally, and you have a built-in inflation adjustor because the companies can adjust for price. So you’re growing your investment above inflation at least and, along with the dividends, you have the potential for further growth in capital appreciation, too.’

Tobacco companies have mitigated the PR damage from their products by being, to one degree or another, much more forthright now about the harm traditional cigarettes can cause, notes Bloomquist.

Indeed, even the Chinese, for whose government tobacco has always been a major revenue source, have now begun to take seriously the potential costs of untold millions of gasping seniors. Notably, the IR website of Swedish Match, the global pioneers of snus, the oral snuff product, not only extols its health benefits but also does so in Chinese.

Smoking substitutes

Stockholders, influenced by the media and consumer buzz, are now asking about snus and e-cigarettes at investor meetings, and Bloomquist reports that all the major companies are investigating it to one degree or another. ‘In our view PMI and BAT are farthest ahead,’ he says. ‘JTI says it is quite close while Imperial is taking a wait-and-see approach given that the regulatory environment for these products is not yet clear.’

PMI is indeed in the white heat of non-combustible development, and its three-man IR team is eager to share the news with investors. ‘We are beginning to communicate about these significantly less harmful products,’ says Rolli. ‘We have three platforms of next-generation products, one of which we think will be ready to commercialize in 2016 or 2017. We have eight full clinical trials scheduled over the next year, and capital expenditure of €500 mn-€600 mn ($654 mn-$785 mn) over three years to build one, possibly two, next-generation factories in Europe.’

Edmunds confirms Imperial’s wait-and-see policy with regard to next-generation products, but it appears to have seen enough to cut the wait a little.

‘We came out of our investor day with renewed interest,’ he says. ‘Because of pricing and excise increases, consumers are interested in both the health and financial grounds for e-cigarettes. We have, however, a slightly different approach from some of our competitors, which have put real targets on what they are going to do, spending hundreds of millions. We have not done that; we want to explore what our consumers want.’

Imperial does not plan to launch any new products until it is certain the regulatory situation is sorted out, adds Edmunds. He has a message, however, for investors who worry the company might miss the boat.

‘We have a financial interest in an e-cigarette business, and we’re developing products in-house, so we will be ready,’ he contends. ‘We have the distribution already and we will have the manufacturing capacity. Some of the players, which presently operate in an unregulated environment, will disappear and it will be the bigger players like us that will be able to go to market.’

Global spread

While all the global tobacco giants have worldwide reach, PMI’s is the most widespread. All of them also have a global stockholder base. JTI has already inherited several other non-Japanese firms along with their shareholders, while both Imperial and BAT’s global businesses were to some extent too big for their native British investors.

Edmunds points out that more than one third of Imperial’s stock trades as ADRs in the US, in addition to US investors holding through London, so the management and IR team are frequent trans-Atlantic travelers. ‘We certainly want to expand our shareholder base: we’re trying to attract more from Europe, and we have begun to travel more often in Asia,’ he adds. ‘A lot of the Asian houses have people in London whom we meet.’

This calls for different approaches to IR. In any country investors like cash, but they don’t all like being paid in the same way. ‘Investors have cottoned on that tobacco is a very successful business model with low capital expenditure, consistent cash flows and strong pricing such that the industry can continue to deliver strong returns to investors – even during periods when actual volume is decreasing,’ says Edmunds.

But he notes that while UK investors in many income funds prefer dividends, US holders like buybacks. ‘In the end it’s our decision, of course,’ he says. ‘But we prefer to consult shareholders on how they want to benefit and so, because there’s a demand from a big shareholder bloc, we do buybacks and pay down debt as well as pay dividends.’

PMI also has a dual focus on dividends and buybacks. ‘The big selling point for tobacco is the cash return,’ says Rolli. ‘We have a 65 percent dividend payout target and we’re buying back our shares, $18 bn of them over three years.’

Shareholder diversity

When PMI split from its overwhelmingly US-based parent Altria five years ago, the company adopted a target of 15 percent non-US shareholders to achieve some level of geographic diversification. At the time, 6 percent were outside the US. ‘We have fallen a little short of our target,’ Rolli concedes. ‘But we have more than doubled our foreign ownership since the spin-off, to 13 percent.’

‘At the time of the spin-off in March 2008, the majority of our shareholders were in the US,’ adds Williams. ‘Given the sheer size of the remaining number of shares outstanding – roughly 1.6 bn despite us having repurchased almost 500 mn since then – it’s a challenge to move the needle.’

Along with senior management, Rolli and his IR colleagues have been on the road constantly in their effort to reach out to foreign investors. The process has also involved recruiting sell-side attention. ‘We’ve doubled our sell-side coverage since March 2008; we have 17 analysts, six based in the UK and one in South Africa,’ Rolli points out.

In the future possibilities department, some investors are wondering whether companies are ready to take advantage of marijuana legalization in some parts of the US, but Bloomquist discounts the possibility.

‘Some investors bring it up, but I don’t think any of the companies are interested,’ he says. ‘It’s a combustible product, whose users draw smoke into their lungs – and hold it for quite some time. I would be very surprised if the companies were prepared to risk the liabilities of commercialization, for a combination of financial and reputational reasons.’And, of course, they seem to be quite capable of creating massive shareholder value without it.