A first look at the research behind the upcoming IR Magazine Europe Awards

With the eurozone crisis rumbling on, pausing briefly for breathers like the French presidential election, IR Insight has spent the last year tracking the significance of the macroeconomic situation to the discussion between investors and European IROs.

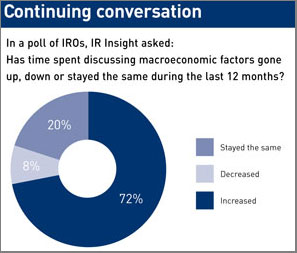

As of Q2 2012, nearly three quarters of IROs (72 percent) say such discussions have increased over the last 12 months, and 88 percent of respondents say the macroeconomic conversation tends to be brought up by the buy side. Meanwhile, almost two in five (38 percent) IROs have discussed the end of the euro with investors.

This two-part survey of IR professionals was conducted in Q3 2011 and Q2 2012. The full results will be unveiled in IR magazine’s Investor Perception Study, Europe 2012, alongside the report of the investment community’s take on the topic.

Investor Perception Study, Europe 2012This comprehensive report on European IR will be published following the IR Magazine Europe Awards, to be held on June 26 at the Hilton on Park Lane in London. This year, 722 portfolio managers, buy-side analysts and sell-side analysts took part in the survey underpinning both the investor perception study and the awards.To reserve your copy, please contact Jonathan Cardle at jonathan.cardle@thecrossbordergroup.com or +44 20 7107 2566. |

To get the investors’ viewpoint, IR Insight commissioned Mary Maude Research to survey a select sample of European buy-side and sell-side analysts earlier this year.

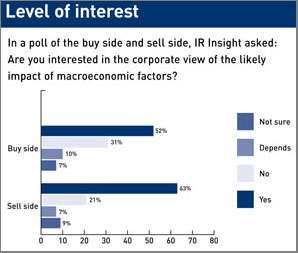

On balance, these respondents say the macroeconomic issue has gone up in importance. Interestingly, though, only half of the buy-side analysts (52 percent) are open to hearing the corporate view of the likely impact of macroeconomic factors.

This contrasts with the near nine in 10 IROs (mentioned above) who say the subject is brought up more often by investors than by IR or the sell side. When asked, the sell side shows more interest in the corporate view than the buy side (see Level of interest).

Buy-side and sell-side analysts were asked specifically whether European companies could give valuable insight to investors by providing commentary and up-to-date analysis on how their companies deal with the difficulties macroeconomic factors present.

Many of the buy-side respondents who have little interest in the corporate view of macroeconomics see the topic as outside of the IR purview – not to mention outside of IR’s skill set – and subsequently a poor use of company time.

Respondents from the investment community in Sweden and Switzerland are particularly disapproving. ‘They should continue to run their businesses, as they are no better than the economists at forecasting,’ says one Swiss buy-sider.

‘They shouldn’t do this as it’s not very convincing and they can look incompetent,’ says another. The viewpoint is similar in Sweden, where a sell-side respondent says, ‘Although it’s interesting to hear, history shows they usually don’t have a clue!’

But not all of the feedback was so negative. ‘No harm in them giving a view – many already do,’ explains a buy-side respondent from the UK. ‘Even though companies can’t predict more accurately than the rest of us, I am interested in their views,’ adds a sell-sider from the Netherlands.

Regardless of their viewpoint, however, both buy-side and sell-side respondents point out that many companies are already providing this information – with varying degrees of usefulness.

European IR elite

Last year, IR magazine unveiled the Euro Top 100 – the definitive corporate ranking of the best IR practices in Europe. BASF, the German chemicals giant, was number one in the rankings, as well as the recipient of the most awards at the 2011 IR awards event.

This year, the early indications are that there is some change afoot – including at the top. Most notably, four of the top 10 companies in 2012 did not feature in the top 10 last year; and three of those have jumped up the rankings from outside the top 50. One of them has improved by an impressive 75 places, year on year.

The big story in 2012, in terms of where the top companies come from, is that five German companies have dropped out of the top 100 rankings, leaving the eurozone powerhouse with 17 companies overall.

By contrast, there are more companies this year from France, Italy, Norway, Switzerland, Belgium, Spain and the UK – the latter having the biggest showing in the top 100 with 24 companies in total. This year, the Czech Republic has its first company in the top 100.

About IR InsightIR Insight is the research arm of IR magazine, the leading voice in global investor relations. We regularly engage with both the IR and investment communities through extensive studies, surveys and detailed interviews with corporate IR professionals, investors and analysts.Our research publications include in-depth investor perception studies, which we produce in conjunction with IR magazine’s highly regarded annual awards in the US, Canada, Europe, Asia and Brazil. Each year, in each of these markets, we ask thousands of buy-side analysts, sell-side analysts and portfolio managers the same question: which company has the best IR? The reports we produce uncover and explain the reasons for successful investor relations as well as the key drivers of investor sentiment. The results of our latest survey of the Canadian investment community provide us with an unrivaled perspective on the latest IR trends and industry best practices. To generate customized reports on your global peer group, please visit www.irmagazine.com/research. To order a copy of the Investor Perception Study, Canada 2012 or to become a professional subscriber to IR Magazine, please call Constance Blackman at +1 212 430 6855 or email constance.blackman@thecrossbordergroup.com.  |