IR Magazine Global Practice Report 2012 shows rise in outsourcing along with shrinking of headcounts

An increasing number of IROs are looking for outside help from consultants and agencies, with global IR departments spending an extra $26,000 in 2012, the addition of which brings the total outsourcing spend to almost a third of the average IR budget.

The IR Magazine Global Practice Report 2012 not only shows a rise in outsourcing but also a simultaneous shrinking of headcounts, with a ‘half-person’ drop bringing numbers down to an average IR team size of 3.2 people.

So are IROs simply looking to supplement resources by outsourcing a portion of their program? What are the best practices when it comes to handing over any part of such an important relationship? One thing that’s clearly sacred is contact with investors and analysts.

Tom Ryan, a former sell-side analyst and co-founder of financial communications firm ICR, whose company provides external support to 350 public companies in the US and China, says that while a firm like his brings many benefits, ‘we don’t replace management’.

Of the firms on ICR’s books, around 25 are Chinese companies that Ryan’s consultants represent in the US. In fact, it’s North America that leads the big outsourcing push, with IROs there increasing spending by an impressive $36,000 – taking the total up to 34 percent of the average IR budget, from 25 percent in 2011.

In real terms, this brings external spending up from an average $163,000 in 2011 to almost $200,000 in 2012. European IROs also upped their spending, with a less dramatic $12,000 hike to $168,000 or 30 percent of the 2012 budget.

While Ryan explains that the degree to which a firm outsources any aspect of its IR program often depends on its market cap, the IR Magazine Global Practice Report 2012 shows that some areas are largely kept in-house no matter what the company’s size.

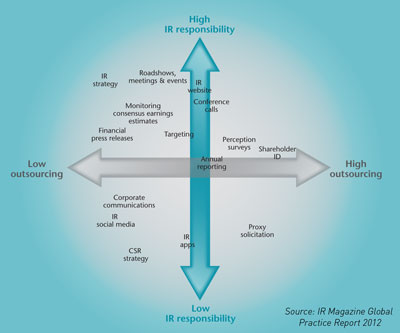

Outsourcing and responsibility

Click to enlarge

One example is IR strategy. As might be expected, this falls under the primary responsibility of the majority (88 percent) of investor relations departments, yet only 8 percent choose to outsource this key task. While a smaller 25 percent of IR departments are responsible for proxy solicitation, when this time-consuming task falls under their remit, 58 percent choose to engage an outside firm to deal with it.

It’s unsurprising that investor relations departments choose to keep their strategy in-house. The same goes for financial press releases, which fall under the responsibility of 71 percent of IR departments, with only 12 percent choosing to outsource.

Social media, which IR has been somewhat slow to embrace, are the primary responsibility of only 30 percent of IR departments – possibly because many departments simply don’t use Facebook, Twitter, YouTube or LinkedIn. But where an IR department does have responsibility for this task, it is loath to give it up to outsiders, with only 11 percent choosing to do so.

The SEC’s December announcement that it is considering civil action against Netflix highlights the impact a seemingly innocuous Facebook post can have. Whether or not IR professionals deem social media useful to the investment community at this stage, they remain something IR departments want to keep a tight handle on – following the trend of keeping contact with investors and analysts strictly in-house.

Fresh set of eyes

This relationship between an internal IRO and investors is ‘critical’ agrees Ryan but, without seeking to replace it, there is still a lot a consultant or external supplier can offer, he suggests.

He says ‘given the volatility of the world’s capital markets at this time’, IROs are increasingly opening up to the benefits a little outsourcing can bring. ‘Sometimes you have less of a need,’ Ryan explains. ‘But when you’ve got news hitting every day and all kinds of macroeconomic problems, getting your story out and telling it the right way is even more critical.’

In addition to the ‘arms and legs and some administrative support’, Ryan says a firm like his offers a cost-effective alternative to hiring a new IRO – as well as being able to present another point of view. ‘Internally, both management and IROs can be very focused on their own company, their own industry,’ he explains.

‘In a typical week I’m handling three completely unrelated but interesting issues on either corporate governance or dealing with activist shareholders or crisis situations. We can be another set of eyes in a process.’

It’s this ‘extra set of eyes’ that Margo Happer, senior vice president of investor relations at hotels group Wyndham Worldwide, values so much. She sums up her view of IR outsourcing as an ‘ongoing think tank’ and uses consultants to bring a fresh perspective rather than help with the tactical day-to-day nuts and bolts that Wyndham takes care of in-house.

‘I think where consultants can really add value is to bring something to the table I didn’t think of,’ she says. ‘Or to tell me that I’m off base or give me another point of view – I think that’s worth paying for.’

Wyndham, which operates more than 7,000 hotels worldwide and has been public since 2006, uses external IR firms for targeting, shareholder ID and special projects, among other things, with proxy solicitation coming under the corporate secretary’s office. Yet Happer maintains that some areas must be kept in-house.

‘The company is the face presented to investors and I feel very strongly about that,’ she explains. ‘I’d never, ever consider outsourcing day-to-day contact with the Street, on any level.’ Even during her time as a consultant ‘on the other side of the desk’, Happer says she always believed each organization had to deal directly with Wall Street.

These no-go areas remain much the same in Asia, even while the region bucks the global trend by cutting spending on external IR services by $19,000 in 2012. This cut takes the average outsourcing spend to $68,000, or 24 percent of the average budget, down from 26 percent the previous year.

This is despite the same falling headcounts seen in North America, with the average Asian IR function going from 4.3 people in 2011 to a team size of 3.8 in 2012.

Doing more with less

It should be noted that Asian IR professionals traditionally work with smaller budgets than their counterparts in North America and Europe. Jeannie Ong, head of corporate communications and investor relations at Singapore communications firm StarHub, says her department has always worked with a ‘lean’ budget.

This year, Asian IROs had an average of $285,000 to play with, far less than the $561,000 Europeans had to spend and the $585,000 in the hands of North Americans, with the money spent on outsourcing falling $100,000 below the external IR budget in Europe and more than $130,000 below US IR department budgets.

Despite the ‘lean budget’ and an IR department made up only of herself, one other IRO and an assistant, Ong says the StarHub IR team attends a steady 250-300 meetings a year. She keeps as much of the program in-house as possible, ‘as we strongly believe an in-house IR team will be able to do the job more effectively than any IR agency’, adding that the company always accepts requests for meetings and IR conferences as long as they don’t fall within the firm’s blackout period.

StarHub’s IR department does engage outside suppliers to deal with some support functions, such as share analysis and perception studies. But Ong says this has less to do with saving time or money, more to do with integrity.

‘We engage a third-party vendor to do perception studies for us,’ she says. ‘Not because it is time-consuming to do on our own but because it is more credible to get a professional external party to help us in this aspect.’ Like Happer, Ong adds that any part of the StarHub IR program that involves contact with the investment community is strictly off-limits to outsiders.

The IR team at Wyndham is made up of two rotating professionals and an assistant, and – excluding salaries – Happer estimates she currently spends around a quarter of her budget on outside agencies, although this fluctuates depending on any special projects the team is running.

She says that although she’s in a ‘lucky’ position at the moment and doesn’t have to worry about her department’s finances, the cost of external service providers would be her primary consideration if she ever saw her budget slashed. What’s more, despite the benefits they bring, IR consultants would be the first to go if Happer had to make cuts.

Value for money

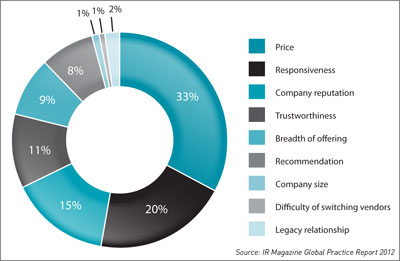

As things stand, it is added value rather than cost-cutting that makes outsourcing attractive to Happer – unlike the 33 percent of IROs who listed ‘price’ as their top priority when choosing to outsource, according to research for the IR Magazine Global Practice Report 2012. Although cost is no doubt important when looking to outsource even a portion of any IR program, Ryan says it’s not the only thing – or even the main thing – IROs should be looking at.

Top factors in selecting external service providers

‘With corporate budgets being stressed, rather than maybe hire another person in the IR department internally, some of that work could go to an agency,’ he says, adding that a company could get a senior consultant and an entire team for the price of a single, more junior IR professional.

But tackling outsourcing from a purely price perspective is ‘a big mistake’, Ryan continues. ‘If you want a strategic solution that can help lower the risk of reputational damage or maximize your valuation at any given time… you’ve got to make sure the person you’re hiring understands the capital markets, understands valuation and understands your industry.’

He accepts that price is certainly a factor, ‘but I think you also need people who are qualified to help – and if you don’t end up with that then the whole thing is a waste of time and money.’

Happer agrees. As well as assistance with share analysis and perception studies – which can benefit from a more candid response when conducted by an outside firm – Happer recognizes the wider advantages offered by agencies. She cites an investor day early on in Wyndham’s IR program as an example of where consultants can be beneficial, and worth the cost.

‘We missed a critical question,’ she explains, adding that although the consultant missed it too, mistakes are simply less likely with more hands on deck. ‘If you have something like that happen, and you lose a dollar or two on your share price, that’s easily $300 mn in market cap so the insurance premium is relatively light compared with the risk.’