More from IR magazine's recent survey of European fund managers and analysts

During the research carried out for the Investor Perception Study, Europe 2011, analysts and investors were asked for their views on access to management and reverse roadshows. On the whole, more than 90 percent of respondents say meeting management is important before they will buy or recommend a stock – but the buy side and the sell side hold very different views on just how important meeting management actually is.

The buy side tends to be more measured about the issue, with several respondents pointing out that it is not always possible to meet with management. This can be either for geographical reasons or because the management team has insufficient time to meet every potential analyst or investor. In those circumstances, a few respondents say a phone call to the CFO would suffice. Some are even happy to forgo management access altogether and rely entirely on the sell side.

By contrast, the great majority of respondents on the sell side consider it to be extremely important to meet senior management before making a stock recommendation. They perceive an initial meeting to be part of their due diligence; vital to their understanding of the company, and a valuable add-on to the marketability of their views.

This initial push to meet management, however, diminishes after the first meeting; thereafter, it is considered less vital to meet the C-suite on a regular basis. Nor is everyone on the sell side clamoring to meet management. As one weary German analyst puts it: ‘I would definitely recommend a stock without meeting management – looking at the numbers, talking to colleagues and speaking with IR departments is enough. It’s so hard to get to see senior management of major European companies.’

On the corporate side, the results of the Investor Perception Study, Europe 2011 and the related Euro Top 100 rankings throw up some conflicting evidence regarding the significance of allowing greater access to management. The contrasting approaches of Nestlé and Novo Nordisk serve as a good example. Nestlé tightly controls access to its top-tier management, whereas the chief financial officer of Novo Nordisk is a regular fixture on the conference circuit. Yet both companies rank highly in this year’s Euro Top 100: the Swiss food and drink company comes in at number two and the Danish diabetes drug manufacturer at number three. Each won multiple awards in 2011 and both featured in the European top 10 last year.

The respondents to this year’s investor perception study describe Novo Nordisk as ‘open’ and ‘shareholder-friendly’. Similarly, Nestlé is singled out for the strength of its website and its ‘perfect’ method of communication. This would suggest that access to management may be important for investors but it is by no means essential in order for a company to have a highly regarded investor relations practice.

Reverse roadshows

Analysts and investors were also asked about reverse roadshows, which, as the name suggests, are the opposite of a traditional roadshow. They involve a corporate broker taking several investors, potential investors and analysts to visit several companies, usually in the same sector, and typically over two to three days.

Reverse roadshows have obvious benefits for companies: they allow management teams to stay at home and meet a number of investors all at once. By the same token, this type of roadshow means investors and analysts must go out on the road themselves. The added time and traveling burden this involves makes the enthusiastic feedback from respondents all the more interesting.

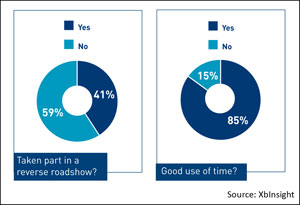

On balance, most investors and analysts have not taken part in a reverse roadshow. Those who have, however, overwhelmingly believe them to be a good use of their time. ‘I am going to one in Oslo tomorrow,’ comments one Finnish respondent from the buy side. ‘As well as meeting the companies, it is interesting to gain a greater understanding of what other investors are thinking about.’

In the view of one UK sell-sider: ‘Clients like reverse roadshows and the companies like them even more as they don’t have to go anywhere. I think they work really well with a chance for clients to see the assets and get face-to-face management time.’

Most say seeing several companies in quick succession is a useful way to compare and contrast. Visiting companies on site is also considered helpful for understanding the business and some investors say meeting other investors over a couple of days allows for a good exchange of ideas.

Respondents who are not convinced by reverse roadshows say their success or failure depends on the level of organization. Many point out that seeing three or four companies a day is the optimum number, and visiting any more than this is just not helpful. Others believe companies tend to be ‘on message’ and say there is insufficient time allowed to get specific answers to specific questions.

One German respondent from the buy side says the usefulness of reverse roadshows depends on the size of the company: ‘With smaller companies it can be advantageous but with the larger ones there’s little benefit for the trade-off in time.’

On the company side, reverse roadshows are seen as a useful addition to the existing suite of formats for meeting with the investment community. The benefits over the traditional roadshow range from the practical, like avoiding the traffic jams in London and New York, to the personal: it is reassuring for a company when a group of investors travels to its corporate headquarters to meet with management. A similar declaration of interest is often missing when companies visit less-enamored investors on the road.

Still, the corporate view is that reverse roadshows cannot replace the original version, not least because traditional roadshows often involve an element of exploration, where new investors are sought out alongside meetings with existing investors.

About XbInsight

XbInsight is IR magazine’s research brand, building on the publication’s established global research efforts. Since 1991, IR magazine has taken its renowned investor perception study around the world to markets as diverse as Brazil, China, Singapore, the Nordic region, South Africa, Canada, the UK and the US. In every market, the process is the same: each year thousands of buy-side analysts, sell-side analysts and portfolio managers are asked which companies have the best investor relations.

XbInsight is building on that expertise and launching a series of studies examining successful investor relations and the key drivers of investor sentiment.

It also provides:

-High-quality thought-leadership studies

-Benchmarking initiatives, including IR magazine’s online interactive benchmarking tool

-Global consolidated IR magazine research.

Specifically, the research division at XbInsight is looking to understand why some companies perform better than others in IR magazine’s investor perception studies. The first step in conducting this analysis is to gain a deeper understanding of the different IR practices at listed companies around the world.

This article appeared in the August print edition of IR magazine.