A sneak preview of the latest investor perception study of Canadian investors and analysts from IR Insight

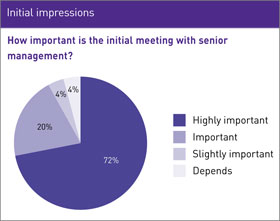

The overwhelming majority (92 percent) of Canadian investors and analysts consider an initial meeting with senior management to be highly important or important prior to buying into or initiating coverage of a stock, according to a survey commissioned by IR Insight, the research arm of IR magazine.

What’s more, the vast majority of respondents (72 percent) rank it as ‘highly important’ rather than just ‘important’, as shown below.

‘This is the only form of contact I have with companies now,’ is how one buy-sider puts it. A sell-side respondent says, ‘It is vital to talk to the CEO as you need to get a feel for the strategic direction.’

This unequivocal response comes from 100 investors and analysts, selected from the sample of 250 respondents who took part in the survey for the upcoming IR Magazine Canada Awards.

Regional comparison

Over the course of the last 12 months, IR Insight has put the same question to a similar constituency of investors and analysts in Europe and Asia, and in both cases the response has also swung definitively in favor of meeting with management: 84 percent and 75 percent, respectively, of respondents in those regions rate it as either highly important or important.

Beneath the top-level similarities, however, the differentiator in Canada is the level of importance the investment community puts on access to senior management. As previously mentioned, 72 percent in Canada consider it to be highly important, compared with 51 percent in Europe and only 42 percent in Asia.

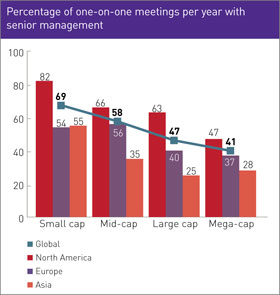

One explanation for this is the interconnectivity of expectation and reality. As demonstrated by the findings in IR Insight’s latest Global IR Practice Report, a comprehensive study drawing together the views of more than 1,200 IR professionals from all over the world, the average CEO or CFO in North America attends more one-on-one investor meetings than his or her peers in either Europe or Asia (see below).

In other words, Canada’s investment community can afford to place such a high emphasis on meeting with management because, in practice, investors there are granted a relatively high level of access to the C-suite.

The remoteness of senior management in Asia, on the other hand, has meant investors and analysts in the region have become well practiced at doing their jobs without relying on direct access to the CEO or CFO.

The small minority (4 percent) of respondents in Canada who say meeting with management depends on the company tend to have difficulty accessing management at large-cap companies and thus have to settle for IR-only meetings as a result.

Second tier

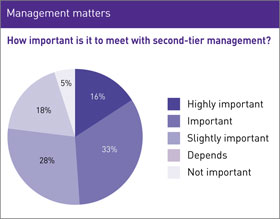

The same sample of Canadian investors and analysts were also asked about the importance of meeting with the next tier of management below the CEO or CFO. Here, the response is more balanced.

The majority view coalesces around the middle ground, as can be seen in Management matters (below). Almost two thirds of respondents (61 percent) think meeting with second-tier management is either important or slightly important.

Only 16 percent of respondents consider it to be highly important, with a similar number (18 percent) saying it depends on factors such as the complexity of the company or the sector. ‘I would never recommend without seeing the strategist,’ declares one decisive sell-sider.

Approaching it from the opposite side, a buy-side respondent says, ‘It’s nice to have some kind of access to divisional managers, but we would buy the stock anyway if we liked the story.’

The Canadian investment community was also asked whether it prefers broker-organized meetings to those organized by the company, as well as whether or not it would like to see a national SEC-style regulator in Canada rather than the existing provincial arrangements.

The full results of the research will be available in the Investor Perception Study, Canada 2012, which will be published immediately after the IR Magazine Canada Awards in Toronto on February 1, 2012.

The Investor Perception Study, Canada 2012 is now available for pre-order. Click here and save 25 percent!

About IR InsightIR Insight is the research arm of IR magazine, the leading voice in global investor relations. We regularly engage with both the IR and investment communities through extensive studies, surveys and detailed interviews with corporate IR professionals, investors and analysts.Our research publications include in-depth investor perception studies, which we produce in conjunction with IR magazine’s highly regarded annual awards in the US, Canada, Europe, Asia and Brazil. Each year, in each of these markets, we ask thousands of buy-side analysts, sell-side analysts and portfolio managers the same question: which company has the best IR? The reports we produce uncover and explain the reasons for successful investor relations as well as the key drivers of investor sentiment. The results of our latest survey of the Canadian investment community provide us with an unrivaled perspective on the latest IR trends and industry best practices. To generate customized reports on your global peer group, please visit www.irmagazine.com/research. To order a copy of the Investor Perception Study, Canada 2012 or to become a professional subscriber to IR Magazine, please call Constance Blackman at +1 212 430 6855 or email constance.blackman@thecrossbordergroup.com.  |