James Chambers finds out what investors think about IR throughout the region

IROs in Asia should give themselves a pat on the back, if only lightly and certainly with only one hand.

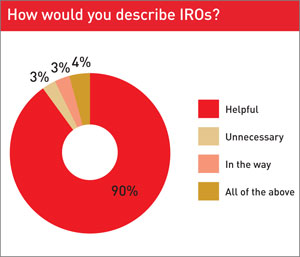

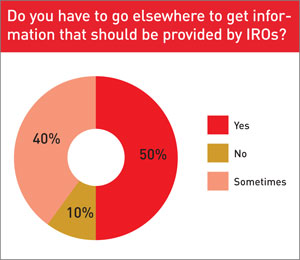

An impressive 90 percent of investors and analysts in Asia believe IROs play a helpful role – yet this positive perception comes despite an equal 90 percent of these respondents also saying they sometimes have to go elsewhere for information that should be provided to them by an IRO.

‘IROs try to be helpful and they always have plenty to say when making money,’ observes one Singapore sell-side analyst in a thinly disguised backhanded compliment.

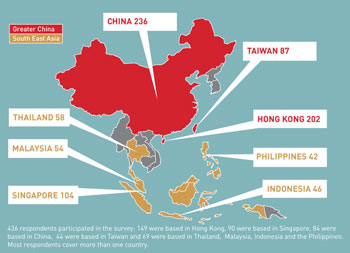

This mixed view of investor relations in Asia comes from a recent survey of 100 members of the Asian investment community commissioned by IR Magazine and carried out by Mary Maude Research.

Our test of investor sentiment takes place each year alongside the research for the annual IR Magazine Awards for Greater China and South East Asia, which this year are being held in December in Hong Kong and Singapore, respectively.

Usefulness of IR

In a repeat of investor sentiment last year, the top complaint about Asian IR in 2012 is lack of transparency and disclosure. ‘Not enough transparency in financials, lack of detail of operations and we need more guidance,’ says a Singapore buy-sider.

There is also a prevailing view among investors and analysts that IR professionals are poorly informed and that the information they provide to the market is too often promotional.

Thus, in many cases, the usefulness of an IR department largely depends on its ability to act as a conduit to management. Only then can investors and analysts elicit a ‘deeper understanding’ of a company’s thought processes, notes a Filipino head of research.

Such investor grumbling is rarely aimed directly at Asian IROs, however. In fact, the Asian investment community is broadly complimentary about IROs’ efforts to be helpful, as the first of the 90 percent statistics above shows. ‘They are usually helpful, or at least try to be,’ says a sell-side analyst from Hong Kong.

To a large extent, this is because investors and analysts recognize the limitations of IR in Asia: IROs are not given the information they need – or at least, not allowed to disclose the information they have.

One effect of this is the frustrating, sometimes even comical lengths to which IROs have to go just to avoid answering a straightforward investor question.

Buy-siders and sell-siders from Taiwan, China, Hong Kong and Singapore have all heard an array of excuses from slippery IROs, ranging from the information being competitor-sensitive to the IRO simply not having it to hand.

The prize for the top excuse, though, has to go to the IRO who ducked an investor enquiry with the response: ‘That question is too detailed.’

The result of all this IRO ducking and diving is that investors and analysts routinely have to conduct their own checks, talking to other analysts, companies and even third-party consultants.

Evidently, senior management in Asia should take note of the importance of employing a capable IR professional who is kept in the loop.

The potential consequences of failing to do so can be severe, as a buy-side analyst from Hong Kong makes abundantly clear: ‘Some IROs are helpful but it only takes one badly informed IRO to affect your perception of the whole company.’

As for where IR professionals can improve their own offering, multiple respondents would like to receive more information on peer-group companies and the industry as a whole – a forlorn hope, perhaps, when the information an IRO can provide about his or her own company is routinely viewed by the investment community as being of limited use.

Usefulness of technology

The research discussed above will be published in full in the upcoming IR Magazine Investor Perception Study, Asia 2012/2013.

This year the research also looks at how investors use technology and how they would like to see IR departments employ resources like Twitter, webcasts, apps and video conferencing.

This is intended to coincide with the introduction of a new award in Asia for 2012: best use of technology for investor relations.

IR Magazine already hands out the best use of technology for IR award in Europe, the US and Canada, and it is now being launched in Asia in recognition of the progress some Asian companies have made in harnessing technology for IR, and to encourage future innovation.