Warren Buffet once said: ‘If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.’ But the rapid growth of investment firms over the last 60 years has resulted in a steep decline in equity hold periods and shareholder loyalty. According to NYSE data, between 1960 and 1980, the average holding period of public company stocks ranged from about three years to five years. By 1990, the period had fallen to about two years, and by the mid-2000s it was less than a year. The average holding period today for individual stocks across all US markets is about 17 weeks.

This secular shift toward short-term gains has incentivized issuers to narrow their focus to their largest institutional investors but this strategy is being challenged by the millions of new retail investors that have entered the stock market since 2020 through commission-free mobile apps. According to a public.com survey, 91 percent of retail investors say they’re more inclined to invest in companies they personally use, while Charles Schwab found that 72 percent of retail investors who joined the stock market in 2020 or later buy to hold for long-term gain. This new and rapidly growing demographic of retail investors has the potential to reintroduce long-termism back to our financial markets.

Tenure shareholder rewards

Historically, ‘one share, one vote’ has been the pervading system of corporate governance, but numerous European countries have adopted ‘double voting rights’ based on hold periods starting as early as the 19th century to reward loyal shareholders. In 2014, the French government reinforced tenure voting rights with a new statute, commonly referred to as Loi Florange, where all shares may potentially increase voting rights after a period of at least two years of uninterrupted ownership unless two thirds of the company’s stockholders vote to opt out. According to the New York Times at the time: ‘The ostensible purpose of these changes, particularly the new voting rules, is to foster ‘long-termism’ – rewarding French shareholders for holding shares for the long term and committing to the company.’

Corporate law researchers David Berger, Steven Solomon and Aaron Benjamin published a paper in 2016 that identified just 12 US companies in the last 30+ years that have implemented tenure voting plans, in part due to the 1980s SEC Rule 19c-4 that prevented companies from adopting dual classes of stock. After the rule was struck down by a DC Circuit court in 1990, exchanges implemented similar initiatives but explicitly noted that their voting policies were ‘more flexible’ than Rule 19c-4, and further recognized the need for ‘additional flexibility in light of the reality that both capital markets and the needs of companies change over time.’

While it is difficult to prove a direct correlation today due to the small sample size of US companies adopting tenure rewards, it should be noted that an investment in 1980 in an index of the 12 tenure voting companies (including Aflac, Carlisle Companies and JM Smucker Company) would in 2013 have been worth six times an identical investment in the S&P 500.

Consumer shareholder rewards

Consumer shareholder rewards have been historically utilized by some of the world’s most popular brands, including now sunset programs from Disney (personalized stock certificates), McDonald’s (free Big Mac coupon with annual report) and Starbucks (free coffee coupon with annual shareholder report, ended in 2019). Other companies have implemented successful consumer programs that increased brand loyalty with measurable results.

Carnival Cruises developed one of the most successful US consumer shareholder rewards programs since launching in the 1990s. Shareholders holding a minimum of 100 shares (around $850) are entitled to up to $250 in onboard credit per year. Other cruise operators such as Royal Caribbean and Norwegian have followed suit with similar programs to compete for customer loyalty.

AMC Investor Connect launched following a 2021 meme stock rally and thousands of retail investors have joined to qualify for a free bucket of popcorn. Berkshire Hathaway shareholders holding just one share of $BRK.B qualify for an 8 percent discount on GEICO auto insurance.

LVMH Shareholders’ Club offers unique benefits and rewards across the French conglomerate, including special access to Hennessy’s centuries-old cellars and the crayères at Veuve Clicquot, as well as special offers on a selection of the group’s wines and spirits and discounted subscriptions to LVMH media publications.

Orix (Japan) and Japan Tobacco recently scrapped their immensely popular shareholder rewards programs ‘amid discontent from foreign investors’ who did not qualify for the benefits. Orix’s individual shareholders grew from about 50,000 at the end of March 2014, before the start of the benefit program, to around 820,000 by the end of March 2022 by offering investors in Japan holding 100 shares (around $1,600) access to gifts produced by the leasing firm’s clients around the country. Japan Tobacco provided food products such as frozen udon under its shareholder benefit program and, when the program began in 2004, only about 6 percent of outstanding shares were owned by individual investors. By the end of 2021, the figure had risen to more than 20 percent.

Stakeholder Labs is unlocking the potential of tenure and consumer shareholder rewards.

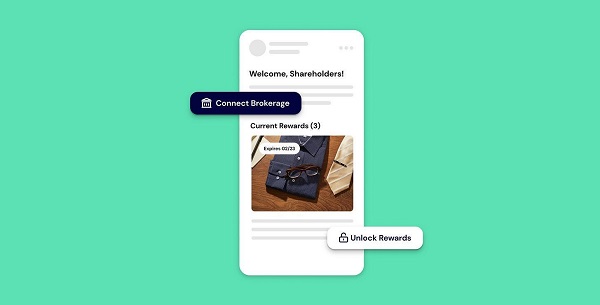

Roundtable integrates with an issuer’s web properties to offer digital shareholder verification and daily reports on beneficial ownership

In taking a closer look at the historical success of the shareholder rewards program, it’s evident that shareholder rewards can drive shareholder loyalty objectives but administrative costs associated with tracking the beneficial ownership of a company’s shares is the primary reason why there is not more adoption.

If shareholders want to verify their stock holdings with Carnival Cruises or LVMH, verification is handled manually via email or mail and this process has to be completed regularly to continue to qualify. In the case of AMC Investor Connect, the company used a self-verification process and any person could say he/she was a shareholder and receive a free bucket of popcorn. When Berger, Solomon and Benjamin examined the 12 tenure shareholder rewards adopters in the US, more than half dropped their programs due to the ‘impracticality of policing [tenure voting] because of difficulties in determining whether there has been a change of beneficial ownership.’

Marco Becht, Yuliya Kamisarenka and Anete Pajuste of the European Corporate Governance Institute concluded that French companies exploring a transition from their default ‘one share, one vote’ system to Loi Florange-era double voting rules ‘impose transaction costs without changing outcomes.’

Stakeholder Labs is using technology to reduce the administrative and transaction costs associated with shareholder rewards programs by allowing issuers to seamlessly integrate digital shareholder verification within their own web properties and manage shareholder communications within their current CRM system. Issuers can now have daily insight into their shareholders’ positions as well as a comprehensive consumer profile of the shareholder to increase personalization and overall brand loyalty. This technological unlock empowers issuers to introduce shareholder rewards programs efficiently and programmatically manage shareholder loyalty and engagement to support more long-term behavior.

This content is provided by Stakeholder Labs and did not involve IR Magazine journalists. For further information on Stakeholder Labs, please click here.

About Stakeholder Labs

Stakeholder Labs builds enterprise software to help companies measure and increase retail investor engagement. Its flagship product, Roundtable, enables companies to verify shareholders, measure their customer loyalty and offer unique shareholder rewards. To learn more about Stakeholder Labs, please visit stakeholderlabs.com.