Jonathan Monk, one of a two-person North American equity team at Aerion Fund Management, talks about how he chooses his investments, and what he looks for in IR

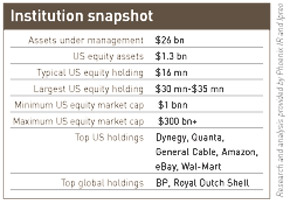

Aerion Fund Management is one of the UK’s largest in-house pension funds, as well as the principal investment manager of the National Grid UK Pension Scheme. It has $26 bn in total assets under management, $7 bn in equity assets and $1.3 bn in North American equities.

Jonathan Monk has been at Aerion since January 1995 and is one of a two-person North American equity team, along with colleague David Shaw. Before joining Aerion, he worked at ICI and insurance company London & Manchester.

What’s the main difference between working for an in-house pension fund and managing third-party money?

The big difference is the amount of time you spend on investments compared with the amount of time you spend with your clients or marketing. We’ve only got one client so we can spend all of our time actually investing money.

How is the US desk organized?

David and I take the big economic sectors and split them. Every year we swap a couple of sectors to keep things fresh. As there are only two of us, we work very closely together and bounce ideas off each other.

How do you measure your performance?

The S&P 500 is our benchmark.

What are your investment constraints?

Market cap. We have a self-imposed $1 bn restriction. In exceptional circumstances, we have held stocks below the $1 bn mark, but they have to have a very strong story. Our share and sector holdings also have to roughly mirror the respective weights in the S&P, plus or minus 2.5 percent. We’re long only, obviously.

How do you screen stocks?

We screen in three ways. Think of three circles: one of the circles is that we meet management and analysts for ideas; the second is that we use quant screens like HOLT [a valuation product from Credit Suisse]. The third circle involves looking for unloved and under-researched companies. Ideally, we’d like these circles to intersect.

Yum! Brands is a good example. During the summer of 2006, it was unpopular with investors following a number of health scares in China, but we met the company and felt it had interesting potential. It met our screening criteria, so we invested and it has since performed well.

Any sectors you won’t invest in?

No, but we try not to take too much risk in sectors where we don’t have an edge, and biotech is a good example. We do take quite big risks in energy or financials where we have quite a good insight into valuations, where HOLT works well and we have a good track record.

How many holdings in the portfolio?

Approximately 80. The average position is around $16 mn. Our biggest holdings are $30 mn to $35 mn and we have quite a lot of $20 mn to $30 mn positions.

What is your turnover?

Our average turnover is 30 percent to 35 percent, or around every three years. We aim to hold a stock for at least one year and a lot of stocks we have held for a considerably longer period.

What constitutes your investment philosophy?

We want to own firms where the wealth creation potential is greater than the market expectations for that company. We deliberately try not to be value or growth-oriented because we want a consistent performance.

If you go down the value route, that’s great when value’s in favor, but when it’s out of favor, you can’t outperform. We are in between the two (value and growth), so there is nothing to stop us outperforming every year.

Which parts of the US market do you currently favor?

We are very much stock pickers. Most of our risk is in individual stocks, not sectors, for consistency’s sake. We like the infrastructure plays, especially electricity transmission firms, and companies that help build power stations and energy plants, such as cable manufacturers and engineering and construction companies.

We are also building up our weight in consumer discretionary names. They are an early-cycle group that has been underperforming for a number of years. For the first theme, we hold companies such as Dynegy, Quanta and General Cable. On the consumer discretionary side, we own Amazon, eBay and Wal-Mart Stores – all good long-term stories.

Is it important to meet management?

Yes, because it’s important to understand what you’re investing in. If you look back at the mistakes you’ve made, the number one reason is because you didn’t understand the company properly. Sometimes the Street doesn’t understand what’s happening and by meeting management you can get an edge.

People’s United Bank is one example. It was under-researched and, by meeting with the company, it became apparent to us that it was about to change its capital structure. This meant that valuation ratios were about to look considerably more attractive. That’s a good example of how meeting a company led to an investment.

How many US companies do you meet a year?

We do six trips between us a year, so we meet a lot of companies in the US – maybe as many as 180. We also meet a lot of companies at our offices in London, as well as attending external presentations, so in total we probably meet over 300 a year.

How has unbundling changed your relationships with the investment banks?

I’m a big fan of unbundling so we have embraced it and now pay for research and execution separately. Independent providers are the only people we don’t have to pay for access. But we don’t speak to that many brokers. A lot of it is about existing relationships – it’s quite nice to deal with people you trust and have known for a long time.

Which US companies are best at IR?

Energy companies are usually very good at investor relations, maybe because they are a bit smaller in terms of personnel and their IR people are quite often involved in corporate strategy as well – so they really know what they’re talking about. Technology companies are also quite good at IR.

Which firms are worst at IR?

Consumer companies. Very big companies often don’t have very good IR. An exception is GE, which has very good IR because it rotates the function. It treats the head of IR as importantly as heads of various divisions. I would also pick on large media companies as being poor at IR.

Who do you like to meet?

The CEO or CFO, but it depends on the company as some IR guys are very good. For example, Newfield Exploration has a very good IRO.

Any companies you don’t currently see that you’d like to?

It would be nice to see more basic materials companies. Consumer names in retail, food and apparel also don’t come to the UK as much as we would like. One we did see was Warnaco. We met management, liked the story and invested, and it has done very well for us.