Matthieu Rolin of Aviva Investors Paris talks sharing ideas globally, superior business models and acting on interest rate changes

How do you see Aviva Investors France positioned in the French investment management industry?

We are a top 10 asset manager in France in terms of assets under management. We invest in all asset classes: equities, fixed income, real estate, multiasset and some alternative investments. There are 35 people – portfolio managers and analysts – in the investment team, and we also share resources with other Aviva offices around the world. There are nine analysts in the US, eight in London, two in Singapore and one in Toronto in addition to the four analysts we have in Paris.

Does Aviva Investors in Paris confer with Aviva Investors in London?

Does Aviva Investors in Paris confer with Aviva Investors in London?

Absolutely. We share ideas, we share resources, we share the way we work. We talk every week. I go to London at least once a month to meet my colleagues and exchange ideas. Also, all equity teams in Paris are on the same floor so I share ideas with the European and Asian/Japanese guys, too.

Do Aviva Investors teams in different locations have common or differing investment styles?

Aviva Investors in Paris and London share the same investment philosophy. We are stock pickers. We act as long-term shareholders, not traders. We are a global asset manager.

Aviva Investors in France has around $12 bn in equities. How much of that is held in US equities?

We hold $1 bn in US equities. Paris invests in US equities, Eurozone equities and Asian equities.

Which screens do you use?

We have an ideas-generation process. We try to identify superior business models and follow longterm themes that will deliver superior investment returns over time. We also like to find out-offavor stocks or stocks that are not on the radar of the market, as we like to discover hidden value. Sometimes we do very basic screening but we are very fundamental investors so we prefer to concentrate on business models and valuation.

Do you have a target price when you buy a stock?

Yes, that’s part of our investment process. We focus on the business models, the long-term drivers of the company, barriers to entry, sector dynamics; we try to understand in depth what a company is doing and what it will look like in a few years’ time. Then we look at the valuation and do the financial analysis. Depending on the sector and the business, therefore, we use different metrics but we always have a target price for each investment realized.

What’s your market cap cut-off?

It’s generally less than $5 bn, for liquidity reasons. Currently, my smallest company has a market cap of $7 bn. The median market cap is $60 bn, so we mainly have a large-cap focus.

What is your average position, and what is your largest?

Our average is 2 percent ($20 mn). I try to run a fairly concentrated portfolio with around 60-80 stocks. Our largest position would be around 4 percent ($40 mn) if I have high conviction.

And your average turnover?

It’s pretty low, as we are long-term investors: around 30 percent-40 percent. We try to keep stocks for two or three years. I might trade around a position and benefit from short-term volatility to try to add a few basis points of alpha but such activity is very limited.

Which benchmarks do you use?

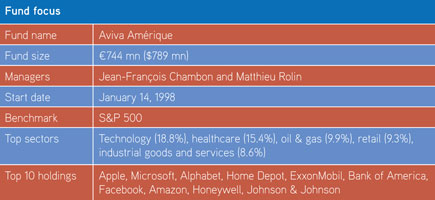

For Aviva Amérique, we use the S&P 500.

And what’s the active share ratio for that fund?

As of November 30, 2016, the active share ratio for Aviva Amérique was 26.5 percent.

Are there any sectors or themes you do or don’t favor?

A theme I currently favor is the steepening of the yield curve and the increase in both short-term and long-term interest rates in the US, so I like companies that will benefit from short-term rates due to large amounts of deposits. I also favor life insurance companies as they will also benefit. On the other hand, I have limited exposure to consumer staples companies because they have already benefited a lot from the fact that rates were very low and investors were hiding in them because of their low volatility of earnings and high dividends. That trend is now reversing as we’ve seen an increase in the 10-year interest rate in the US, so a lot of money flew out of consumer staples and into financial stocks.

Another theme that is very long term is mobility, the cloud and the technology revolution. Salesforce is a holding because it is a clear leader in cloud computing and solutions in cloud and is a leader in customer relationship management. I really like that type of business. E-commerce is another theme I like and Amazon has developed two businesses: the first is the marketplace, where it is a global leader and has developed a super infrastructure that has created extremely strong barriers to entry. The other is a surprise business (given that it was not part of Amazon’s original business model): Amazon Web Services. It is number one in public cloud computing globally and it has a tremendous growth rate.

What are your largest holdings?

Amazon is a large holding, as is Microsoft because it’s a clear leader in cloud and I like the transition it has made under the new CEO. Before it was just a software company stuck with the decline of PC sales but the new CEO has managed to turn the company into one of the leading players in cloud tech. Another large position is Bank of America. As mentioned before, I favor financials because of what is going on with interest rates. Bank of America is making strong efforts to cut costs and improve its cost-income ratio.

Is corporate governance important?

Yes, it is part of what we look at. ESG criteria are part of our investment process.

Do you have to meet management before you buy a stock?

I try to meet or talk with management before buying a stock but this can sometimes be difficult in Paris. I travel to the US a few times a year, meet companies in my office and attend conferences such as the Nasdaq conference in London. I meet roughly 100 companies a year.

How do you prefer to meet management?

One-on-ones are always best because you can ask all the questions and have a more direct relationship with the company.

Can you name any companies whose IR really stands out?

Home Depot: it comes to Paris and I had an excellent meeting with the CEO.

Why should US corporates target Aviva investors in Paris?

We are long-term investors, not a hedge fund, not short-term shareholders. We want to understand management and the strategy and go in-depth. We take our time to get to know a company but when we invest we are faithful investors and want to hold a stock for the long term.

Gill Newton is a partner at Phoenix-IR, an independent investor relations consulting firm

This article appeared in the Spring 2017 issue of IR Magazine