Rajesh Varma of Paris-based management company Carmignac Gestion talks about getting burnt in Japan in 2006 and what he looks for in IR

Has the number of corporates coming to Paris increased since you’ve been at Carmignac?

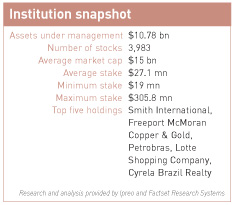

Yes it has. Now I see six companies a week and meet with an analyst or a corporate every day. Back in 2002 we managed only $1.5 bn whereas now we manage over $16 bn. We also take large positions so shareholdings are in the $100 mn to $150 mn range.

How do you screen stocks?

Initially I look at the sector. I need to have an idea of where it will be in five years’ time. If there is sector potential, I look at price to cash flow and PEG (price to earnings ratio divided by earnings growth). I don’t look at the P/E ratio as it is a relative number and means nothing without understanding the long-term growth potential. The cash flow yield is very important to me as is the quality of the balance sheet. I won’t buy unless I’ve spoken to management, ideally face to face, but I also do video conference calls. Meeting management is absolutely vital for understanding a group’s strategy. My big problem with US firms is that they are short-term driven because of hedge funds.

Do you have any market cap constraints?

I don’t buy micro-caps – anything less than $100 mn – as they are too risky. I also look closely at liquidity.

What’s the average length of holding?

I’m a long-term investor with a two-to-three-year time horizon at least. If something becomes more than fairly valued I sell it. I focus on long-term growth. I do not buy cyclical companies where you’ve got to be in and out at the right time – I like to buy a stock and put it to one side.

What are your current favored holdings and why?

In the US, I hold Adobe and Seagate Technology – two companies that have done well this year – and Corning, which makes glass for flat screens, I have held since 2004. Flat screens have come down in price but the glass component hasn’t, so Corning has continued to increase its margins because of increased demand for the final product. It is one of the largest polysilicon producers in its joint venture with Dow Chemical, from which it is minting money.

Cogent is another company I favor as I expect huge growth in content over the internet. The stock is up 130 percent year on year and I still expect it to double or treble. We need firms like this – it’s a long-term story. NDF, which encrypts and decrypts data, is another holding of ours. It was up only 12 percent in 2007 but we’re looking at it over the longer term.

What was your worst investment?

My ‘annus horribilis’ was 2006: I got burnt in Japan and I had no US big-cap names to balance it out.

Can you short stocks?

I can’t short stocks even though we’re an absolute performance fund. However, I can buy options so I bought calls in HP, Cisco, Apple and IBM – they went up and I converted. How have hedge funds changed the investment management industry?

How have hedge funds changed the investment management industry?

They’ve increased volatility. Back in 1988, if a stock was up or down 1 percent it made headline news. Now a stock can go down 15 percent and nobody blinks. Hedge funds have forced management teams, particularly in the US, to be much more short term, so they have had a huge impact on company strategy. Real hedge funds do their jobs when they short stocks that are overvalued but they have caused carnage elsewhere – look at the damage done to the South East Asian economies a couple of years ago.

What’s the outlook for US equities?

I was shocked by the performance of the US market in 2007 as I didn’t expect it to do so well. I do expect some kind of correction there but I don’t look at indices; I look five years ahead at specific sectors and stocks.

Which firms are best at IR?

None of the big US tech names come here as they can’t be bothered. The large bio-techs are good, though – we regularly see Genzyme, Amgen, Celgene and Gilead Sciences. They all come here and realize Carmignac is a long-term holder, not a fly-by-night hedge fund. We also see smaller technology companies like Nuance and Citrix Systems. Nuance is a leader in speech technology and Citrix I first met at the NASDAQ conference in London.

Is language an issue for US companies visiting Paris?

No. All fund managers in Paris speak good English – otherwise they wouldn’t have a job. They might have poor accents, but they speak English!