Boost your stakeholder profile by adopting it early, urge study authors

Integrated reporting is doubtless one of the most-debated topics in the corporate reporting community. Internationally, numerous corporations are considering the adoption of integrated reporting. Yet what benefits can they expect? To find out, the Center for Corporate Reporting and the University of Leipzig initiated a joint research project on the benefits and challenges of integrated reporting implementation.

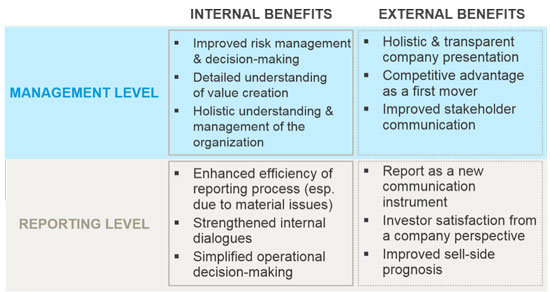

The study shows that integrated reporting implementation is tackled on two levels: as a managerial change process at the strategic level, and as a reporting process at the operational level. On both levels there are arguments for and against implementation.

Arguments for and against the implementation of integrated reporting as a management approach

From a management perspective, integrated reporting implementation is driven by the adoption of integrated thinking. Corporations can benefit from improved information and data access, advanced decision support systems and a more holistic view of the company. These insights facilitate a forward-looking stance and sound strategic decision-making. Risk management can be improved by highlighting interdependencies in the value process. As increased transparency leads to better assessment of opportunities and risks, management finds it easier to align strategic objectives.

Businesses report a renewed appreciation and improved internal understanding of the value process as well as employee identification with the company. By disclosing value drivers and analyzing the value chain, the individual contributions of each function and department are highlighted and appreciated. By linking financial and non-financial capital, integrated reporting enables a holistic presentation of the company, which in turn elucidates the value drivers for stakeholders. The status as an integrated reporting pioneer combined with increased transparency can enhance the public image of the corporation and improve stakeholder trust – including investor trust.

Arguments against implementation include internal resistance by individual departments and individual employees, particularly resistance to the changes resulting from the implementation. Another downside is higher costs and resource requirements at every level of the corporation, primarily due to lack of experience and an increase in guidelines. Furthermore, a greater degree of transparency leads to potential new risks for the company due to the disclosure of negatives and the corresponding responsibilities.

Arguments for and against the implementation of integrated reporting as a reporting format

An integrated report can optimize reporting – for example, it can enable multiple departments to collaborate on an interdisciplinary level, share information and create synergies. It can broaden the understanding and knowledge of the overall corporation and different departments. A positive outcome of the implementation process is a strengthening of the internal dialogue beyond departmental boundaries. Integrated reporting implementation can also enhance resource efficiency as financial, sustainability and governance reports are merged (up to and including production and distribution costs).

Operational decision-making processes are expedited due to an improved consistency in individual reports on the corporation’s value chain. The integrated report can also facilitate external communication by providing a consistent tool applicable to various stakeholders, and through disclosure of relevant information and linkages to the financial community. The integrated report satisfies investors’ need for a holistic picture of the company to enable easier, more comprehensive assessments.

On the downside, the introduction of integrated reporting can cause sweeping changes and a lengthy implementation period. It may well take several years from the initial implementation decision to the publication of the first report. A tremendous co-ordination effort is needed when there is lack of experience in interdepartmental co-operation. Generally, the resource requirements are perceived as high, although each corporation can actively shape the process and edit the report according to distinct requirements.

To enable a step-by-step implementation of integrated reporting, it is possible to draw and build on existing reporting structures and processes that are then adapted and extended incrementally. Respondents agree, however, that if they had to do it all over again, they would (see figure for overview of benefits).

Figure 1: Arguments for the implementation of integrated reporting from a company perspective

About the study

From December 2015 to April 2016, interviews were conducted with those responsible for corporate reporting at Bayer, DSM, EnBW, Exxaro, JLL, Munich Airport, Novo Nordisk, Novozymes, Palfinger, PPR, SAP, Standard Bank, Takeda and four consultancies: BSD, EY Switzerland, EY UK and Pauffley & Company. All the companies had already implemented integrated reporting. The study was sponsored by Clariant International.

Dr Christian Hoffmann is professor for communication management at the Institute of Communication and Media Studies, University of Leipzig, Germany. Dr Kristin Köhler is CEO of the Center for Corporate Reporting in Zürich, Switzerland