The global director of institutional relations at Sustainalytics talks about the ESG research it provides on more than 4,000 companies to investors each year

Sustainable or responsible investment is an increasing trend among the global investment community. Research groups such as Sustainalytics, Hermes EOS, Eumedion and EIRIS provide investors with intelligence that enables them to implement a sustainable and/or responsible approach to their investments.

‘Responsible investment is a powerful channel for creating a more sustainable world’ – Diederik Timmer |

Headquartered in Amsterdam, Sustainalytics is the largest provider of ESG research for the global investment community, with clients including ING, Deutsche Bank and Société Générale. Here IR Magazine speaks with Diederik Timmer, Sustainalytics’ global director of institutional relations.

How do you define responsible investment and why is it important?

Responsible investment is where investors integrate ESG into their investment processes. It is important because it creates better investment decision making; it is also important because investors have an environmental and social impact, be it positive or negative. By considering ESG factors they can influence the impact their investments have. Responsible investment is a powerful channel for effecting positive change and creating a more sustainable world.

How do you describe your firm?

Sustainalytics helps investors develop and implement responsible investment, from the sustainability-focused to more mainstream investors wishing to integrate ESG into their investment processes. We help investors analyze risks and opportunities traditional research methods might not unearth.

Who are your competitors and how do you differ from them?

Our competitors are companies like MSCI, Hermes EOS and EIRIS. What distinguishes us is that we are solely a research firm, with presence around the globe. We have no assets under management and we don’t undertake direct engagement with companies. We do meet with companies, but only as part of our fact-finding process. We don’t try to change corporate behavior – instead, we try to identify how well firms are performing and support our clients’ engagement with those companies.

How does a company find out its status? For example, a company might be on some ‘exclusion lists’ for its involvement in controversial weapons or tobacco.

We have an extensive research process in which we analyze all companies using publicly available information, and at least once a year we contact companies for feedback on our findings. Once they provide us with feedback, we provide them with the final report of our findings for free.

We analyze corporate involvement in certain types of activities, but we also analyze policies, procedures and management systems more broadly – how companies’ strategies are set out to benefit from opportunities coming from sustainability, and how they mitigate their risks. We don’t have a standard exclusion list, but some clients formulate their own exclusion lists based on the information they receive from us. In the end it is our clients’ decision whether or not to put a company on a blacklist; we simply provide them with the information. We help them to classify companies.

Is the trend to outsource this function or do it in-house?

Responsible investment has become increasingly important. Investors are now looking at ESG factors across their entire investment universe – equities, fixed income and alternative assets – so they buy research from us as they don’t have the time or the expertise to do it in-house.

As a global equity investor, how would I use your services?

Our research would enable you to integrate ESG factors into your investment process to mitigate risk or add value. We offer best-in-class research that shows you which companies have performed better than their peers.

Furthermore, a client might want to have an exclusion strategy, excluding tobacco, alcohol and/or controversial weapons, for example. We provide tailor-made research to fit a client’s needs.

Which groups use Sustainalytics? And which countries are most active in ESG?

Currently we work with approximately 250 institutional investors worldwide – asset managers or asset owners. Our clients are global, but some markets are more advanced than others. In Europe, the Nordic region, the UK, the Netherlands, Switzerland, France and Germany are very advanced, whereas Spain and Italy in general are laggards.

Responsible investment is advanced in Canada; and in the US, the market is rapidly developing in terms of responsible investment. Last year we acquired a research company in Singapore and we are seeing increasing interest in responsible investment and ESG across Asia.

Are you allowed to name any of your clients?

Our clients include some of the largest asset owners and asset management companies in the world. Some examples are APG, BBVA, ING, PGGM, Deutsche Bank, DWS and Société Générale.

How are you remunerated?

We sell ongoing research subscriptions for which we charge a fixed fee, so we work long term with many of our clients. Some of our clients pay a variable fee.

Although Sustainalytics doesn’t have assets under management, how much do you advise on?

It’s difficult to say, but it’s easily in the trillions of dollars.

How many companies do you communicate with each year?

We research more than 4,000 companies across the globe. We offer full research coverage of major indices in emerging and developed markets and have the largest coverage among all of our peers. Our assessments are sent to all of the companies we research, and the type of feedback we get back varies from email comments to extensive meetings. The majority of our communication with firms is through email, which has been effective for our team.

Do companies visit your offices?

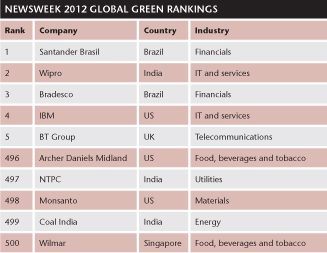

Yes, frequently. We encourage companies to have a dialogue with us. This is partly why we provide the research for Newsweek’s annual Green Rankings. We want to encourage good corporate behavior and make a competition out of it. When it relates to the Green Rankings, the feedback we have received has been tremendous.

Source: Newsweek

How often do you review firms on your coverage lists?

Annually we do a very thorough assessment; but we also perform a quarterly review of companies involved in high-profile controversies or involved in controversial weapons, for example. We strive to find a balance between ensuring companies are not overwhelmed with information requests and maintaining a solid process where the research is done thoroughly.

Is there any evidence to suggest that if you use a responsible investment approach, your portfolio will outperform non-responsible investment?

There has been a substantial amount of academic research, and it depends on the implementation of responsible investment. What you typically see is that investors don’t necessarily get a higher return but they are able to manage their risk better. This means that they can achieve a similar return for a lower risk profile.

Which sectors have most issues?

It tends to be utilities, materials and oil & gas. Food and beverage companies tend to be America’s ‘dirtiest’ firms.

What’s the outlook for firms like Sustainalytics?

We are growing very rapidly. We now have more than 120 employees; we had only 60 a couple of years ago. Investors are really trying to integrate ESG into their decision-making processes – not just looking at exclusion criteria but also looking at it from a more fundamental perspective – and for that they need good insight and good research. Investors struggle to read sustainability reports and understand them.

Companies should include sustainability in their annual reports, but they don’t always report on things that are not going well. They provide lots of policy information, but there’s less on management systems and performance. Reporting on environmental information is getting better, but information on social issues is still lacking. Companies report well on internal activities but not on the impact they have.

Our research really relates to the ESG performance of a company and the impact it has on that firm’s business. We don’t link that to share prices, because our research is not timely enough; that’s the fund manager’s job. We offer insights and information from a business and a strategic level. Fund managers are better at timing when to buy and sell a stock.

What advice would you give to US companies that don’t usually consider ESG?

We’ve seen a gigantic increase in the number of sustainability reports from the Russell 1000, so that’s really improving. The vast majority of companies now report. Below that, very little information was available, but that’s also changing, partly because of peer pressure – if your peers are reporting on sustainability, maybe you should, too.

Also, companies are still worried about the legal implications of disclosing ESG information. This is why they find it difficult to have a conversation with investors: because they don’t know what they can and can’t say. Legal counsel tend not to be helpful as they fear the disclosure could lead to increased legal exposure.

When you engage with a firm directly, who do you contact?

Typically our first contact is investor relations, but we go beyond the IR people as they sometimes struggle to get the information we need. We then speak to the corporate secretary, the corporate sustainability officer or people in line management.

Any final thoughts?

We’ve talked a lot about exclusion, and that’s just one strategy investors can use to create a more sustainable portfolio. This approach is very much regionally biased – in the Netherlands and the Nordic region, for example, investors have chosen to go down this route. I don’t necessarily think it’s the best way to create a sustainable portfolio, however; there are far more sophisticated ways, and I believe a more integrated and engaged approach is the way forward.

Exclusion is a way to avoid the worst companies, but engagement with firms in the investment portfolio, and the integration of ESG into your investment approach, can also help you make more sustainable investments.

Gill Newton is a partner at Phoenix-IR, the independent investor relations consulting firm (www.phoenix-ir.com).