Market experts are cautiously optimistic about the 2013 outlook for IPOs

For those still waiting for the global IPO market to revive, 2013 couldn’t arrive soon enough. In 2012 the markets were buffeted by negativity, causing a long-awaited recovery to stall across much of the globe.

Last year, IPOs in western Europe dropped significantly from the year before and concerns over China’s economy prompted Asian offerings to fall further. And while the number of IPOs in the US rose slightly, hopes for real momentum were snuffed out after Facebook’s mammoth, long-awaited IPO turned into a debacle.

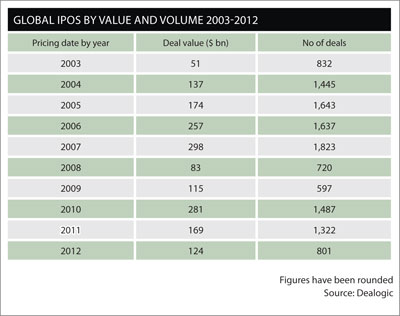

During 2012 in total, only 801 firms made initial offerings globally, raising almost $125 bn – compared with 1,322 companies raising $168.5 bn in 2011, a 26 percent decline in the amount of funds raised, according to Dealogic.

Confidence in a strong 2013 is by no means solid, but a number of experts appear cautiously optimistic the IPO markets will improve in the months ahead.

‘Globally, we definitely think the IPO markets will be up this year, especially in volume,’ says Maria Pinelli, global vice chair of strategic growth markets at Ernst & Young. ‘In terms of capital raised, we will have a better sense by the end of the second quarter.’

Good momentum in the US

Alex Lynch, a partner at Weil Gotshal & Manges in New York, notes that for the market to really take off across the globe there needs to be a ‘better economic outlook, a couple of deals that have priced well on the market and investor enthusiasm. If you get a positive market going, there is certainly a backlog of companies that have been held back.’

Reduced stock market volatility, assertive action from central banks and brighter economic prospects all are positives, adds Pinelli, noting that the US especially came out of 2012 strong, with ‘very good momentum in the IPO pipeline’. ‘We’re bullish in the US,’ she says. ‘The fourth quarter IPOs performed well, we see a rise in the real estate sector, great momentum in the energy market and the US has always led on tech. Though we’ve been uncomfortable with the fiscal cliff situation in Washington, if it can resolve that, we think the US can sustain momentum.’

‘We’re bullish in the US,’ she says. ‘The fourth quarter IPOs performed well, we see a rise in the real estate sector, great momentum in the energy market and the US has always led on tech. Though we’ve been uncomfortable with the fiscal cliff situation in Washington, if it can resolve that, we think the US can sustain momentum.’

The opinions of other professionals who work daily in the IPO markets are mixed. About a third of the leading transaction attorneys specializing in US IPO markets – 35 percent of those surveyed – expect the market to improve, while 65 percent believe it will remain flat, according to a survey conducted by KCSA Strategic Communications of almost 50 lawyers who advised on 87 percent of the IPOs in 2012.

Though the economy in Europe has continued to hold back a vibrant IPO market there, in the US ‘the outlook is probably positive, but certainly not super-positive,’ says Michael Kaplan, a partner at Davis Polk & Wardwell.

‘People are feeling cautiously optimistic. They are a little less worried Europe is going to collapse any day now, we are past the election, and Congress is past the fiscal cliff battle. But obviously there are still uncertainties overhanging the market.’

New regulations may also prove a draw for US exchanges. In the spring of 2012, Congress passed the JOBS Act, designed to spur growth and provide relief to the US capital markets.

Among other provisions, the law exempts companies with $1 bn or less in revenue from certain reporting requirements for their first five years as public firms, and also allows them to hold off filing their intention to go public.

Jacqueline Kelley, Ernst & Young’s Americas IPO leader, notes that many will be watching closely in 2013 to gauge what impact the JOBS Act has on drawing foreign companies to list on US exchanges. Already, she notes, the competition for capital in the markets is fierce.

‘One of the challenges for companies going public is that if you are an IPO-bound company, you are competing for capital not only with other US companies, but also potentially with foreign issuers taking advantage of the JOBS Act, and looking at its capital markets as the most stable,’ she explains.

‘In addition, you have companies doing multiple follow-on offerings. These are very enticing to others that manage portfolios. It makes for a pretty challenging market for new IPO companies.’

The European view

The situation in Europe is less positive but there, too, there are reasons for optimism. In its recent report spelling out the results for the IPO market in the fourth quarter of 2012, PwC, the Big Four accounting firm, notes that while economic and political conditions have remained challenging across Europe, the outlook for IPOs ‘is more optimistic than we’ve seen for a long time.’

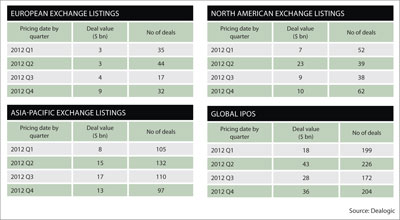

The region’s markets as a whole, by PwC’s count, raised just €10.9 bn ($14.5 bn) across the whole year, down from €26.5 bn in 2011. London in particular appears to have had a hard year with IPO values down 60 percent to €5.1 bn.

But there are indications momentum could be building. About €7.5 bn of the €26.5 bn raised across Europe came in the fourth quarter, making it the strongest quarter since Q3 2011. Those transactions included the debuts of MegaFon and Direct Line in London, and Talanx and Telefónica Deutschland in Germany, by far the largest issues there in recent months.

Click to enlarge

In order for the market to really find its wings, notes Kaplan, the economy needs to pick up. ‘IPOs tend to be companies that are growing and, obviously, there’s not a lot of growth in Europe right now,’ he points out. ‘That’s why there is not a lot of activity.’

Pinelli says she’s had ‘mixed reviews’ from her firm’s teams working with pre-IPO companies around the continent. ‘We certainly think we will see a comeback by the end of 2013 – or at least an increase in activity,’ she says.

‘Our teams on the ground in Germany and northern Europe think those countries will do okay in the first two quarters. The rest of Europe is betting on the latter half, including our team in London.’

The London Stock Exchange is doing its part to encourage listings by launching a new high-growth segment, with relaxed free float rules, although it faces a struggle as London has not attracted a European tech firm to its main market for almost three years.

One potential catalyst for Europe, notes Pinelli, is the likelihood that cash-strapped governments looking to raise capital might elect to sell off state-owned enterprises – a prospect that would likely add momentum to any IPO recovery, given that the businesses usually have strong cash flows and hold mature assets.

Cloudy picture in Asia

Some are also predicting an uptick in Asia, but the outlook there is cloudy and varies across countries. Overall, much of the continent is also coming off a disappointing year. During 2012, Asia-Pacific exchanges raised $53 bn from 444 IPOs, compared with $92.3 bn from 679 in the previous year.

Notable IPOs include Japan Airlines in Tokyo and Felda in Malaysia, which helped push Malaysia to fourth in the IPO rankings for 2012 as investors searched for stability.

Perhaps most significantly, however, Hong Kong picked up some momentum toward the end of the year with the huge IPO of Chinese state-owned People’s Insurance Company of China, which raised $3.1 bn.

The Hong Kong market will also be boosted by the relaxation of listing requirements for H-shares – companies incorporated in China but listed in Hong Kong – and the streamlining of secondary listing rules, a move intended to attract more overseas firms to list in the city.

Edmond Chan, partner in PwC’s capital market services group, predicts a slight rise in the number of IPOs in Hong Kong this year – from 64 in 2012 to 80 in 2013 – but qualifies that by saying the market can only fully recover when the fundamentals improve.

‘We have to see the stabilization of the US economy,’ he says. ‘If the US economy does not recover as expected, it will definitely affect the IPO market in 2013.’

A further fillip to the Hong Kong market may come from Chinese companies converting their mainland B-shares into Hong Kong H-shares. CIMC, the shipping container firm, became the first to make this switch in December 2012 and two other companies announced plans to do the same in January this year.

Authorities set up the B-share market as a route for non-domestic investors to invest in Chinese companies, but the market has become increasingly illiquid due to the popularity of Hong Kong. Deloitte says around 40 companies with B-shares would meet the requirements to switch to an H-share listing. ‘We expect to see some kind of market traction because some of those B-share companies are industry leaders in China so investors will be very interested in investing if they convert,’ says Edward Au, national co-leader of the public offering group at Deloitte China.

‘We expect to see some kind of market traction because some of those B-share companies are industry leaders in China so investors will be very interested in investing if they convert,’ says Edward Au, national co-leader of the public offering group at Deloitte China.

The mainland China market, meanwhile, should remain in deep freeze until at least the second quarter of the year, following the government’s decision to require all companies in the queue to undergo a self-assessment of their readiness to go public.

‘Some may not be up to the standard yet, and some may have been affected by the poor [economic] performance of 2012,’ explains Chan.

Private equity pressure

One factor that could hit IPOs across the globe is the activity of private equity firms. Colin Diamond, a partner at White & Case, says many are under pressure to exit investments made in companies before the downturn. Kelley agrees, noting that some of the largest deals in the US in recent months have been private equity-backed companies.

Such deals could be especially significant in Asia. In January, two private equity firms exited investments in the Chinese mainland by selling shares on the Hong Kong Stock Exchange: Hony Capital sold HK$585 mn ($75 mn) of shares in Chaowei Power, and the US-based Carlyle Group completed its sixth block sale of shares in China Pacific Insurance Group at $200 mn, a reported 600 percent return on its 2005 investment.

Some have suggested it could be a record year for private equity exits in China, though that may depend on how fast the government moves to approve new IPOs. By some accounts, more than 800 companies are awaiting IPO approval in China.

Pinelli says there is more than $360 bn in private equity ‘dry powder’ sitting on the sidelines and $150 bn in venture capital.

‘That is one indicator we look to: how much money is still waiting to be deployed, what people are going to be doing with portfolios and whether they will be pushing for initial public offerings,’ she says. ‘Private equity has been in Asia for quite some time; it’s about time for it to exit.’

Job prospectsThe slowdown in IPOs has had a profound effect on the job market for those specializing in investor relations, a number of industry recruiters say. ‘It’s in Europe in general, but we have certainly felt the effects in London,’ says Lisa Wannell, principal consultant at the VMA Group in London.‘London has been a very popular market for companies looking to have an IPO. That has obviously dwindled enormously recently because market conditions haven’t been favorable. Companies have been cautious about coming to market for the better part of two years and that has had a big impact on the number of new mandates coming out of the corporate world.’ Andrea Abbate, practice leader at specialist marketing recruitment firm EMR, agrees. ‘There are only two ways job roles come about: either new roles are created or people leave existing ones,’ she says. ‘IR teams are small anyway; with few, if any, IPOs happening there are no new IR roles being created. And if no new opportunities are being created, even people in existing posts have nowhere to go. It’s a little like musical chairs, except there are no extra chairs – so even people who are looking to move are basically static in their jobs.’ Many IR professionals ‘would happily move jobs for another opportunity,’ Abbate adds. Once the market picks up, ‘there will be a domino effect. Even a few IPOs would have an incredibly positive effect. There were only a handful here last year, at best.’ The situation is a little better in the US. Sandra Charet, president of Charet & Associates, a boutique public relations and investor relations executive search firm, notes that after Lehman Brothers went bankrupt in 2008, the IR job market ‘went into deep freeze.’ Lately, however, it’s begun to feel like it is ‘thawing out’ a bit. ‘I definitely saw a 75 percent or 80 percent decrease in activity in investor relations jobs that I work on,’ Charet says. ‘It just went silent after the markets fell. Over the last three years or so, however, I think the healthcare, medical technology and life sciences spaces have had a slow heartbeat.’ The pick-up has continued into the New Year, she adds, and she is optimistic 2013 will continue to see growth in IR job prospects. |