Juerg Vogt provides a case study of investor targeting

According to NIRI’s definition of the term ‘investor relations’, the ultimate goal of any IR activity at a publicly listed firm should be to achieve fair valuation. Looking beyond fundamental principles of transparency, consistency and access, this suggests an IR strategy focused on building and actively managing a robust investor base that:

1. Supports the business strategy

2. Has a long-term interest in the company’s equity story

3. Minimizes the daily share price swings (reduction of volatility = reduction of capital costs)

4. Contributes to a fair valuation of the company (in the sense of matching its intrinsic value to its market value).

Above all, attracting a solid investor base with the patience to accompany management through good as well as turbulent times should be a key goal for a publicly traded firm to address through selective investor targeting.

Breaking down investor types

Many IROs still segment and target institutional investors according to classical criteria, such as investment style (eg, growth vs value), investor type (long-only vs hedge funds, institutional vs retail) or geography (US, continental Europe, UK). But this kind of segmentation doesn’t reveal much information about which investors actually matter to a company.

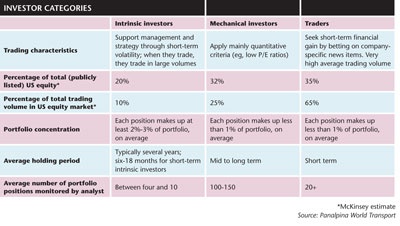

A more effective and possibly more goal-oriented classification was introduced by McKinsey (McKinsey on Finance, spring 2008). It suggests a breakdown of the investor world into three broad categories: intrinsic investors, mechanical investors and traders.

Click to enlarge

Within this scheme, the ‘intrinsic investors’ category should be given the highest priority with respect to a company’s investor relations activities, because this group of investors bases investment decisions on a deep understanding of the business strategy and its potential to generate long-term value for shareholders.

Moreover, this type of investor is also more likely to support management and business strategy during temporarily turbulent times. Due to the limited time resources at its disposal to interact with the capital market, top management members should concentrate on a maximum of 20-25 intrinsic investors.

This also makes sense when considering that a stock exchange-quoted company’s 10 largest shareholders typically hold about 40 percent of its outstanding shares, according to EuroBusiness Media’s InvestorSight benchmark.

Intrinsic criteria

At Panalpina, a Switzerland-based logistics company with more than $2.3 bn in market cap, our IR activities have focused on intrinsic investors for many years. In addition to the above-mentioned criteria, they should ideally also exhibit the following features:

-A minimum of $1.5 bn in assets under management (equity portion only). At our current market cap, an investor who decides to invest 3 percent of his/her portfolio in Panalpina shares would thus hold a share of at least 2 percent in the firm.

-Sector focus: existing (basic) knowledge of the transport and logistics sector garnered through prior research or experience in the sector.

-Investment universe that includes European mid-caps.

-Due diligence process: engaged in extensive dialogue with competitors, customers, suppliers and company management before – and normally also after – an investment decision has been made.

-Investment decision making based on a deep understanding of the business strategy and its potential to create long-term shareholder value.

-Passive or active (but not activist) investment approach that brings in investors’ ideas, know-how and network on a predominantly strategic level.

-Disclosure policy with respect to shareholding: full disclosure upon request regarding shares held in the company.

Changes to the shareholder base

Since the introduction of systematic investor targeting in 2008 with a focus on intrinsic investors (according to the above definition), the composition of Panalpina’s shareholder base has changed noticeably. While in 2008 the 10 largest shareholders held 75 percent of the company’s outstanding shares, this number rose to 83 percent four years later.

When excluding the largest shareholder – an intrinsic investor in the form of a charitable foundation that has been holding more than 40 percent in the company for many decades and whose shareholding has been practically unchanged since the IPO in 2005 – the cumulative share of the nine largest financial investors four years ago was 32 percent. This has grown to 38 percent today.

Of that 32 percent shareholder concentration in 2008, 21 percent was held by hedge funds (largely composed of activists and traders) and 8 percent by mechanical investors. There was only one intrinsic investor, with a holding of 3 percent. Today, making up that 38 percent of shares held by the nine largest financial investors, 30 percent is held by intrinsic investors, 6 percent by mechanical investors, and there is only one hedge fund (classified as a trader).

On the one hand, the concentration of the company’s shareholder base has markedly increased over the last few years, which goes hand-in-hand with greater shareholder stability. On the other hand, the shareholder base today is primarily composed of intrinsic investors, an abundantly clear majority of which have been invested in the company for more than two years.

So even in today’s persistent environment of uncertainty, the seemingly endangered species of the long-term investor who is not primarily fixed on quarterly results still exists. Just as certain industries are characterized by an ongoing war for top talent, however, a publicly listed company today finds itself probably more than ever in a war for top capital.

While capital itself is generally still available, intrinsic capital in the sense described above is very scarce. And just as top candidates are often identified and screened by an executive search firm in the recruiting process, dealing with capital search should be a core task of the IR team’s duties.

Juerg Vogt is corporate head of IR for Panalpina World Transport in Basel, Switzerland. He also serves on the board of the Swiss Society of Investor Relations.