The agency brokers behind dark pools are spurring the growth of alternative equity research

The death knell was supposed to have sounded for sell-side research when Eliot Spitzer struck his Global Research Analyst Settlement in 2003. Independent equity research was deemed to be doomed when the settlement ended its run in 2009. Throw in the long-term trend toward in-house buy-side research and IR professionals judged third-party equity research to be drying up. So why does it seem like it’s raining analysts?

You know all about fragmentation of trading: dark pools and other electronic alternatives have been taking market share from traditional stock trading venues since the 1990s. Now we’re seeing the fragmentation of research, and the same agency brokers that invented dark pools are behind the phenomenon: names like Instinet, BNY ConvergEx, Investment Technology Group (ITG) and Liquidnet.

Agency brokers, as opposed to full-service broker-dealers, historically offered execution but no research. In recent years, however, they have helped the proliferation of new research by sharing commission dollars with independent research providers. They have also been getting directly involved in research and corporate access, especially in the past year, which saw a series of significant developments.

Beyond the core

Under the traditional equity research model, bulge-bracket Wall Street firms were one-stop supermarkets for an investment manager’s needs: research, capital for trading and trading, all in one place. As trading went electronic, it spread beyond the bulge bracket, and so did research. ‘Trading got cheaper, trading got electronic; it diversified away from that bulge-bracket core and research followed it,’ explains John Adam, Liquidnet’s head of research.

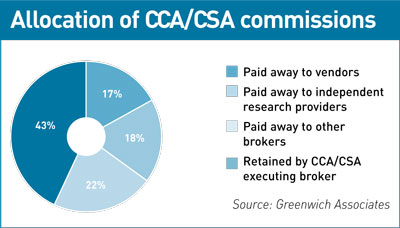

Most commission dollars still go to bulge-bracket firms to pay for a bundle of services. But bundled commissions are not the only way to pay for research anymore. Commission-sharing arrangements (CSAs) and their variant, client commission agreements (CCAs), are relatively new innovations in the US. They allow an investor to execute a trade through a broker while reserving a portion of the trading commission to pay a research provider. Thus CSAs and CCAs ‘unbundle’ trading and research while letting the buy side pay for everything out of a single commission pool.

CSAs ramped up quickly in the UK after regulator the Financial Services Authority issued new guidelines in 2005. The SEC issued its guidelines in 2006 and, while CSAs have been slower to gain traction in the US, the growth has started to look explosive: from next to nothing 10 years ago, the share of US institutions using CSAs rose to 54 percent in 2010 from 48 percent in 2009, according to a June 2010 Greenwich Associates report, and 73 percent said they would have them by year-end. Among institutions with more than $20 bn under management, the share of commissions paid through CSAs was 27 percent in 2010, up from 19 percent in 2009. Overall, the figure was 22 percent.

Not making a bundle

As bulge-bracket companies thinned their research ranks following the global settlement, CSAs encouraged analysts thinking of hanging out their own shingle. Star analysts like Meredith Whitney from Oppenheimer, Dana Telsey from Bear Stearns and Ivy Zelman from Credit Suisse have all thrived on CSAs since leaving the bulge bracket.

Unfortunately for many independent research firms, the financial crisis hit CSAs hard. There was so much capital outflow that the buy side’s commission budgets shrank, forcing investors to look for savings in bundled services. ‘Now things have begun to improve in the fourth quarter of 2010 and, going into 2011, I would expect to see unbundling accelerate again,’ Adam says.

So independent research took off partly due to the growing acceptance of CSAs, and agency-only brokers can take the credit for being the driving force behind CSAs, at least initially. Instinet was a pioneer in managing CSA programs for clients, along with BNY Convergex and ITG. Liquidnet recently launched its second-generation CSA program, providing investors with a single consolidated account to pay for all the independent research they receive. Adam says there are signs the amounts being reserved for CSAs are on the rise again, showing that the consumption of independent research will grow.

By offering CSA programs, agency brokers get to be right in the middle of the independent research stream. But that’s still not enough to achieve the ‘stickiness’ they want to have with their institutional investor customers. That’s one motivation for getting into the research racket themselves. ‘Providing research and corporate access moves us further up the food chain at institutional clients, from traders to senior-level portfolio managers. Relationships tend to be stickier the higher we go,’ explains an industry insider.

Falling volumes

Again, the financial crisis played its part, apparently triggering the recent spate of new research-related initiatives by agency brokers. The crisis sent volumes plunging, meaning brokers have been making less money from trading commissions. Equity trading volume in the US dropped 16 percent from 2009 to 2010, or 24 percent below 2008, according to Standard & Poor’s.

As the overall commission pool shrank, the hurt to agency brokers was magnified. Execution tends to be last in line when the buy side allocates trading commission for research, corporate access, access to deals, and so on. ‘As the overall commission pie shrinks, the execution-only part of that pie shrinks disproportionately fast. Agency brokers are hit harder,’ says JT Farley, vice president of IR and corporate communications for ITG.

Being stuck with a shrinking slice of a shrinking pie seems to have prompted the rush to research. Agency brokers need to provide more services to the buy side to justify a bigger share of the commission pool. The first question, then, is whether to build or buy, with most opting to buy – as in the case of Liquidnet taking a stake in OTR Global, or ITG buying Majestic Research.

BNY Convergex and Instinet have different approaches: Convergex runs a huge network of independent research providers on its Jaywalk platform while Instinet has a small network of exclusive providers. ‘In most cases, the idea has been to take a cash register that is becoming ever-more efficient – electronic trading – and marry it to content that’s worth paying for,’ Farley sums up.

One major difference between Instinet’s partnering with independent providers and ITG’s acquisitive strategy is that Instinet could shift partners as tastes change. For example, Instinet is a rare case of an agency broker with ties to an expert network, a type of research whose entire being is looking shaky in light of the SEC’s insider trading sweep. If the commission clamps down on expert networks, Instinet could presumably break off its arrangement with Public Insight, an expert network partner focused on public policy.

Agency brokers generally find an enthusiastic audience for their independent research because they don’t carry the whiff of conflict of interest that surrounds bulge-bracket banks. This is because the agency model offers unbiased, neutral trading, in contrast to principal brokers, which can trade on their own proprietary account, so agency brokers’ research offerings could also be considered unbiased and neutral.

New flavors

Just as electronic trading yielded all kinds of new twists, fragmentation has been encouraging different flavors of research. Most research springing up around agency-only brokers is a departure from basic buy-sell-hold reports. The belief is that Wall Street banks have fundamental research covered so the opportunities are elsewhere.

Traditionally, analysts do fundamental research and write a report including a recommendation, an earnings estimate and details on a firm’s outlook. Today there are many alternatives: channel-checking, expert networks, data-driven, micro-structure. Interested in a particular type of chip used in cell phones? There’s bound to be a research firm that specializes in it. A research firm may have a client list of five or even fewer – enough to sustain at least one analyst.

This explosion of research surely has its limits. It’s believed that today’s depressed equity volumes can’t support the 40-plus dark pools currently operating in the US, and a shakeout is expected. The same will happen in the crowded field of independent research. Judging by the pace of research initiatives by agency brokers over the last several quarters, however, the game is far from played out.

Advice to IROs

You will have noticed it’s not just the bulge-bracket banks seeking access to management and writing research. Who are these names popping up? Are they credible? Does the buy side really care about the research it provides?

Those are some of the questions IROs are asking about the array of new analysts, says Nicole Olson, Liquidnet’s head of issuer services and investor relations. ‘Our answer is: make sure you vet the independent research providers,’ she says.

Some independent research firms are an annoyance, Olson points out – expert networks, perhaps, or channel checkers that may sidestep the IR department to talk to employees. ‘Others go through IR and follow its protocols, and they can benefit the company with additional coverage,’ she says.

When a new analyst pops up, ask your investors, ‘Are you a client? Is this someone you listen to?’ Ask the research provider, ‘Who are your clients? What are your methods? If I don’t want you to call my employees directly, will you respect that?’

‘It’s essential for IROs to understand who investors care about, and engage with them, even if they don’t necessarily approve of their methods,’ says Olson. ‘They’re out there now. You can’t ignore them.’

Expanding into research

In January 2010 Liquidnet took a stake in OTR Global, a channel checker, building on a management access business launched in June 2009. Liquidnet does some non-deal roadshows but more of its efforts go into bespoke events, called Liquidnet Research Forums.

In December, with the NYSE, Liquidnet held its Leading Indicators 2011 conference. So Liquidnet gives its clients more than just execution but doesn’t have to produce its own content. The December conference, for example, featured Dana Telsey of Telsey Advisory Group and Ivy Zelman of Zelman & Associates leading panels with companies they cover.

Also in January 2010, BNY Convergex launched a management access service. Convergex already offered a huge clearinghouse of independent research through its Jaywalk division.

BTIG announced in March 2010 that it was adding a fundamental equity research group, focusing at first on telecoms, media cable and satellite industries.

Also in March, Instinet launched Meet the Street, a web-based platform for IROs to plan non-deal roadshows, joining Liquidnet, BNY Convergex and Capital Institutional Services (CAPIS) in the corporate access space.

Instinet first delved into offering independent research in 2003. Under a service now called Instinet Access, it has exclusive partnerships with independent research firms, so the only way the seven partners’ research gets distributed is through Instinet’s trading desk.

In April 2010 ITG announced a partnership with Disclosure Insight, a specialist in forensic research. The deal included taking a significant stake in the business.

In June 2010 CAPIS added Zelman & Associates to its Alliance platform for independent research, which it started in 2003.

In July 2010 Weeden & Co carved out an exclusive trading and marketing partnership with independent research provider Sector & Sovereign. Weeden has gradually transformed its agency brokerage into a boutique investment bank.

In October 2010 ITG bought Majestic Research, an independent research firm specializing in mining proprietary data. The unit has been renamed ITG Investment Research. ‘When we wanted to branch out into research, it was natural to find a product that was grounded in data,’ ITG’s IR chief JT Farley says.