Tim Human presents the first in a regular series of columns on the latest tech developments in IR

The ‘likes’ are racking up for Loyal3, the San Francisco start-up that lets companies sell stock to customers via Facebook. The firm, which had only one participating company at the end of 2012, is adding 10 issuers to its platform in January, including ‘some of the most well-known brands in the world,’ according to CEO Barry Schneider.

The idea behind Loyal3 is that shareholders make better customers,and vice versa. If you own a company’s stock, you’re more likely to buy its products, and customers who own shares tend to hold them for longer than non-customers.

Loyal3 encourages the transition from shopper to shareholder by setting up what it calls social stock plans (SSPs), which allow customers to buy stock in three clicks, invest as little as $10 and pay no fees (the costs are picked up by the issuer). Customers can buy stock through a company’s website, as well as via an app on their Facebook page.

The firm also plans to allow customer participation in IPOs from this spring. ‘For IPO companies, this is a great way to broaden their shareholder base with buy and hold investors, who are less inclined to flip their shares,’ explains Schneider. ‘For people, it’s an opportunity to buy stock in IPOs for as little as $100, at the same price – and at the same time – as institutions.’

Loyal3 originally launched SSPs under a different name – customer stock ownership plans (CSOPs, pronounced see-sops) – but is rebranding the product to reflect ‘the modern and social nature of the offering,’ says Schneider.

The big break for the start-up was supposed to come in 2011, when NASDAQ agreed to help companies sell shares via CSOPs. That partnership ended after brokers put pressure on NASDAQ, according to a source who spoke to Reuters. The future looks bright for Loyal3, however: Schneider expects more than 50 companies to be on board by mid-March.

App upgrade

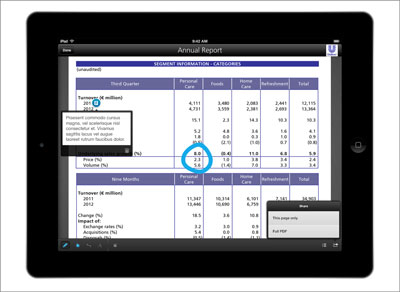

It already has one of the flashiest IR apps on the market, but Unilever has brought out an update. The first version of the Unilever Investor Centre, which has notched up 6,000 downloads since its launch a year ago, offered live streaming of investor days and results presentations, along with a range of other tools. The new 2.0 version adds events modules, YouTube integration and the ability to annotate PDFs.

Comments noted: investor feedback encouraged Unilever to add PDF annotation tools to its Investor Centre app

Buy-side input helped guide the refit. ‘We used initial investor feedback from the first launch of the app to filter ideas we were considering for the 2.0 update – which is how we came up with the annotation tools and events module,’ says Caroline Moylan, head of business development at The App Business, which designed the app.