The crop of IPOs in 2013 made IR a priority well in advance of listing, say communications consultants.

While many management teams now consider investor relations a key strategic function, it is not always given the attention it deserves by companies coming to market. The class of 2013, however, made a bigger deal of IR than its predecessors, say consultants.

‘Companies are increasingly recognizing the importance of being prepared for life after the IPO early on, well in advance of listing, which we feel is an encouraging trend,’ says Sandra Novakov, a director at Citigate Dewe Rogerson in London.

‘Companies increasingly recognize the importance of being prepared’ – Sandra Novakov, Citigate Dewe Rogerson |

‘This means appointing a head of investor relations before the launch of the transaction, having policies and service providers in place ahead of the IPO, preparing an IR website to go live as soon as the listing has been completed – assuming legal restrictions prevent an earlier update – and providing IR training to members of senior or operational management.’

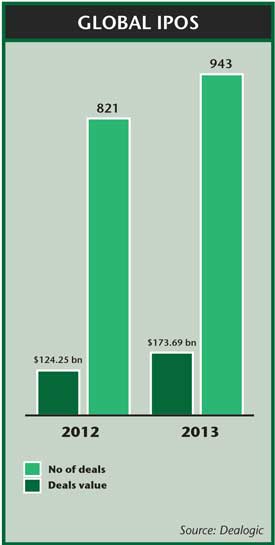

The IPO market blew hot and cold in 2013, depending on your perspective: on a global basis, the number of listings rose to 943, up more than 100 from the year before, but still down considerably from the 1,500 seen in 2010, or the pre-crisis boom of 1,800 in 2007, according to data from Dealogic.

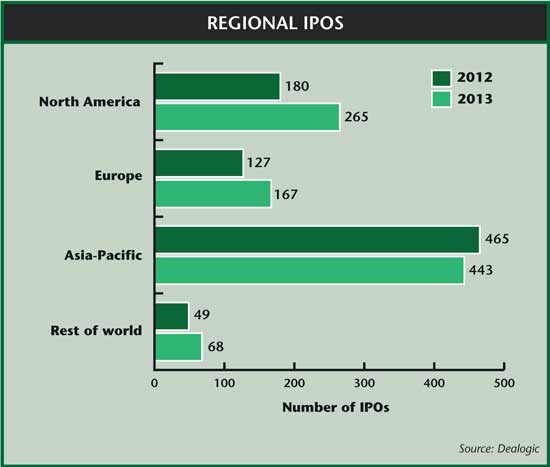

If you sit in the US, though, you are probably feeling a little more upbeat about the state of the IPO market. In the land of the NYSE and NASDAQ, listing volume surged from 131 in 2012 to 213 last year. A combination of rising markets, low interest rates and eager investors led to a total deal value of nearly $60 bn, the highest figure since 2000. The UK market, too, hit boom times, with 71 listings in 2013, up from just 25 the previous year.

By contrast, the Asia-Pacific region saw total IPO volume fall slightly from 465 to 443, affected in part by the closure of the Chinese IPO market throughout the year. Nonetheless, Asia-Pacific still accounted for more deals than any other region in 2013.

Getting in early

Erica Abrams, co-founder and managing director at the San Francisco-headquartered Blueshirt Group, has spent the last 20 years helping to manage investor relations programs for companies going public. One trend she has noticed in recent years is a growth in the number of companies seeking IR counsel well before the IPO process has started.

‘[This is happening] maybe even a year in advance,’ she says. ‘[Firms are] starting to think about the process and wanting to have somebody on board to help them… think about their messaging, their metrics, who the right bankers are, who the right analysts are.’

‘We saw a clear trend among companies that went public in 2013, with more of them seeking outside expertise from qualified firms,’ says Don Duffy, president of New York-based ICR. ‘In fact, whether the companies have an internal IR officer or not, they are still seeking expert advice regarding IPO preparation, analyst teach-in support, media prep and presentation training.’

Being prepared

Abrams and her counterparts in the consulting industry list several reasons why companies might be getting their IR sorted earlier on in the process. One is the high-profile failures of some IPOs in recent years. ‘I think everybody’s heard stories about how the deal team hasn’t really performed the way they want it to perform,’ she says. ‘I think boards are really pushing companies to make sure they are prepared for all of this.’

|

Novakov picks up on the same point. ‘There is a different mixture of factors for each of the companies,’ she explains. ‘As a general trend I think bankers are applying a little bit more pressure given the high-profile disappointments following IPOs in recent years. [They want to] preserve the stability of the IPO market and make sure the pipeline for this year and beyond is not jeopardized.

‘In addition, with some of our clients, we’ve seen that certain senior management members or communications heads with public company experience have driven the process internally because they knew what demands they would be facing following the IPO, in terms of reporting obligations and investor expectations.’

The desire to ensure a smooth listing process was perhaps most evident in the NYSE’s decision to run a test IPO for Twitter’s listing shortly before the actual event. The exchange regularly holds tests over the weekend, but this was the first time it had run a dummy IPO, reported Reuters at the time. Member firms collectively sent in hundreds of thousands of orders to mimic the rush for stock on the day of a hot tech float.

Twitter had already laid the groundwork for a smooth debut on the public markets by bringing in an experienced IR director way in advance of the listing. Nils Erdmann, a former IRO at Sonic Solutions and Pixar, joined the tech firm in February 2011, two and a half years before the flotation took place. Similarly, Royal Mail, the highest-profile IPO in the UK last year, opted for an experienced choice when selecting its IR head, Catherine Nash, who ran IR at BT Group for five years. She moved across to the postal company in January 2013, a full 10 months before the IPO.

The stop-start nature of the IPO market over recent years has helped companies be better prepared, says Novakov. ‘With some of the transactions, they’ve just taken a lot longer to come to market. Where we had a few starts and stops, that gave people a lot longer to get ready,’ she explains. ‘So companies would appoint a head of IR, thinking they were just about to come to market, and then the transaction would get postponed and, as a consequence of that, the head of IR would be in place, in some cases, for more than a year before listing.’

Novakov also highlights the role of private equity sellers in recent IPOs. ‘They want to have a stable aftermarket so that further along the line they can sell more of the remaining stakes,’ she says. ‘Given their quite considerable experience in IPOs, they’ve put pressure on companies to put in place internal and external IR resources early on.’

Private equity-backed IPOs surged in 2013, raising more than twice as much as the previous year, according to professional services firm EY. In fact, last year was the second-highest year on record in terms of value, with only 2007 recording a higher total.

Transparent approach

In the Asia-Pacific region, the latest listings are strongly influenced in their communications strategy by the short attacks of the last couple of years, says Cara O’Brien, senior managing director at FTI Consulting. Initially, these attacks targeted US-listed Chinese companies, but later spread to South East Asian issuers as short-sellers expanded their range of targets, she adds.

‘The combination of a slowed capital market with pressure from the outside caused a lot of companies to look inward and begin to figure out different ways to accelerate and improve their investor relations,’ comments O’Brien, who is based in her firm’s Hong Kong office. ‘What we are witnessing is an evolution of sorts, although there is a long way to go to meet international best practices on the communications side. You can’t have ignored the news and the pressure management teams and stock prices were under given some of these outside activists.

‘I think it has served to make management teams be more cognizant of this at the time of an IPO, thinking through how they can make sure they are – and are perceived to be – transparent.’

One area newly listed companies could improve on is being more internationally focused in their investor relations from the outset, suggests Leela Pandit, a senior director in FTI Consulting’s Singapore office, citing recent listings in Malaysia as examples.

‘Companies have been so domestically focused at IPO time,’ she says. ‘They haven’t used the IPO as enough of a platform to raise their profile and international visibility, so they face challenges in tapping international investors over the long term.’

Digital decisions

Last year saw a huge amount of interest from IROs in social media, much of it prompted by the SEC’s decision to allow the disclosure of material information via social channels like Facebook. Twitter, unsurprisingly, made the most of its own platform when going public, for example by announcing its IPO in a tweet. But most newly public companies continue to play it technologically safe.

‘When new issuers have that much on their plate from the IPO process and the early stages of being public, it’s a case of how much can we handle and effectively act on,’ says Ross Marshall, senior vice president at Canadian investor relations company TMX Equicom. ‘Our advice is always to adopt the crawl-walk-run strategy.’

‘We are seeing more companies taking advantage of video and using it as part of their presentation on retailroadshow.com,’ notes Duffy. ‘IPO videos allow firms to tell a more intimate story beyond the roadshow presentation.’

At the time of writing, 2014 looks set to be another hot 12 months for IPOs. EY thinks it could be even bigger than 2013, fuelled by private equity sellers in the US and Europe. Many of the IPOs to come have already put plenty of thought into their IR strategy.

‘We’ve been pitching for business that is quite a while off, so [we have been looking at] companies preparing for an IPO in around 18 months’ time that want to have initial chats and think about things they should be doing now,’ says Novakov. ‘That was quite rare in the past.’