Majority of buy-siders want to meet boards at least occasionally, finds IR Magazine research

Far from making do with just meeting senior management, most of Canada’s buy-siders would like to meet independent chairmen and lead directors on a regular basis, according to the latest IR Magazine research.

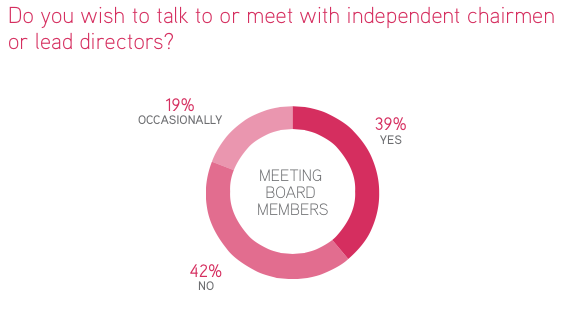

As part of the survey carried out to determine the winners of the IR Magazine Awards – Canada 2016, 70 buy-side respondents were asked a number of general questions about corporate governance, shareholder activism and sustainability. And the majority of them – 58 percent – say they want to talk to or meet with independent chairmen and lead directors at least occasionally.

On the one hand, most respondents recognize that meeting board members would happen more regularly in an ideal world but, as one buy-sider writes, ‘often there is not enough time.’ Another notes that having regular meetings with the board would be more useful than trying, for example, to arrange an ad hoc meeting when a crisis hits, when it might be harder to get a response.

Other respondents are less enthusiastic about the idea; most of these say requesting time with board members would be crossing the line regarding the role of investors. ‘The board is there to govern the company on behalf of the shareholders,’ says one buy-sider, while another prefers a more traditional approach: ‘I would just send a letter. It’s easier to articulate your views and reasoning that way, and it ultimately carries more weight.’

Of those who would speak with independent chairmen or lead directors, the vast majority – three in four respondents – would prefer management not to be present when they do, with the remaining 25 percent split almost equally between ‘no’ and ‘it depends’ or ‘I’m not sure’.

Regarding management not being present, one buy-sider notes: ‘The meetings will tend to be more productive that way.’ Another enthuses: ‘It would be ideal, because then the gloves would be off!’ Several point out that management members being present might be awkward – or worse, disruptive – if they and their performance are to be the subject of discussion.

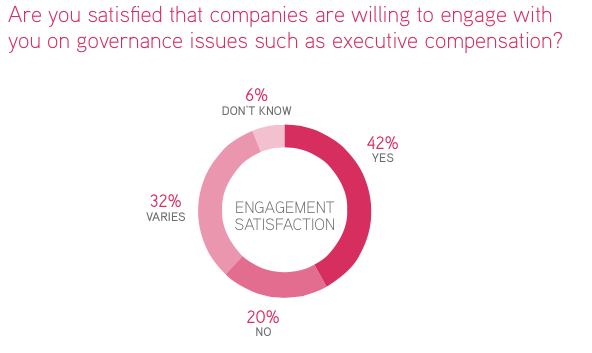

If investors would like more time with companies, how are issuers doing when it comes to actively engaging with the investment community? In Canada, at least, the answer is ‘not too badly’: 42 percent of respondents say they are satisfied that companies are willing to engage them on governance issues, including executive compensation.

‘Generally, Canada is starting to turn the corner,’ says one. ‘As board issues have become more important and come under greater scrutiny, firms have responded by being more open.’ Others echo this sentiment, and say most of the companies they are invested in are engaging well.

Twenty percent of respondents disagree, while 32 percent say it varies. Most in this latter group say that while companies will eventually open up, it requires a lot of work on the part of the IRO. One says he has to ‘squeeze information out of them’, while another says: ‘You have to really dig into them for it.’

So Canada’s companies could do better when it comes to corporate access, particularly with a view to improving and explaining their governance processes. But these are just a few of the extra questions asked as part of the IR Magazine Investor Perception Study – Canada 2016. To find out more or order your copy, please click here.